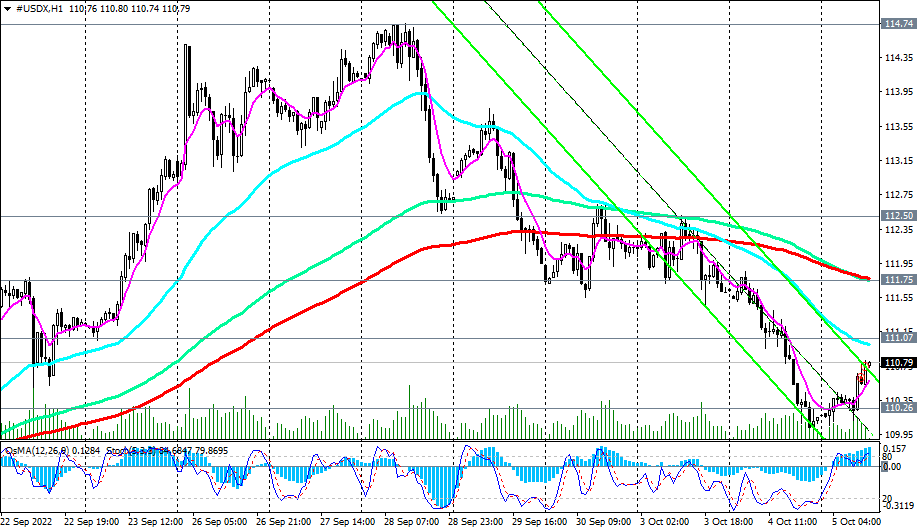

DXY: has the dollar correction ended? Short term forecast

The DXY fluctuation range for the past partial 2 weeks was 4.34%. This is a fairly strong downward correction of the dollar. Has it ended? Perhaps we will already know about this this week: today at the beginning of the American trading session, a whole block of important macro statistics for the United States will be released, including reports for September by the ADP on employment in the private sector and the Institute for Supply Management (ISM) on business activity in the sector services to the American economy, and on Friday - the weekly report of the Ministry of Labor with data on the US labor market for September.

As we noted in our Fundamental Analysis today, "the dollar's uptrend continues, pushing the DXY towards more than 20-year highs near 120.00, 121.00." Breakdown of short-term resistance levels 111.07, 111.75 will be the first signal that the dollar and the DXY index will return to growth.

In an alternative scenario, a confirmed breakdown of the support level 110.26 will become a sell signal.

*) for today's and this week's important events, see Key economic events of the week 03.10.2022 – 09.10.2022

Support levels: 110.26, 109.40, 105.55, 103.80

Resistance levels: 111.07, 111.75, 112.50, 114.00, 114.74, 115.00

- see details ->https://www.instaforex.com/ru/forex_analysis/323491/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading