On Tuesday, the dollar strengthened, taking into account warnings from Powell. The DXY , starting last trading day with a gap down, increased by 45 points, and on Wednesday the dollar continues to strengthen. At the time of publication of this article, DXY futures are traded near 97.20, 27 pips above the closing price last Tuesday.

At the same time, the dollar remains vulnerable against the Canadian dollar, which is supported by rising oil prices.

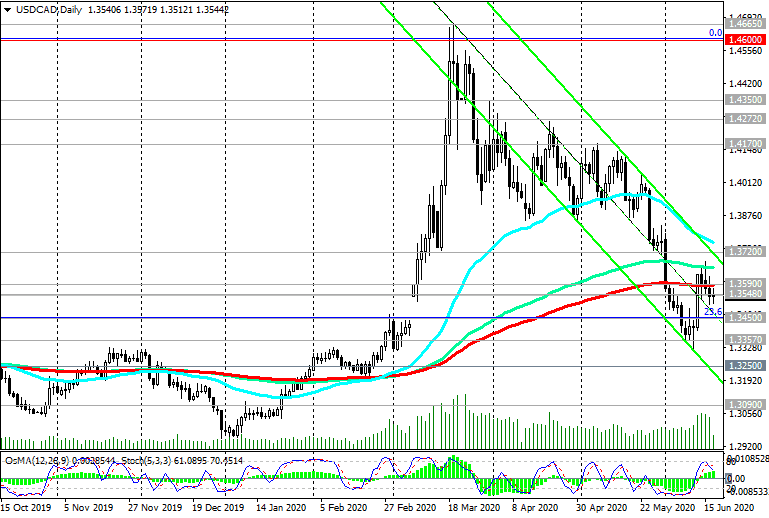

The USD / CAD remains in a 3-month downtrend, has been traded at the beginning of today's European session near the level 1.3548, below the key resistance level 1.3590.

After USD / CAD reached a local 20-year high near 1.4668 in mid-March, the pair subsequently plummeted, was traded near 1.3530 at the beginning of today's European session, below the short-term resistance level of 1.3548 (EMA200 on the 1-hour chart) and 1.3590 (ЕМА200 on the daily chart).

The breakdown of the support level 1.3450 (the Fibonacci level 23.6% of the downward correction in the wave of USD / CAD growth from the level 0.9700 to the level 1.4600) will trigger a further decrease in USD / CAD within the downward channels on the 1-hour, 4-hour, daily charts.

In an alternative scenario and after the breakdown of the resistance level 1.3590 USD / CAD will go to the upper border of the downward channel on the daily chart and EMA200 on the 4-hour chart, which will create the prerequisites for the restoration of the bullish trend of USD / CAD.

Today, the volatility in the USD / CAD may again increase sharply at 12:30 (GMT), when important macro data for the USA and Canada will be published. It is also worth paying attention to another speech by Powell in Congress, which is scheduled to begin at 16:00 (GMT). Any unexpected statements on his part may also cause increased volatility in the financial markets.

Support Levels: 1.3450, 1.3357, 1.3250, 1.3090

Resistance Levels: 1.3548, 1.3590, 1.3680, 1.3720, 1.3900

Trading Scenarios

Sell Stop 1.3490. Stop-Loss 1.3610. Take-Profit 1.3450, 1.3357, 1.3250, 1.3090

Buy Stop 1.3610. Stop-Loss 1.3490. Take-Profit 1.3680, 1.3720, 1.3900, 1.4150