Trading Without Support and Resistance

Looking at a trading chart without support and resistance can be quite challenging. It’s like trying to navigate without a map. You have to rely on other indicators, which might not always give you a clear picture of where the market is heading.

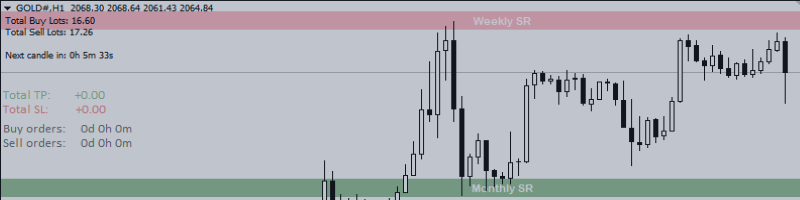

Trading with TradeWise EA

On the other hand, using TradeWise EA, which offers automated support and resistance, is like having a GPS in your trading journey. It gives you a clearer idea about the direction the market will take and where it might bounce off. This can make your trading decisions more informed and potentially more profitable.

In conclusion, while both methods have their own merits, using automated support and resistance like TradeWise EA can provide a more guided and potentially more successful trading experience.

Product Link: https://www.mql5.com/en/market/product/107274

TradeWise EA is a tool that simplifies the trading process by offering automated support and resistance. It provides a range of features that enhance the trading experience:

-

Risk Management Based on Percentage or Dollar Value: You can set the level of risk you’re willing to take for each transaction, either as a percentage or a dollar value of your available capital. This allows for better control over potential losses.

-

Max Lot Calculation based on Risk Management: TradeWise EA automatically calculates the maximum lot size you need based on the risk level you’ve set. This eliminates the need for manual calculations and potential errors.

-

Auto Close All Open Position at BreakEven Price: If the “B” button is active, TradeWise EA will automatically close all open positions once they reach the break-even price. This can help secure your profits and limit losses.

-

Lock in Profits for Auto BreakEven Close: This feature allows you to lock in your profits once your positions reach the break-even point.

-

ReadHistoryData = true: This setting enables the EA to read the account history based on the selected period. This can provide valuable insights into past performance and inform future trading decisions.

In fast-paced markets, placing orders should be a straightforward process. However, with platforms like Metatrader, you’re required to enter numerous details each time you place an order. You also need to calculate the trade size, the risk, and the potential profit.

TradeWise EA simplifies all these tasks. All you need to do is set the values and click “Buy” or “Sell”. The tool takes care of the rest, showing you the total profit and loss based on the open order’s TP SL, and allowing you to trail the stop-loss with just one click.

In conclusion, TradeWise EA offers a range of features that can make trading more efficient and potentially more profitable. It provides a clear picture of the market direction and potential bounce-off points, making it a valuable tool for any trader.