The Fed is in a very difficult situation. Its leaders need to tackle the challenge of curbing inflation in a way that doesn't hurt the US economic recovery or trigger a recession.

It is widely expected that the rate will be increased by 0.25% in today's meeting. However, during the period of publication of the decision on the rate, volatility may increase sharply throughout the financial market, primarily in the US stock market and in dollar quotes, especially if the Fed's decision differs from the forecast or unexpected statements come from its management. Of interest will also be the FRS report with forecasts for inflation and economic growth for the next two years and, no less important, individual opinions of FOMC members on interest rates.

At 18:30 (GMT), the Fed's press conference will begin, which will be of the greatest interest to market participants. They want to hear Powell's opinion on the Fed's future plans for this year. Any unexpected statements or hints of Powell, which will differ significantly from the current market expectations, will cause an increase in volatility, primarily in dollar quotes and on the US stock market.

Meanwhile, despite the observed fall in prices for oil and other commodities, quotations of commodity currencies such as the Canadian, Australian and New Zealand dollars are growing.

Thus, the NZD/USD pair is growing today for the second day in a row, primarily on the weakening of the USD.

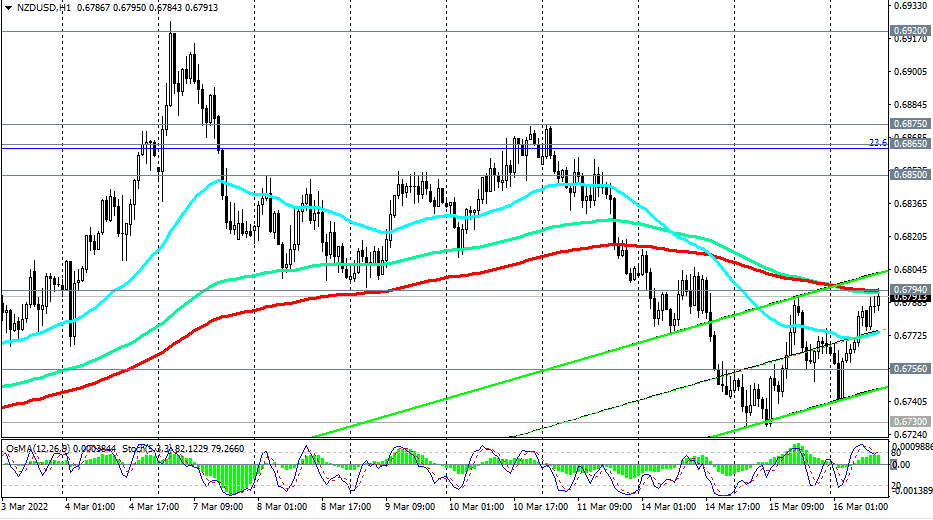

At the time of publication of this article, the pair is trading near the important short-term resistance level of 0.6794. Its breakdown will open the way for further corrective growth towards the key resistance levels of 0.6850, 0.6865 (Fibonacci 23.6% correction in the global wave of the pair's decline from the level of 0.8820), 0.6875. Below these resistance levels, the NZD/USD remains in the bear market zone. The first signal for the resumption of sales will be a breakdown of the short-term support level of 0.6774, and a breakdown of the support level of 0.6756 will be confirming.

Support levels: 0.6774, 0.6756, 0.6730, 0.6700, 0.6661, 0.6600, 0.6540, 0.6500

Resistance levels: 0.6794, 0.6850, 0.6865, 0.6875, 0.6920, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

See also - > Trading recommendations

*) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading

**) Get no deposit StartUp bonus up to 1500.00 USD