One of the most popular timeframes for scalping is the 1-minute chart, also known as the M1 timeframe. This timeframe is popular among scalpers because it allows them to make quick trades and take advantage of short-term price fluctuations. In this article, we will discuss 5 scalping strategies for the M1 timeframe.

- Trend following strategy One of the most popular scalping strategies is the trend following strategy. This strategy involves identifying the trend on the M1 timeframe and entering trades in the direction of the trend. To identify the trend, traders can use indicators such as moving averages or trend lines. Once the trend has been identified, traders can enter trades when the price retraces to a key level of support or resistance.

For example, if the price is in an uptrend, traders can look for buying opportunities when the price retraces to a key support level. Conversely, if the price is in a downtrend, traders can look for selling opportunities when the price retraces to a key resistance level.

- Breakout strategy Another popular scalping strategy is the breakout strategy. This strategy involves entering trades when the price breaks out of a key level of support or resistance. Traders can use indicators such as Bollinger Bands or the Relative Strength Index (RSI) to identify key levels of support and resistance.

Once a breakout has occurred, traders can enter trades in the direction of the breakout. For example, if the price breaks out of a key resistance level, traders can look for buying opportunities. Conversely, if the price breaks out of a key support level, traders can look for selling opportunities.

- Price action strategy The price action strategy is a popular scalping strategy that involves analyzing the price movement of a currency pair without the use of indicators. This strategy is based on the idea that price action can provide valuable information about the market.

Traders using this strategy will look for key levels of support and resistance and enter trades when the price approaches these levels. For example, if the price is approaching a key level of support, traders can look for buying opportunities. Conversely, if the price is approaching a key level of resistance, traders can look for selling opportunities.

- News trading strategy The news trading strategy is a scalping strategy that involves trading on the release of economic news. This strategy involves monitoring economic calendars for upcoming news releases and entering trades based on the expected impact of the news.

For example, if the market is expecting a positive economic report, traders can enter buying positions before the report is released. Conversely, if the market is expecting a negative economic report, traders can enter selling positions before the report is released.

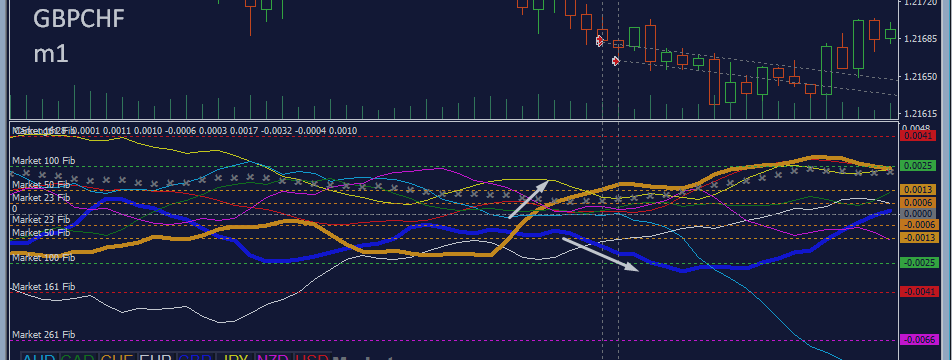

- Scalping with multiple timeframes The final scalping strategy we will discuss involves using multiple timeframes to identify trading opportunities. Traders using this strategy will analyze the M1 timeframe to identify key levels of support and resistance, and then use higher timeframes such as the M5 or M15 to confirm their analysis.

For example, if the price is approaching a key level of support on the M1 timeframe, traders can look to higher timeframes to confirm the validity of this level. If the level of support is also present on the M5 and M15 timeframes, traders can enter buying positions with more confidence.