Futures on the DXY dollar index is trading at the beginning of today's European session near 97.42, 18 pips below the opening price of the current trading week and 188 pips below 99.30, near which it was trading earlier this month, when the DXY reached its highest level since March 2017 year.

And yet, despite the decline, the long-term positive dynamics of the US dollar remains. The US economy growth rates, despite signs of a slowdown, is still higher than in other developed countries. The US continues to outperform other developed economies in terms of GDP growth, which creates the preconditions for maintaining demand for US assets and the dollar.

Today (at 12:30 GMT) annual data on US GDP will be published. According to the forecast, GDP in the 3rd quarter grew by 1.7% after rising by 2.0% in the previous 2nd quarter.

And at 18:00 (GMT), the Fed will publish its decision on interest rates. It is widely expected that the Fed will lower its base rate by 0.25% to 1.75%. However, market participants do not have full clarity regarding further plans of the Fed.

Therefore, the attention of financial market participants will be focused on the Fed press conference, which will begin at 18:30 (GMT). If Fed leaders signal that they are likely to take a break in a further rate cut in order to evaluate the results of the ongoing mitigation cycle, this could trigger a fix for short positions and a dollar growth.

If the rhetoric of the accompanying statement by the Fed is soft, then the growth of stock indices and the decline in the dollar may continue.

At 14:00, the Bank of Canada will publish its decision on the rate. Bank of Canada officials said last month that the economy and labor market are in good shape despite escalating trade conflicts. This creates the prerequisites for the Bank of Canada to be able to leave its key rate unchanged at the current meeting, at the same level of 1.75%.

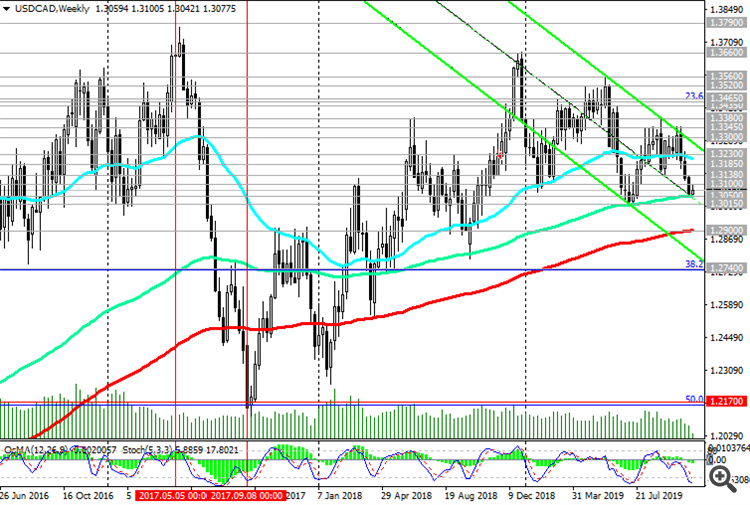

Despite the decline, the long-term positive dynamics of the USD / CAD pair remains. The pair is trading above the key and long-term support level of 1.2900 (EMA200 on the weekly chart).

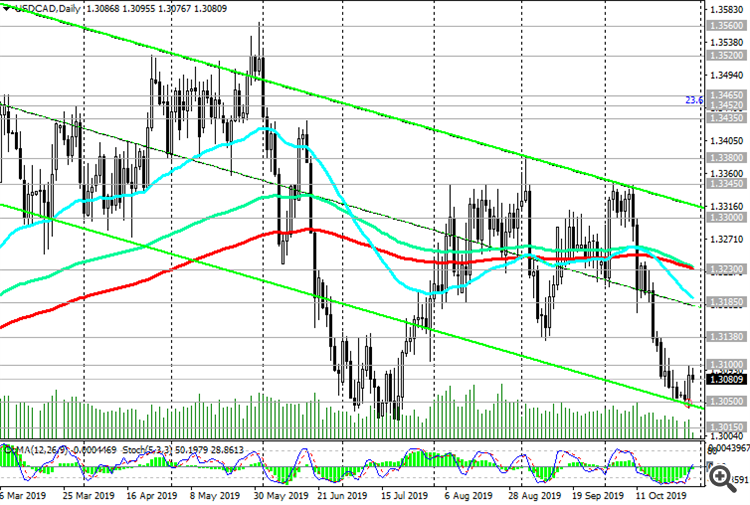

A break into the zone above the resistance level 1.3230 (ЕМА144, ЕМА200 on the daily chart) will resume the bullish trend of USD / CAD and direct the pair towards recent local maxima near the resistance level 1.3345.

The first signal to resume purchases will be the breakdown of resistance levels 1.3100 (ЕМА200 on the 1-hour chart), 1.3138 (September lows).

Support Levels: 1.3050, 1.3015, 1.2900

Resistance Levels: 1.3100, 1.3138, 1.3185, 1.3230, 1.3300, 1.3345, 1.3380

Trading Recommendations

Sell Stop 1.3040. Stop-Loss 1.3110. Take-Profit 1.3015, 1.2900

Buy Stop 1.3110. Stop-Loss 1.3040. Take-Profit 1.3138, 1.3185, 1.3230, 1.3300, 1.3345, 1.3380, 1.3435, 1.3452, 1.3465, 1.3520