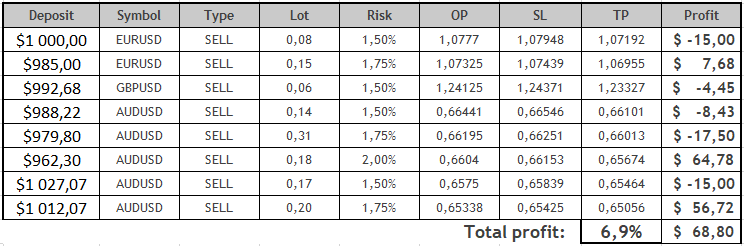

Review of trades of the Owl Smart Levels strategy for the week from May 22 to 26, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from May 22 to 26, 2023. Trades were made on each currency pair, and, looking ahead, we can say that the trading week closed on the plus side. The Owl Smart Levels indicator did its job and indicated the dead zone as usual, prompted to close the trades manually on the reversal of the big arrow on M15 timeframe and recommended opening profitable trades.

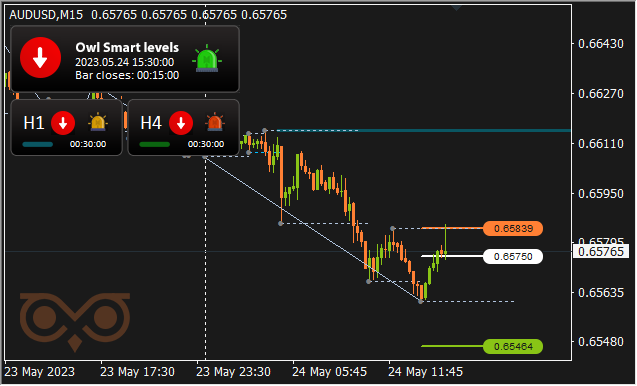

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

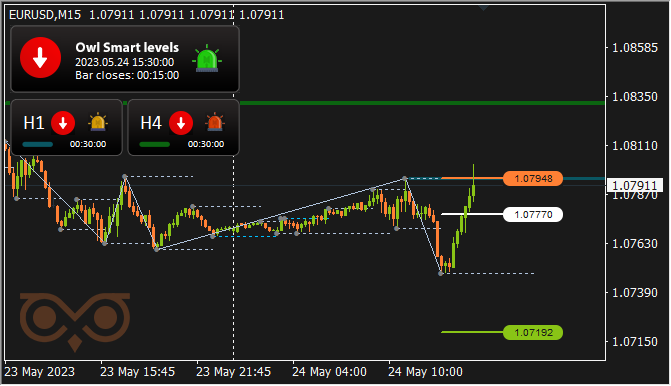

EURUSD review

The market spent Monday in the dead zone. The Owl Smart Levels indicator has given the first signal to open a trade on EURUSD on Wednesday.

Fig. 1. EURUSD SELL 0.08, OpenPrice = 1.07770, StopLoss = 1.07948, TakeProfit = 1.07192, Profit = -$15.

The trade quickly went into deficit when the shadow of the green candle briefly crossed the StopLoss level.

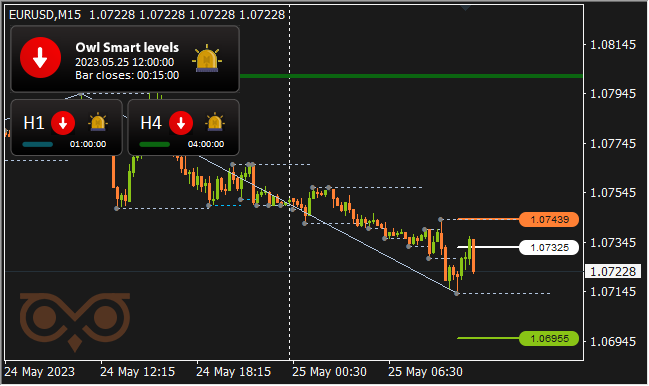

The next trade was opened at noon on Thursday, also for selling.

Fig. 2. EURUSD SELL 0.15, OpenPrice = 1.07325, StopLoss = 1.07439, TakeProfit = 1.06955 Profit = $7.68.

The trade was closed in time on the reversal of the big arrow of the Owl Smart Levels indicator, which allowed not only to minimize losses, but also completely prevented them, keeping a slight plus.

The market spent Friday steadily in the dead zone, and there were no more trades on the EURUSD asset.

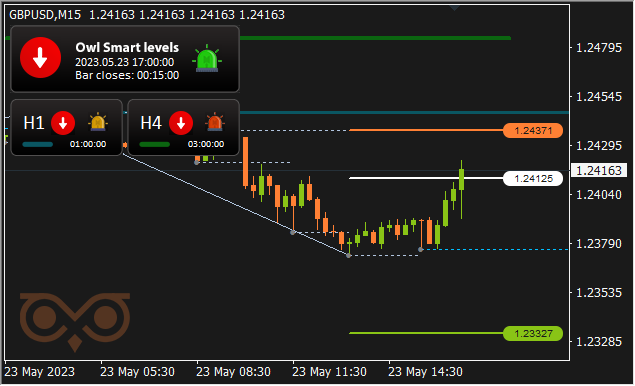

GBPUSD review

After a dead zone that lasted throughout Monday, the Owl Smart Levels indicator suggested opening the trade to sell the GBPUSD asset from the 1.24125 level on Tuesday.

Fig. 3. GBPUSD SELL 0.06, OpenPrice = 1.24125, StopLoss = 1.24371, TakeProfit = 1.23327, Profit = -$4.45.

The trade was closed by the reversal of the big arrow of the indicator and reduced the loss to $4.45.

Thus, the only trade on GBPUSD last week brought some losses.

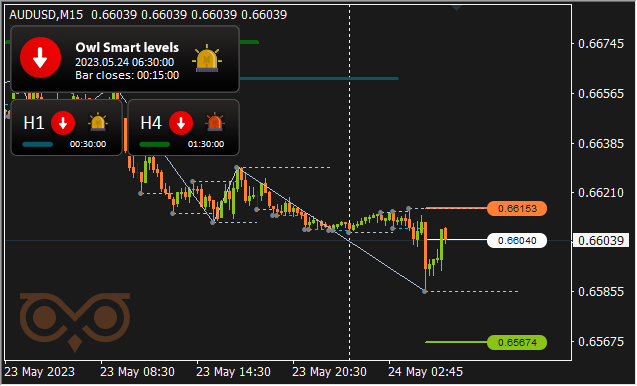

AUDUSD review

Three trades were opened on AUDUSD. Most of the day on Monday the market was in the dead zone. But one trade still was opened at that day.

Fig. 4. AUDUSD SELL 0.14, OpenPrice = 0.65750, StopLoss = 0.65839, TakeProfit = 0.65464, Profit = -$8.43.

The trade was unprofitable, but the loss was minimized by the large arrow of the Owl Smart Levels indicator on the M15 timeframe.

The next trade also turned out to be unprofitable, but the loss on it has not been minimized.

Fig. 5. AUDUSD SELL 0.31, OpenPrice = 0.66195, StopLoss = 0.66251, TakeProfit = 0.66013, Profit = -$17.50.

The next trade, opened on Wednesday for selling Aussie dollar, has turned out to be profitable.

Fig. 6. AUDUSD SELL 0.18, OpenPrice = 0.66040, StopLoss = 0.66153, TakeProfit = 0.65674, Profit = $64.78.

The trade closed at TakeProfit level and brought good profit.

Another trade opened on Wednesday, like the first one on AUDUSD, closed at StopLoss. The long shadow of the green candle crossed the StopLoss for a short time, the indicator did not react to it.

Fig. 7. AUDUSD BUY 0.17, OpenPrice = 0.65750, StopLoss = 0.65839 TakeProfit = 0.65464, Profit = -$15.

These losses were compensated by the next trade, opened on Thursday to sell the Australian dollar from 0.65338.

Fig. 8. AUDUSD BUY 0.20, OpenPrice = 0.65338, StopLoss = 0.65425, TakeProfit = 0.65056, Profit = $56.72.

The trade closed with TakeProfit and brought quite a good profit.

The market spent the second half of Friday in the dead zone, so there were no more trades on AUDUSD.

In summary, only 8 trades were opened at the previous trading week, all of them were for selling. Three trades were closed by StopLoss, another three trades were closed manually by the indicator in time to minimize losses or even to keep a slight profit, and two trades were closed by TakeProfit with a good profit and made the whole week's trade.

Results:

As we hoped, trend trading, to which we were finally able to move with the market, turned out to be much more successful. The 7% return a public or private bank can offer in a year or 52 weeks, although with minimal risk, which is still there.

Let's see what the next trading week will bring, and what kind of trades the Owl Smart Levels indicator will offer to open.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.