On Sunday, Italian President Sergio Mattarella blocked the formation of a Eurosceptic government. On Monday, representatives of European countries expressed concern about the unstable political situation in Italy, which could provoke a new centrifugal crisis in the Eurozone.

The situation with Brexit is not yet fully settled, and in Spain a new political crisis is maturing after the referendum in Catalonia, the political crisis in Italy again made us speak about the future of a united Europe.

On Wednesday in Paris, high-ranking representatives of the EU and the US will hold talks on trade issues. Negotiations will take place in the context of deepening contradictions between Europe and the US on trade and defense issues. The European Commission was told that they will seek to abolish duties on imports of steel and aluminum in the US from Europe and exclude the EU from the duty regime two days before the end of the deferment of their introduction.

Investors as a whole avoid risks, in connection with which the prices for government bonds of the US and Germany are growing. The yield of 10-year US government bonds fell to 2.8% on Tuesday from the level of 3,122%, fixed in the middle of last week. The yield of similar German bonds fell to 0.214% from yesterday's 0.340%.

The unstable geopolitical situation in the world once again provoked an increase in demand for safe haven assets, such as yen and gold. Quotes of gold on Tuesday increased again.

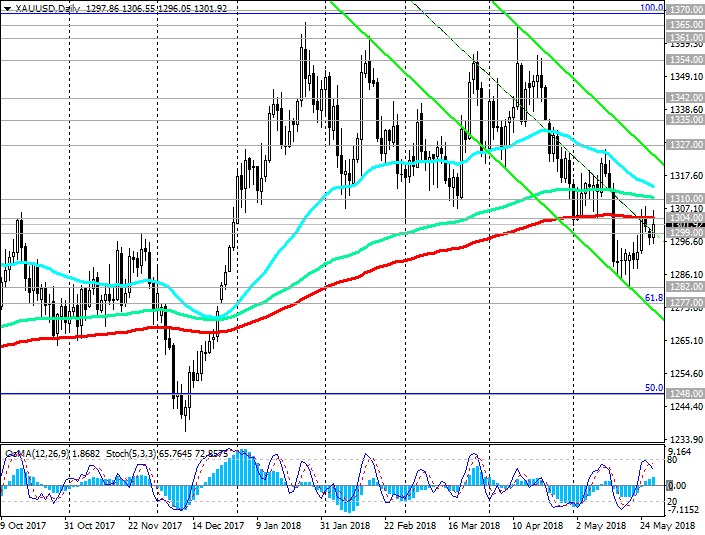

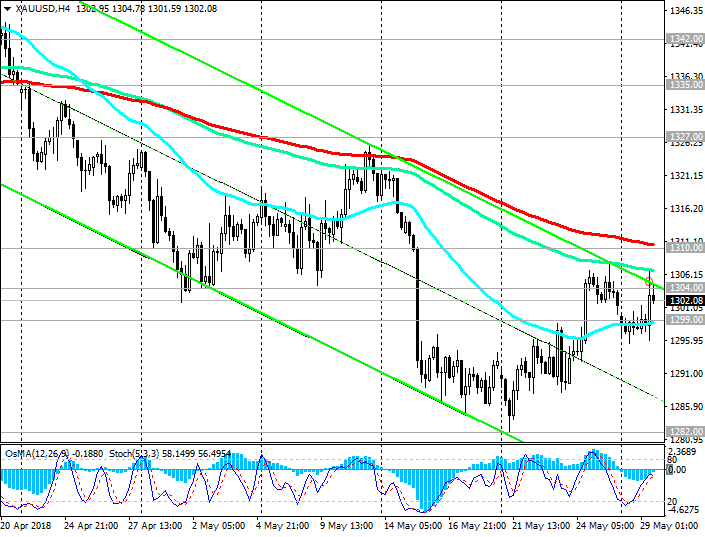

Nevertheless, the current growth in the price of gold in the face of a strengthening dollar can be considered corrective and used to build short positions on gold.

As you know, at the meeting that ended in early May, the Fed confirmed its intention to adhere to its plan to gradually tighten monetary policy. "Too slow increase of rates will lead to the fact that at some point it will be necessary to sharply tighten monetary and credit policy, putting GDP growth at risk", Fed Chairman Jerome Powell said last month.

On June 12-13, the Fed will hold a regular meeting, and most market participants believe that at this meeting the interest rate will be increased by 0.25% to 2.00%.

According to the Fed interest rate futures quotes, investors estimate the probability of a rate hike in June at about 100%, and the likelihood of another three rate increases this year is approximately 50% (compared to 32% a month earlier).

As you know, in the context of an increase in the interest rate, the price of gold is falling, because it is more difficult for him to compete with other objects for long-term investments that generate revenue, such as, for example, government bonds. At the same time, the investment attractiveness of the dollar is growing.

The focus of traders this week will be the publication (on Friday 12:30 (GMT)) of data from the US labor market. Strong figures are expected (the number of new jobs in the non-agricultural sector of the US economy increased by 185,000 in May against +164,000 in April, unemployment remained at the same low level of 3.9%, the lowest level in the last 18 months). If the data prove to be better, the dollar will receive another strong support against the backdrop of positive macro statistics coming in recently from the US, and gold will continue to fall in price.

Only weak macro data from the United States, as well as an even greater strengthening of geopolitical tensions in the world, can push gold quotes higher. So far, negative dynamics prevails.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1299.00, 1295.00, 1282.00, 1277.00, 1274.00, 1248.00

Resistance level: 1304.00, 1310.00, 1325.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00

Trading Scenarios

Sell in the market. Stop-Loss 1311.00. Take-Profit 1295.00, 1282.00, 1277.00, 1274.00, 1248.00

Buy Stop 1311.00. Stop-Loss 1294.00. Take-Profit 1322.00, 1335.00, 1342.00, 1354.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com