AUDUSD Test Key Resistance at 0.8255, Reversal Pattern Imminent

The FX market shifted its bias after the weaker than expected Retail Sales data for the US economy. The US dollar was weighed by the sluggish retail growth data and remains in consolidation against its major counter parties. More specifically, the USDJPY dropped to as low as 116.08 after the release, nevertheless the Japanese Yen remains vulnerable and following the Japan’s lower than projected Machine orders and PPI the samurai currency declined. The USDJPY clawed back yesterday losses and is trading now at 117.75.

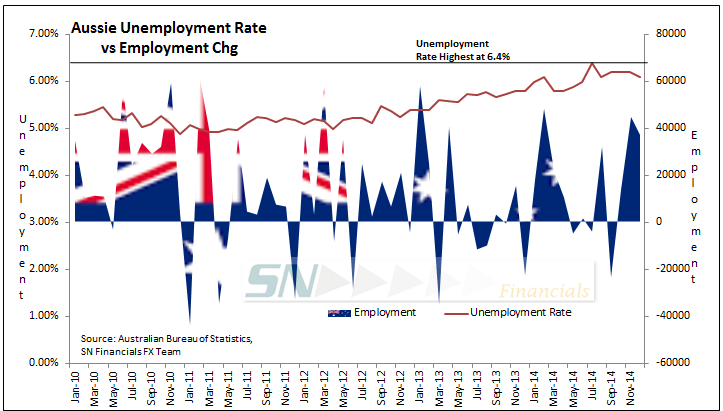

The Aussie against the greenback on the other hand jumped by more than 2.03% from yesterday support at 0.8069 to as high as recent cap at 0.8233. The Australian employment report was much better than market participants’ forecasts. The Employment increased by 37.4K for December exceeding forecasts of a 5.3K increase. As we can see at the chart below in the last two consecutive months the employment has been increasing and the Unemployment was decreasing steadily, now standing at 6.1%. That is changing expectations over the monetary path the RBA will follow in future. We might see a reversal pattern in the AUDUSD today should the cap at 0.8255 is breached.

The US dollar against the Canadian is in a tight range between 1.1993 upper boundary and lower boundary at 1.1927. The Crude oil inventories increased much more than expected and that is weighing on oil prices which in turn could weaken the demand for Canadian dollars. Based on technical the USDCAD is overbought and we should be expecting a retracement or sideways trading.

Later for today we expect the following: (All times are GMT)

• 10:00 Euro Trade Balance exp at 21.3B

• 13:30 US PPI mom exp at -0.3%

• 13:30 US Jobless Claims exp at 299K

• 13:30 Empire State Manufacturing Index exp at 5.3

• 15:00 US Philadelphia Fed Manufacturing Index exp at 20.3

• 16:15 Euro German Bundesbank President Speaks