USD/JPY: the divergence of the monetary policy of the Fed and the Bank of Japan will intensify

"We do not plan to curtail mitigation until inflation reaches 2%", Bank of Japan head Haruhiko Kuroda said at a press conference on Tuesday, adding that "the possible side effects of mitigation will not prevent further softening of the policy if necessary".

The yen continues to weaken after Kuroda's speech, and the USD / JPY came close to 113.00 before publication (at 18:00 GMT) of the Fed decision on the rate.

It is expected that the rate will be increased by 0.25% to 2.25%, and this increase is already included in the price. Investors are waiting for a press conference and Powell's speech to understand the prospects for monetary policy for 2019.

Any hints Powell on the possibility of a more rapid increase in the interest rate will cause the strengthening of the dollar. Soft Powell rhetoric will bring down the dollar.

Nevertheless, the difference between the monetary policy of the Bank of Japan and the Fed remains the main fundamental factor for the further growth of the pair USD / JPY. Probably, the USD / JPY will keep positive dynamics and will continue to grow, despite the speech of Powell.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Trading scenarios

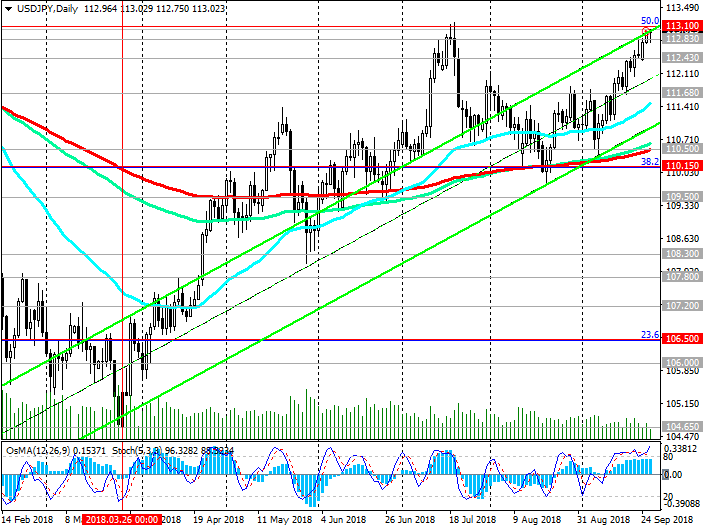

Since the end of March, the USD / JPY has been growing, currently trading above the key support levels of 110.15 (Fibonacci level 38.2% of the correction of the pair's growth since August last year and the level of 99.90), 110.50 (EMA200 on the daily chart). Ascending dynamics prevails. Long positions are preferred. The nearest growth targets are 113.10 levels (Fibonacci level 50% and maximums of the year), 113.70 (December highs). Long-term growth targets are the level of resistance 116.00 (Fibonacci level 61.8%), 118.60 (highs in January 2017).

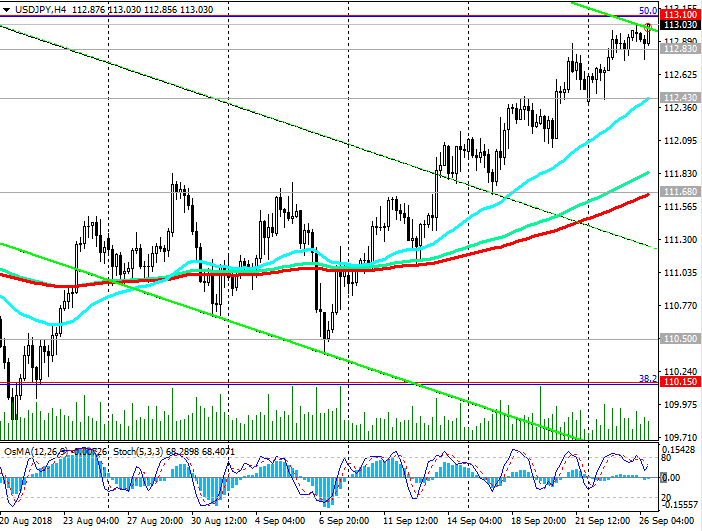

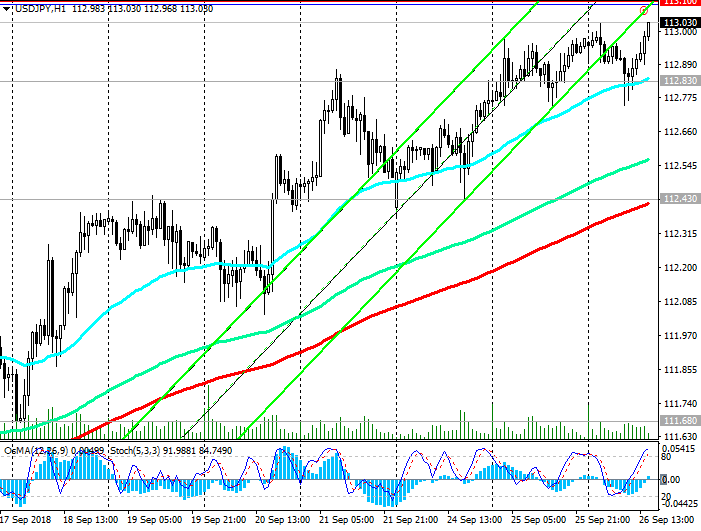

The signal for the decline will be the breakdown of short-term support levels of 112.83 (EMA200 on the 15-minute chart), 112.43 (EMA200 on the 1-hour chart).

The purpose of the downward correction is the support level of 111.68 (EMA200 on the 4-hour chart).

Support levels: 112.83, 112.43, 111.68, 111.00, 110.50, 110.15

Levels of resistance: 113.10, 113.70, 114.00, 114.40, 115.00, 116.00

Trading Scenarios

Buy Stop. Stop Loss 112.70. Take-Profit 113.70, 114.00, 114.40, 115.00, 116.00

Sell Stop 112.70. Stop Loss 113.20. Take-Profit 112.43, 112.00, 111.68, 111.40, 111.00, 110.50, 110.15

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com