Prototype: The ultimate trading template.

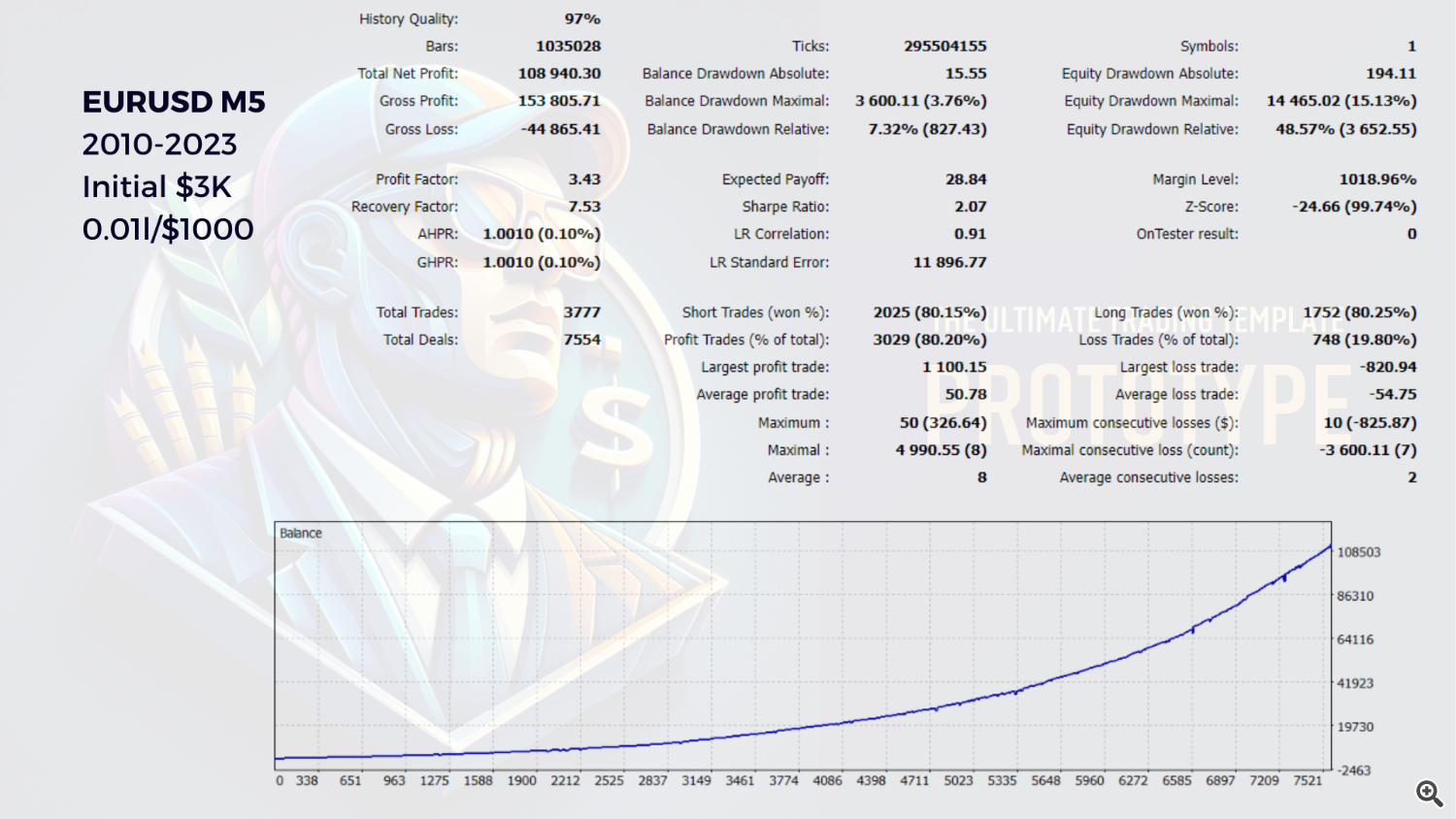

The Prototype is not just a trading advisor, successfully backtested on quotes since 2010, but a universal tool for creating almost any trading strategies.

Prototype source code will be available to the customers within 7-10 days after payment verification is completed.

Users will also get access to a private Telegram group created to support Prototype.

If you are looking for a versatile and powerful tool to trade on the forex market with any trading strategy you want, you might want to check out Prototype. Prototype is a trading solution that can be used as a universal template for applying different trading strategies. You can customize Prototype according to your needs, risk appetite, and market situation.

Prototype is designed to help you trade more effectively and efficiently, by providing you with a flexible and customizable tool that can fit any trading style and strategy. You can use Prototype to test and optimize your trading ideas, or to automate your trading decisions. Prototype is compatible with any currency pair and any time frame. You can also use it with other indicators and expert advisors.

To use Prototype, you need to have minimal knowledge of the mql language to add the necessary indicators and conditions to the code of the expert advisor. Prototype has all the necessary checks for verifying the code in the MQL market. You can find more information about Prototype and its parameters on the MQL market website.

Here are some of the main benefits of using Prototype:

- It allows you to trade with any trading strategy you want, by using a universal template that can be customized according to your preferences and risk tolerance.

- It allows you to set the trading levels based on fixed or relative methods, depending on your trading goals and market conditions.

- It allows you to choose the order size based on fixed, balance-based, or risk-based methods, and to use arithmetic or geometric progression to calculate the order size for multiple orders.

- It allows you to use market or pending orders to enter and exit the market at the best prices, and to avoid entering the market during high volatility.

- It allows you to manage each order separately or control the whole basket of orders as a single entity, and to use physical or virtual levels for stop loss and take profit.

- It allows you to set the balance control to limit the maximum drawdown or the maximum number of orders, and to customize the levels for each order and/or the entire basket, such as take profit, stop loss, breakeven, and trailing stop.

- It allows you to partially close orders to lock in profits or reduce losses, and to access a dialog window that shows the statistics of your trading performance and the buttons to close all orders or only the profitable or the losing ones.

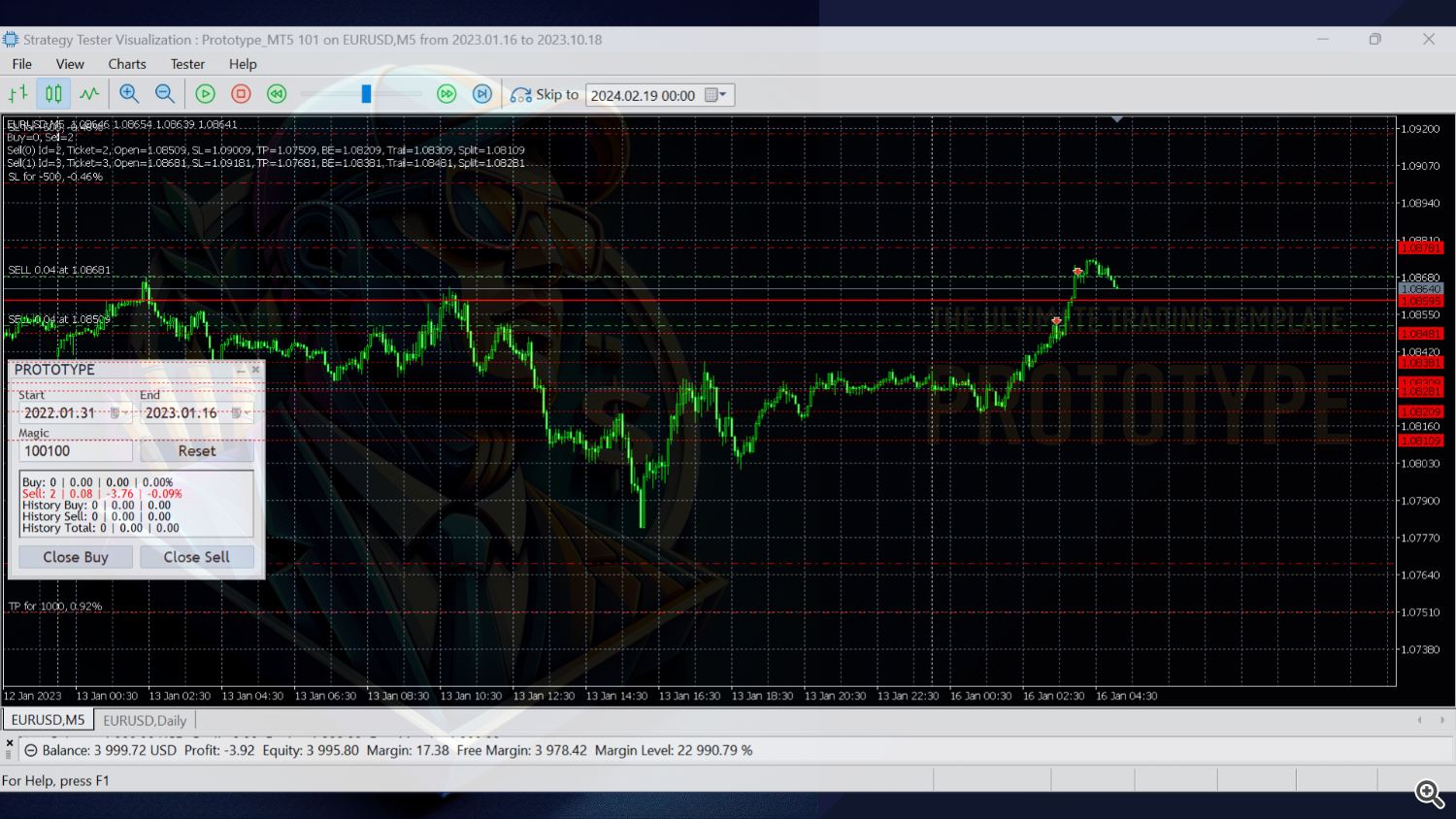

- It allows you to visualize your trades and trading levels on the chart with arrows and lines that indicate the entry and exit points, the order size, and the profit or loss.

- It allows you to test and optimize your trading ideas, or to automate your trading decisions, by using a flexible and customizable tool that can suit any trading style and strategy.

- It is compatible with any currency pair and any time frame, and can be used with other indicators and expert advisors.

- It has all the necessary checks for verifying the code in the MQL market.

One of the key features of Prototype is the ability to set the trading levels. You can use fixed or relative levels. Fixed levels are set in points from the current price. Relative levels are set in percentage from the current price. You can use fixed or relative levels to set the entry, exit, and stop levels for your orders.

Another feature of Prototype is the ability to choose the order size. You can use fixed, balance-based, or risk-based methods. The fixed method allows you to set a constant order size in lots, regardless of the market movement. The balance-based method calculates the order size based on the percentage of the balance you want to use per trade. The risk-based method determines the order size based on the percentage of the balance you are ready to risk per trade.

You can also choose the method of calculating the order size for multiple orders. You can use arithmetic or geometric progression. Arithmetic progression adds a constant value to the order size for each subsequent order. Geometric progression multiplies the order size by a constant factor for each subsequent order. You can use arithmetic or geometric progression to increase or decrease the order size for multiple orders.

You can also choose how to enter and exit the market. You can use market or pending orders. Market orders are executed instantly at the current market price. Pending orders are placed at a specified price and are executed when the market reaches that price. You can use pending orders to enter the market at a more advantageous price or to avoid entering the market during high volatility.

You can also choose how to manage your orders. You can manage each order individually or control the whole basket of orders as a single entity. You can use physical or virtual levels for stop loss and take profit. Physical levels are placed on the server and are visible to the broker. Virtual levels are stored on the local computer and are invisible to the broker. You can use physical or virtual levels to protect your orders from slippage or manipulation.

You can also set the balance control to limit the maximum drawdown or the maximum number of orders. You can also customize the levels for each order and/or the entire basket, such as take profit, stop loss, breakeven, and trailing stop. These levels can be modified manually or automatically based on the market conditions.

You can also choose how to close your orders. You can partially close orders to secure profits or reduce losses. You can access a dialog window that shows the statistics of your trading performance and the buttons to close all orders or only the profitable or the losing ones. You can also visualize your trades and trading levels on the chart with arrows and lines that indicate the entry and exit points, the order size, and the profit or loss.

Prototype is a must-have for any forex trader who wants to have more control and flexibility over their trading activities. With Prototype, you can trade with confidence and convenience, and achieve your trading goals.

Inputs

--- Common ---

Magic - magic number

Comment - comment

Positions Total Max, pos - maximum total number of opened positions

Positions Direction Max, pos - maximum number of open positions in one direction

Volume Total Max, lot - maximum total volume of all open positions

Volume Position Max, lot - maximum volume of each position

Spread Max, point - maximum spread value for trading actions

Direction - position direction

DIR_LONG - only long

DIR_SHORT - only short

DIR_LONGSHORT - long and short

Timeframe In - position opening timeframe

Action Type - trade action type

ACT_TYPE_TICK - on a new tick

ACT_TYPE_BAR - on a new bar

Timeframe Action - trade action timeframe (excluding the opening)

Order Type - order type

ORD_TYPE_MARKET - market orders

ORD_TYPE_PENDING - pending orders

Control Mode (Separate/Basket) - open position control mode

CTRL_MODE_SEPARATE - separate processing of each item

CTRL_MODE_BASKET - whole basket processing

--- Time ---

Hour On - initial hour for opening new positions (only first position in CTRL_MODE_BASKET)

Minute On - initial minute for opening new positions (only first position in CTRL_MODE_BASKET)

Hour Off - initial hour for opening new positions (only first position in CTRL_MODE_BASKET)

Minute Off - initial minute for opening new positions (only first position in CTRL_MODE_BASKET)

--- Volume ---

Type - volume calculation type

VOL_TYPE_FIXED - fixed volume = Inititial Value

VOL_TYPE_RELATIVE - balance based volume

VOL_TYPE_RISK - risk based volume (loss as a percentage of balance sheet)

Inititial Value - initial volume value (VOL_TYPE_FIXED: constant value/VOL_TYPE_RELATIVE: base value/VOL_TYPE_RISK: risk value)

Relative Value - part of balance: volume=Balance/RelativeValue*InitialValue (applies to type VOL_TYPE_RELATIVE)

Progression Type - progression type for volume calculation

PRG_TYPE_ARITH - ariyhmetic progression: volume=last volume + ProgressionValue

PRG_TYPE_GEO - geometric progression: volume=last volume * ProgressionValue

Progression Value - progression factor (0 - progression is not used)

--- Levels ---

Type - trade lavels (stoploss, takeprofit, split, trailing) type

LEV_TYPE_FIXED - fixed levels, points

LEV_TYPE_RELATIVE - average bar size based levels, % of average bar size

Avrg Period - averaging period (for LEV_TYPE_RELATIVE)

Virtual Stoploss - stoploss value is controlled by EA and is not set on the server (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Virtual Takeprofit - takeprofit value is controlled by EA and is notset on the server (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Position Stoploss - stoploss value is set on the server (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Position Takeprofit - takeprofit value is set on the server (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Grid Back - distance between positions against direction (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Grid Forward - distance between positions in the direction (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Shift - level offset in mode ORD_TYPE_PENDING (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

--- User code start ---

--- Pattern ---

RSI Period

RSI Level

ATR Period

ATR Avrg Period

ATR/Atr Avrg Ratio

--- User code end ---

--- Exit ---

Exit on/off - enabling/disabling additional conditions for closing/deleting positions

--- Trailing ---

Breakeven Start - level of setting to breakeven (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Trailing Start - trailing stop activation level (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Trailing Distance - trailing stop distance, LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

--- Split ---

Split Start - split activation level (0-unused), LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Split Step - split distance, LEV_TYPE_FIXED: point/LEV_TYPE_RELATIVE: %

Split Lot - split value, % of remaining volume

--- Balance Stop ---

Type - balance stop type

FIXED - fixed value, $

RELATIVE - relative value, % of balance

Value - balance stop value (0 - unused,>0 - profit control, <0 - loss control)

--- Display ---

Color Buy - buy levels/positions color (clrNone-unused)

Color Sell - sell levels/positions color (clrNone-unused)

Trades - deals/levels display type

DISP_NONE - no display

DISP_MT - by terminal

DISP_EA - by EA