Price Pattern Analysis for US Dollar, S&P 500, Gold and Grude Oil: Gold Mounts Sharp Recovery, Crude Oil Snaps 5-Day Loss Streak

US DOLLAR TECHNICAL ANALYSIS

Prices stumbled after spiking to a

new five-year high, finishing the day with a modest loss. Near-term

support is at 11350, the 14.6% Fibonacci expansion, with a break below

that on a daily closing basis exposing the November 27 low at 11284.

S&P 500 TECHNICAL ANALYSIS

Prices turned sharply lower,

producing the largest daily drawdown since mid-October. Sellers now aim

to challenge the 14.6% Fibonacci retracement at 2038.40, with a break

below that on a daily closing basis exposing the 2015.20-22.10 area

marked by the 23.6% level and the September 19 high.

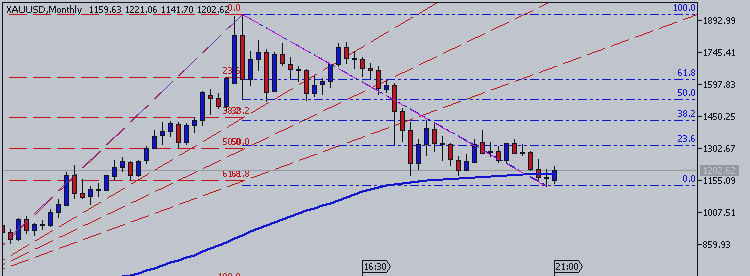

GOLD TECHNICAL ANALYSIS

Prices vaulted aggressively higher

after tapping a three-week low. Near-term resistance is in the

1212.23-19.41 area marked by the 38.2% Fibonacci retracement and a

falling trend line set from early July. A break above this barrier

exposes the 50% level at 1237.59.

CRUDE OIL TECHNICAL ANALYSIS

Prices recoiled upward after

hitting the lowest levels since 2009, snapping a five-day losing streak.

Near-term resistance is at 75.31, the 38.2% Fibonacci retracement, with

a break above that on a daily closing basis exposing the 50% level at

77.72.