Review of trades of the Owl Smart Levels strategy for the week from January 29 to February 2, 2024

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from January 29 to February 2, 2024.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

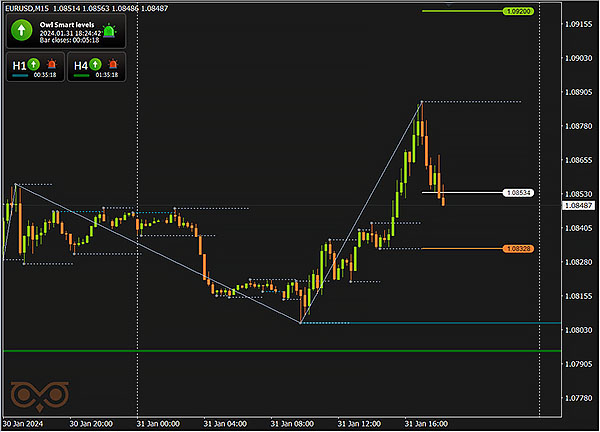

EURUSD review

The first trade on this currency pair was opened on the signal of the Owl Smart Levels indicator on Wednesday at 18:00 and was closed according to the rule of the reversal of the arrow of the main timeframe with a loss of 7$.

Fig. 1. EURUSD BUY 0.07, OpenPrice = 1.08534, StopLoss = 1.08328, TakeProfit = 1.09200, Profit = -$7.43.

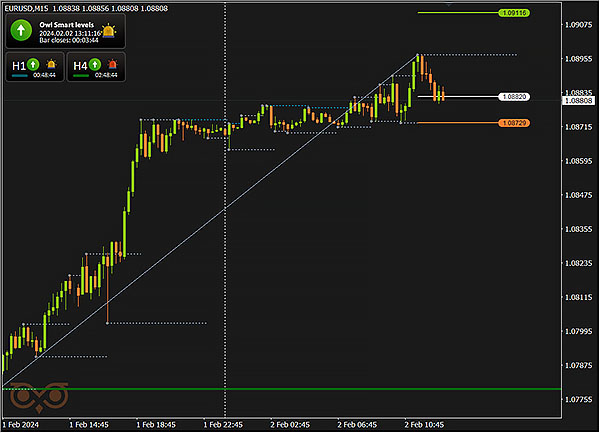

The second trade on this instrument occurred on Friday at 12:30. According to the strategy, the trade was opened with a higher risk of 1.75%. The risk for the first trade is set at 1.5% and if the trade is closed with a loss, the risk is increased by 0.25%. The trade was closed at StopLoss with a loss of 17$.

Fig. 2. EURUSD BUY 0.19, OpenPrice = 1.08820, StopLoss = 1.08729, TakeProfit = 1.09116, Profit = -$17.50.

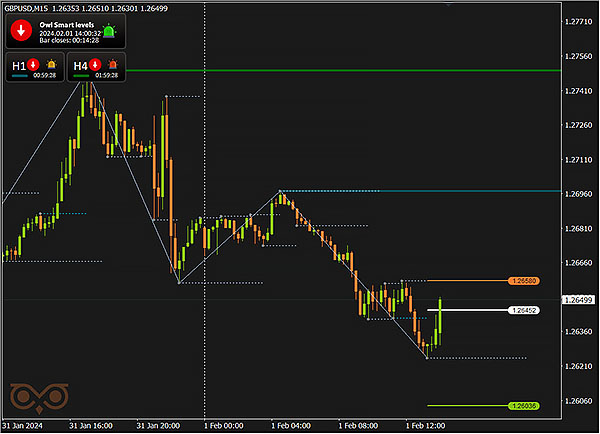

GBPUSD review

The first and the only trade on this currency pair was opened on the Owl signal on Thursday at 14:00 and was closed at StopLoss with a loss of 15$.

Fig. 3. GBPUSD BUY 0.12, OpenPrice = 1.26452, StopLoss = 1.26580, TakeProfit = 1.26036, Profit = -$15.

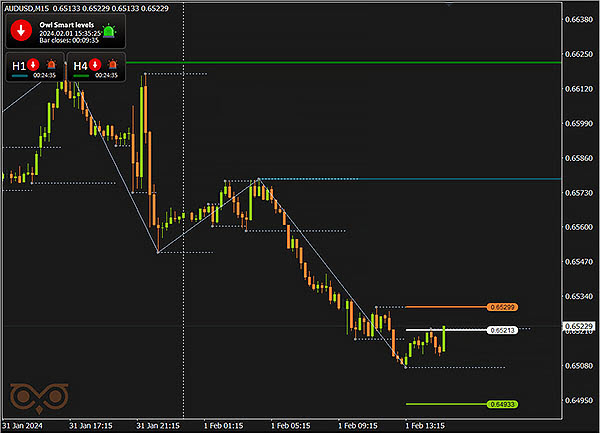

AUDUSD review

The first trade on this currency pair was opened on the Owl signal on Monday at 15:15 and was closed at StopLoss with a loss of 15$.

Fig. 4. AUDUSD BUY 0.32, OpenPrice = 0.65975, StopLoss = 0.65928, TakeProfit = 0.66125, Profit = -$15.

The second trade on this financial instrument occurred on Thursday at 15:30. According to the strategy, the trade was opened with a higher risk of 1.75%. The risk for the first trade is set at 1.5% and if the trade is closed with a loss, the risk is increased by 0.25%. The trade was closed according to the rule of the reversal of the arrow of the main timeframe with a loss of 12$.

Fig. 5. AUDUSD SELL 0.20, OpenPrice = 0.65213, StopLoss = 0.65299, TakeProfit = 0.64933, Profit = -$12.21.

Results:

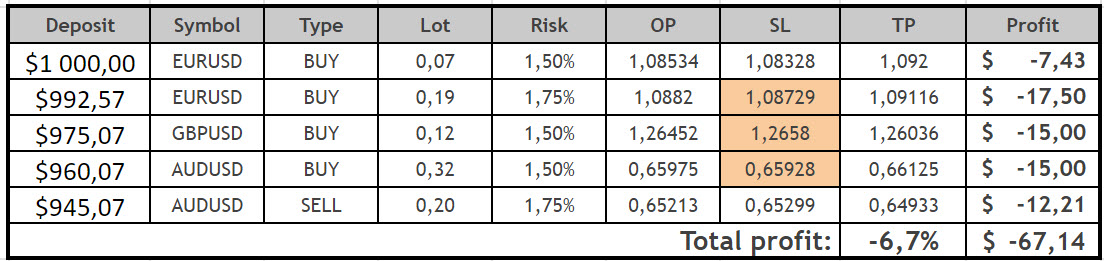

There were 5 trades during the last trading week, the total balance is negative. The currency market is in a very unstable state because of the complicated geopolitical situation. All this has an extremely negative impact on trading. For the second week in a row the Owl Smart Levels indicator and the trading system developed on its basis showed negative results. There is a high probability, based on the long previous statistics of observing the indicator's work, that after the currency market stabilization the indicator will again show its efficiency and bring profit.The detailed data in the final table.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.