Swing Strategy Builder for MT5 is a flexible MT-5 Expert Advisor configurable to different trading strategies for swing trading.

The objective is to offer an open toolbox enabling transparent development, testing and automated execution of market specific trading strategies.

Key characteristics:

- Support of multiple candle and price movement patterns for trade entry

- Trade exit based on profit target or and/or candle and price movement patterns

- Support of low risk, single trade risk management with defined risk and exit levels

- Support of high-risk grid and martingale techniques

- Overarching trend checks to minimize wrong market entries

- Open parameters to tune pattern and trend detection algorithms

- No restriction to specific symbols, markets, and time frames

Link to Expert Advisor: https://www.mql5.com/en/market/product/89073

Parameters:

Money Management:

| Parameter | Description | Range |

| Initial lot size | Lot size for entry trade | Depends on broker, will be checked during execution |

| Trading Mode | Allowed Trading modes. The Mode Buy and Sell requires a hedging account. |

|

Trade Entry/Exit Patterns:

| Parameter | Description | Range |

| Hammer Pattern | Single candlestick pattern | True / False |

| Pin Up/Down Pattern | Single candlestick pattern | True / False |

| Force Pattern | Single candlestick pattern | True / False |

| Engulfing Pattern | Multiple candlestick pattern | True / False |

| Pivot Reversal Pattern | Multiple candlestick pattern | True / False |

| Dark Cloud / Dojistar Pattern | Multiple candlestick pattern | True / False |

| Divergence Pattern | Price movement pattern | True / False |

| Moving Average | Slow / fast moving average | True / False |

Comment: Multiple entry expert patterns can be configured in parallel. If one of the patterns applies entry / exit is triggered.

Trade Exit Money Management Strategies:

| Parameter | Description | Range |

| Close on Profit Target | Closes trades if profit target is met | True / False |

| Profit target | Profit target in account currency | >0 |

| Exit on stop loss | Close trades on stop loss | True / False |

| Stop Loss | Stop loss in account currency | >0 |

| Trend change with loss | Allow closing of positions with loss | True / False |

| Virtual trailing stop | Activate the virtual trailing stop | True / False |

| Trailing stop points | Set the points for the virtual trailing stop | >=0 |

Comment: Profit target is set on top of candlestick exit patterns, trades are closed if either a candlestick pattern is met, and profit is >0 or if profit target is met. In case of grid configuration the virtual trailing stop tracks the highest / lowest entry and closes all positions if trailing stop points is hit.

Trend Checking:

| Parameter | Description | Range |

| Trend Check Trade on Entry | Activate additional trend check logic to open trades | True / False |

| Trend Check on Exit | Activate additional trend check logic to close trades | True / False |

| Time Frame for Trend Check | Time frame for trend check. | All supported time frames. Should be equal or higher than EA time frame |

| Slow Moving Average Period | Slow moving average period in bars | >0 and > Fast MA period |

| Fast Moving Average Period | Fast moving average period in bars | >0 and < Slow MA period |

Comment: The fast- and slow-moving averages are used to detect the trend.

The trend also has an impact on the multi-bar candle patterns.

Trade Management:

| Parameter | Description | Range |

| Maximum number of trades in each direction | Settings >1 activates the grid and martingale strategies | >0, limitations according to selected broker might apply |

| Initial minimum points distance for rollover trades | Minimum points distance for next entry . A new rollover trade takes place if an additional entry signal is detected AND the distance is bigger than this setting. | >=0 |

| Factor for points distance increase | Factor for a progressive distance increase. This is an additional option to control the grid system. | >=1 |

| Increase Factor lot size for additional rollover trades | Factor for a progressive lot size increase. With a factor set to one grid is activated but no martingale strategy | >=1 |

| Open trades interval to increase to next Lot Size | Interval for lot size increase. This is an additional option to control the martingale system. | >=1 |

General:

| Parameter | Description | Range |

| Magic | Set Magic Number for this EA | Use different Magic numbers in case EA is used on different symbols on the same account |

| No new trades, maintain existing trades | Open trades are maintained until exit criteria is met; no new trades opened | True / False |

| Deactivate trading after stop loss is hit | EA stays active, no new trades opened. Re-Init the EA to reset | True / False |

| Display trade statistics | Activates comment section on the chart | True / False |

| Display patterns in chart | Activates display of identified patterns on the chart | True / False |

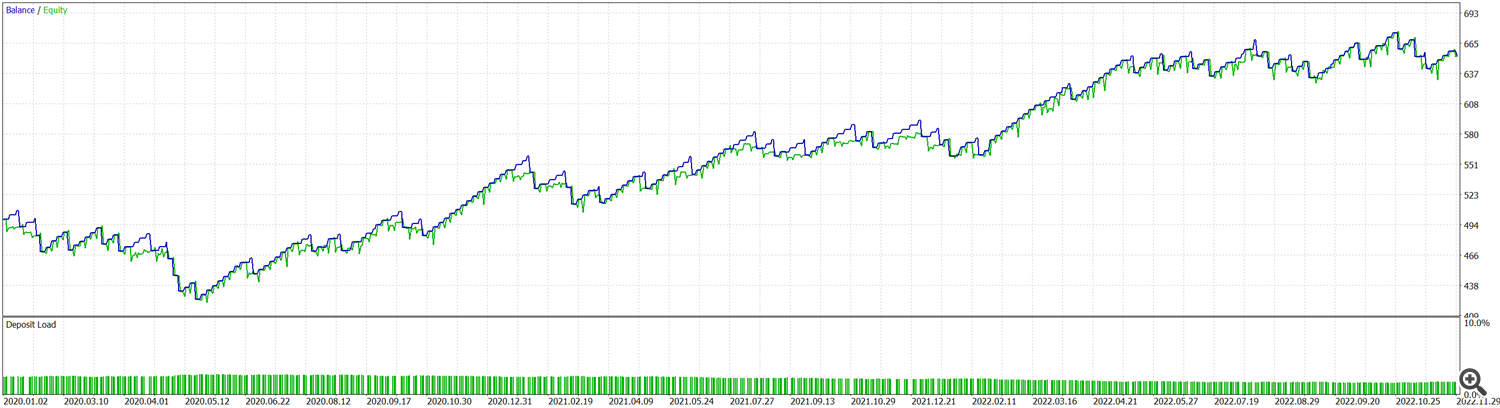

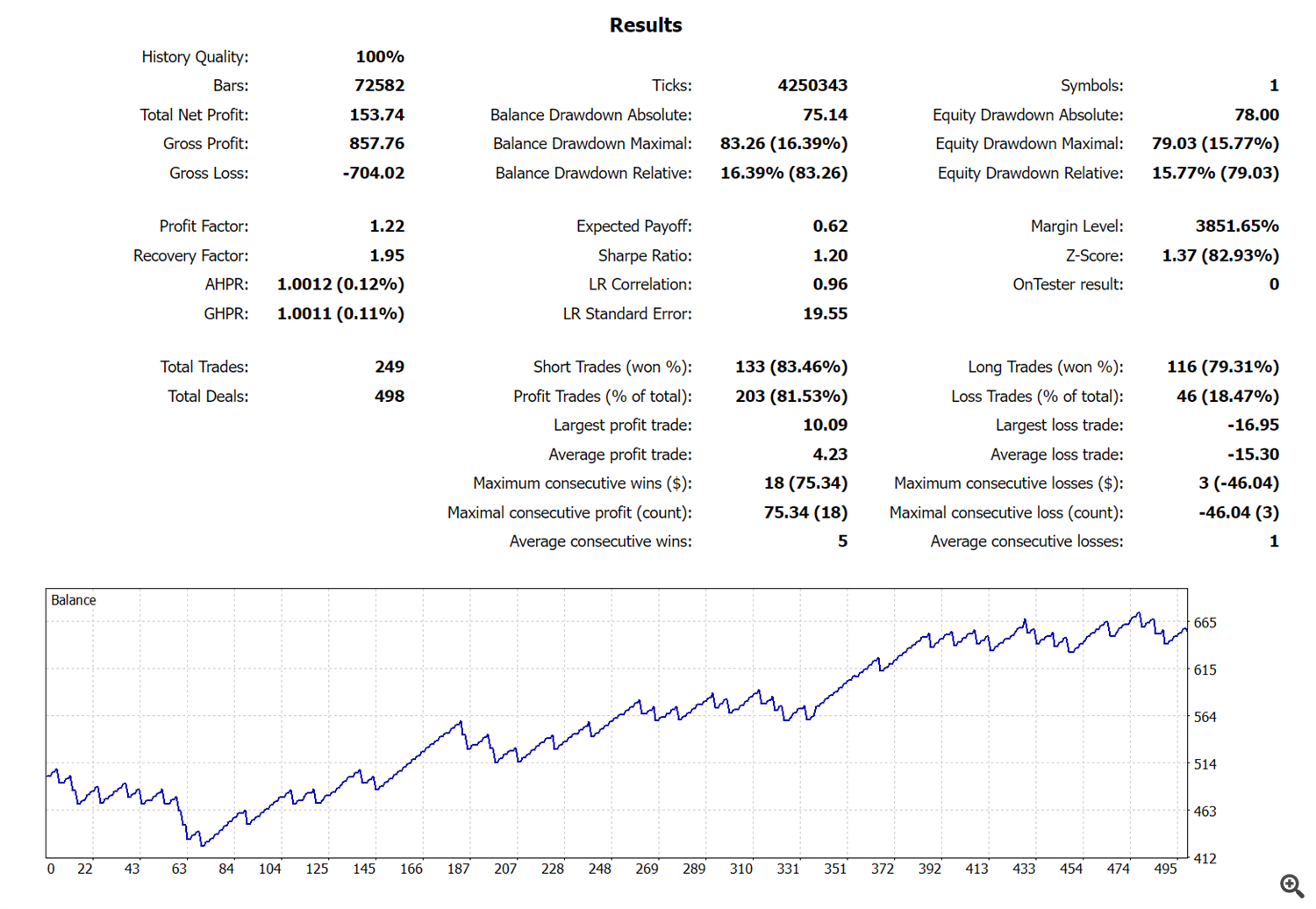

Application Example 1: Configure a simple Swing Trading Strategy for a 500$ account.

Approach: Entry on Price Movement Pattern, Exit on profit target, no use of grid or martingale techniques due to low account deposit.

EA-Configuration:

- Symbol EURUSD

- Time Frame M15

- Lot Size: 0.01

- Account Deposit 500 $

- Trade Entry Pattern: Divergence

- Pofit target: 4 $

- Stop Loss: 15 $

- Trend Check on 1 hour Time Frame with MA Fast Period 110 and MA Slow Period 40

- Back Testing 01.01.2020 – 30.11.2022

Results:

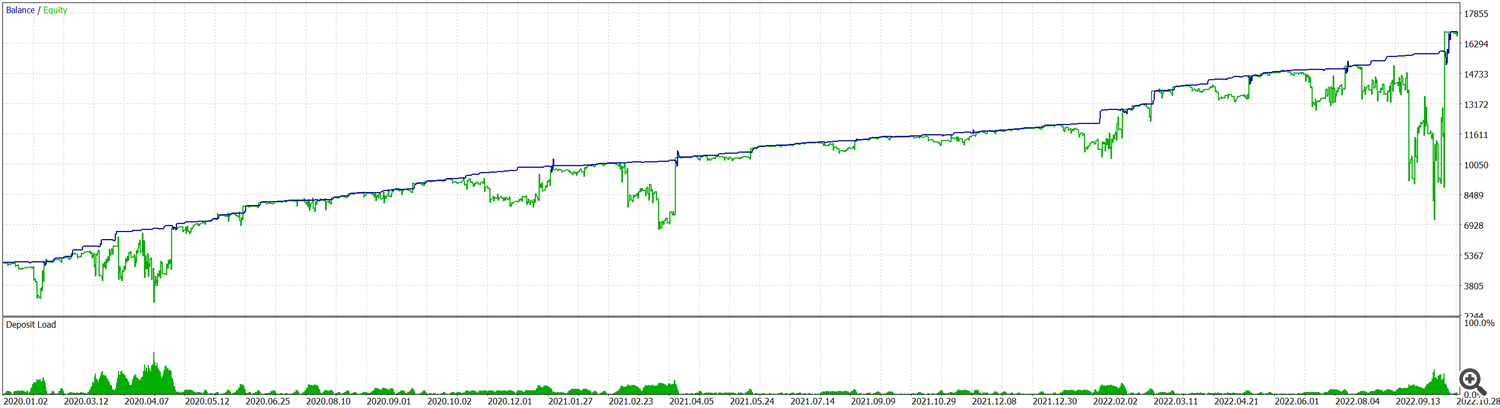

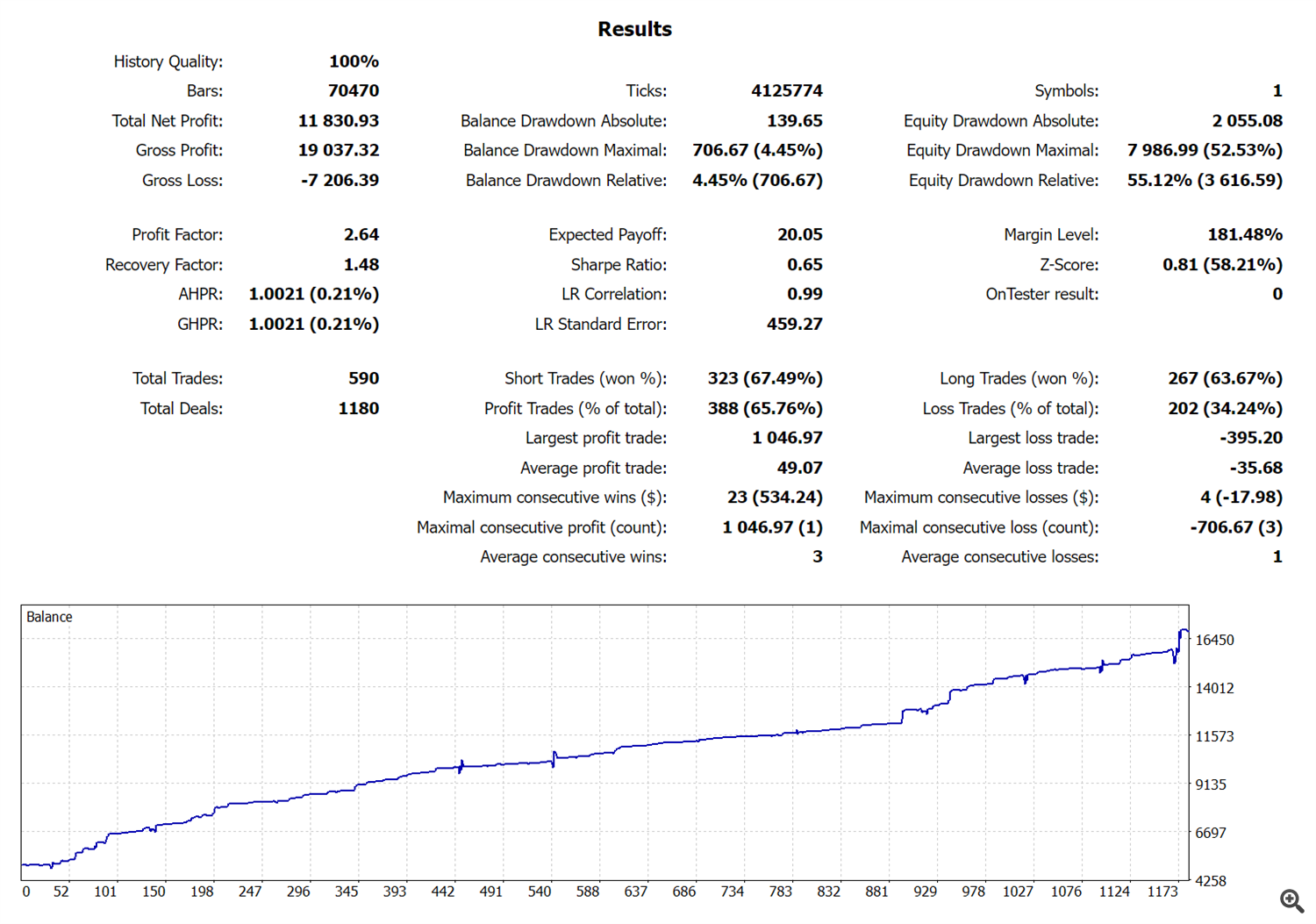

Application Example 2: Extention of Example 1 to multiple trades

Approach: Increased account deposit to 5000$, allow more trades and dynmic lotsizing (=high risk approach)

EA-Configuration:

- Symbol EURUSD

- Time Frame M15

- Lot Size: 0.01

- Account Deposit 5000 $

- Trade Entry Pattern: Divergence

- Pofit target: No profit target, exit on divergence pattern

- Stop Loss: No stop loss

- Maximum number of trades: 15

- Minimal points distance for roll over trade: 50

- Lot size increase factor: 5

- Trend Check on 1 hour Time Frame with MA Fast Period 110 and MA Slow Period 40

- Back Testing 01.01.2020 – 30.10.2022

Results: