AI ChartPattern Pro

- Indicators

- Israel Pelumi Abioye

- Version: 1.0

AI ChartPattern Pro

AI ChartPattern Pro is an indicator built to help traders identify advanced chart patterns objectively, without bias or manipulation. Version 1.0 includes two powerful patterns: the Wolfe Wave and the Head and Shoulders.

This indicator doesn’t just show patterns, it gives actionable signals:

- Entry price

- Stop Loss (SL)

- Take Profit 1 (TP1)

- Take Profit 2 (TP2)

All of this is delivered with minimal configuration required from the user. You don’t need to wrestle with dozens of settings. It’s designed to work right out of the box so you can focus on trading.

Key Features

- Automatic detection of Wolfe Wave and Head and Shoulders patterns

- Clear visual display of entry, SL, TP1, and TP2 levels

- Objective pattern recognition (no manual bias or manipulation)

- Minimal user setup, plug and play

- Early adopter pricing, the price increases as more advanced patterns are added

What’s Next

Future updates will expand the pattern library based on buyer feedback and demand. Each new advanced pattern added will make the tool more powerful, and the price will increase with new patterns added.

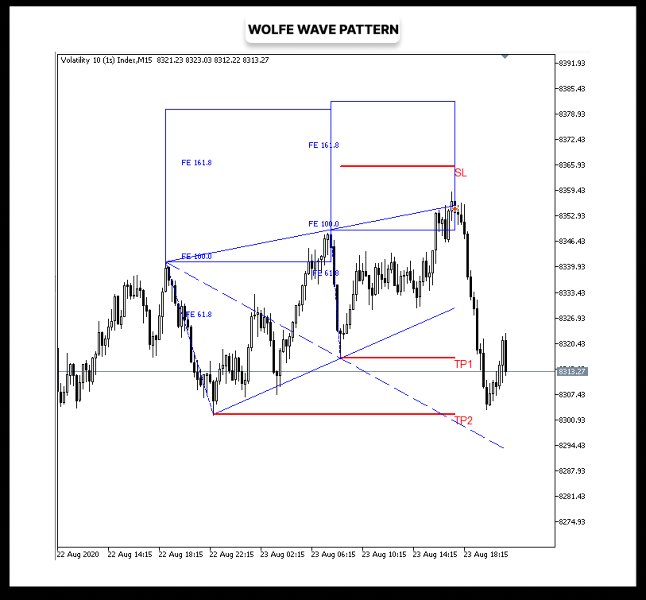

Wolfe Wave Pattern

The Wolfe Wave is a natural price pattern made up of five waves that reflect supply and demand dynamics in the market. It is often used to predict price reversals and project future price targets. This pattern is known for its ability to forecast where price may go with high precision, especially when the fifth wave completes.

Parameters

1. Display Wolfe Wave Pattern?

- If set to Yes, the indicator will display both current and historical Wolfe Wave signals for the last 500 bars.

- If set to No, it hides Wolfe Wave drawings from the chart.

2. Wave 1 and 2 Fibo Extension Max Level

- This defines the maximum Fibonacci extension level allowed for Wave 3 relative to Waves 1 and 2.

- For example, if you set this to 200, Wave 3 must fall within or below the 200% extension of Wave 1 and 2.

- This helps prevent detecting invalid or overly extended patterns.

3. Wave 1 and 2 Fibo Extension Min Level

- This sets the minimum Fibonacci extension level required for Wave 3 relative to Waves 1 and 2.

- If set to 161.8, Wave 3 must extend above the 161.8% level, ensuring the wave has enough momentum to qualify as a valid Wolfe Wave.

4. Wave 3 and 4 Fibo Extension Max Level

- This defines the maximum Fibonacci extension level for Wave 5 based on Waves 3 and 4.

- For example, if set to 161.8, it means Wave 5 must not exceed the 161.8% extension of Wave 3 and 4.

- This helps to ensure that Wave 5 forms within a realistic range for valid Wolfe Wave structures.

5. Wave 3 and 4 Fibo Extension Min Level

- This defines the minimum Fibonacci extension for Wave 5 relative to Waves 3 and 4.

- For instance, if set to 161.8, Wave 5 must extend at least above the 61.8% extension of Wave 3 and 4.

- This filter ensures that the final wave has enough length to complete a valid Wolfe Wave.

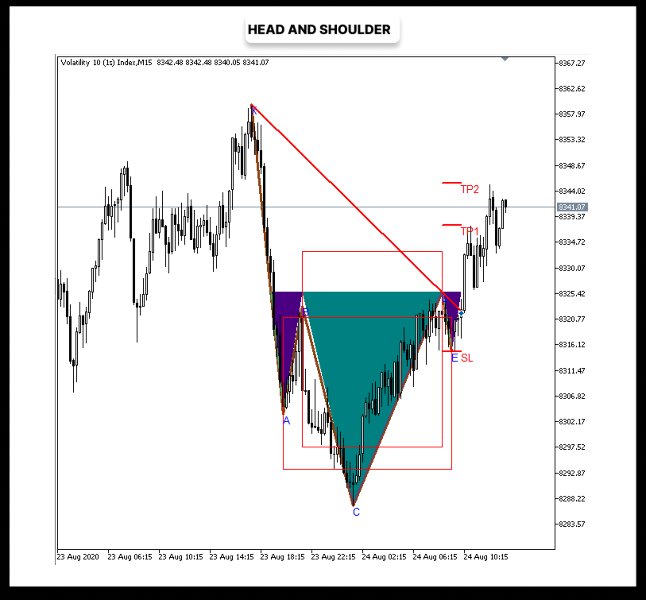

Head and Shoulders Pattern

The Head and Shoulders is a classic reversal chart pattern that signals a potential change in market direction. It consists of three peaks: a central Head (the highest point), flanked by two Shoulders (lower swing highs or lows) that form around the same price level. This pattern is widely respected for its reliability in spotting trend reversals.

Parameters

1. Display Head and Shoulder

- If set to Yes, the indicator will scan and display both past and current Head and Shoulders signals within the last 500 bars.

- If set to No, the pattern detection will be disabled.

2. Zone A and B Price Intervals

- This defines how closely the left shoulder (A) and right shoulder (E) must align in price, as well as how closely point D must align with point B.

- A smaller value (e.g., 0.0010, which equals 10 pips) means the price swings must fall within a tighter, more precise range.

- Increasing this value allows for a broader tolerance when detecting shoulder symmetry, which can help accommodate more volatile markets or slightly imperfect formations.

User didn't leave any comment to the rating