Hello, After long time I came with a new educational blog where I will be teaching some popular methods to detect a trend change. I am not going to discuss basic methods such as moving average as I am a wave / fibo / price action type of trader and I do not use any indicator such as Moving average to detect trend change.

1. X's Breakout : In this method we consider bottom as A, and the previous swing high as X. If price breaks X by close, the trend change probability exists in this case.

2. Trend Breakout: In this we consider A as bottom and look for recent xy trendline, there can be many trendlines making xy as lower low but we only select recent one. We do not consider more than 2 touches on trendline, that is why I call it xy trendline. When a breakout occurs, the probability of trend reversal exists.

3. Method of completion : Its a method which may give late entry. In this method we detect any pattern completion, it could be any harmonics, chart pattern or any type of pattern which is not pending

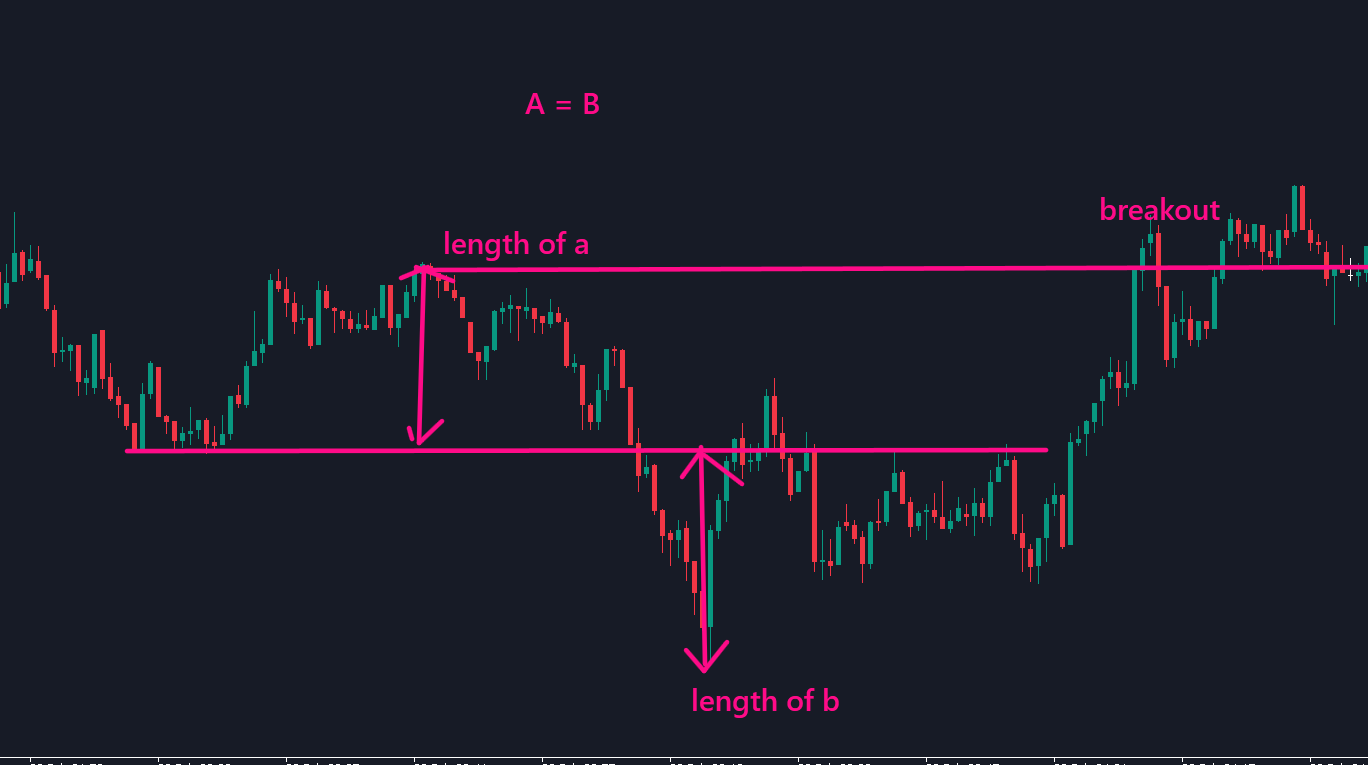

in this example we see there was Ab = Cd pattern completed, as you can see the leg of A is equal to leg of B

So now we wait for the breakout of A and the trend reversal probability exists in this case

These are 3 basic methods which can be better than watching indicators e.g. Moving average and others for trend reversal.