Major US stock indexes after a sharp decline at the beginning of today's European trading session returned to the levels of yesterday's closing trading day. Here, market participants seem to have preferred to take a wait-and-see position before the publication of the Fed's decision on the interest rate (for more details, see the Major economic events of the week 09/19/2022 - 09/25/2022).

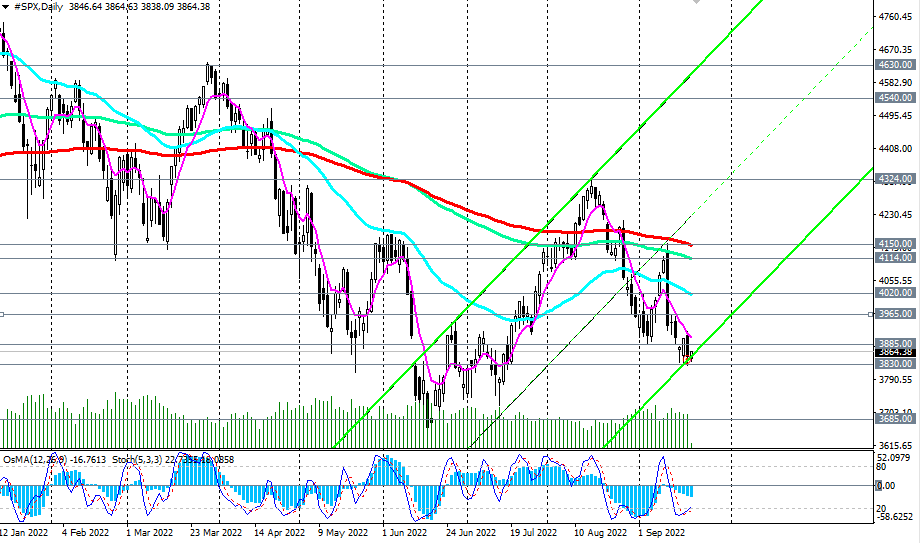

Thus, the S&P 500 broad market index at the time of publication of this article is trading near the 3860.00 mark, slightly above yesterday's local and 9-week low of 3830.00.

If today the Fed leaders justify market expectations and once again raise the interest rate by 0.75% (or even by 1.0%), then after the breakdown of the local support level 3830.00, we should expect a further decline in the S&P 500 towards the key support level 3685.00. Its breakdown will significantly increase the risks of breaking the long-term bullish trend of the S&P 500. But there is an alternative scenario (for more details, see "S&P 500: technical analysis and trading recommendations for 09/21/2022").

Support levels: 3830.00, 3800.00, 3685.00

Resistance levels: 3885.00, 3965.00, 4020.00, 4114.00, 4150.00

· signal -> Insta79 -> https://www.mql5.com/en/signals/1617289

· see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading