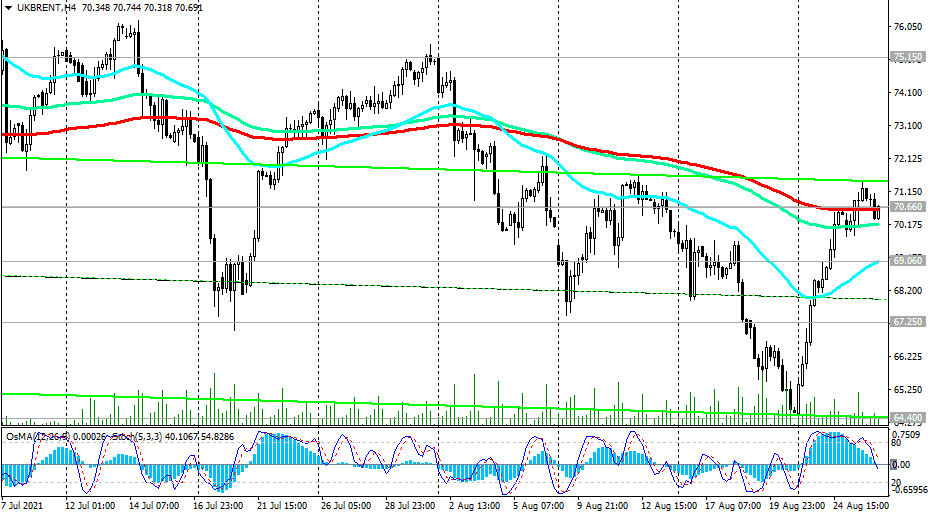

At the time of this posting, Brent crude oil futures are trading near strong resistance at $ 70.66 per barrel. Below this resistance level, the downward corrective price dynamics remains. Therefore, the breakdown of the short-term support level of 69.06 will be a signal for the resumption of short positions (see also "Fundamental Analysis and Recommendations")

In the event of a breakdown of the support levels 64.40, 62.90 (Fibonacci level 23.6% of the correction to the wave of growth from record lows after the collapse of prices in March 2020), the decline may increase towards the key long-term support level 59.80. Its breakdown will strengthen the negative dynamics and the likelihood of a return to a long-term downtrend.

In an alternative scenario and in the event of a confirmed breakdown of the resistance level of 70.66, corrective growth may turn into a resumption of long-term upward dynamics with targets near the resistance levels 75.15, 77.50 (highs since November 2018), 79.80.

Trading recommendations

Sell Stop 69.80. Stop-Loss 71.50. Take-Profit 69.06, 67.25, 64.40, 62.90, 59.80, 53.80

Buy Stop 71.50. Stop-Loss 69.80. Take-Profit 75.15, 77.50, 79.80

*) Brent: Current Fundamental Analysis and Market Expectations

**) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading