Markets positively perceived the information that the US and China agreed on a trade truce. At last weekend's talks, Beijing agreed to increase purchases of goods manufactured in the US to reduce the US trade deficit with China, which is $ 375 billion now.

The Trump administration tried to force China to agree to reduce the trade imbalance by $ 200 billion.

Nevertheless, Beijing has refused to determine the exact amount of purchases in dollar terms, and now everything depends on the talks between the two presidents, Trump and Xi Jinping.

On Sunday, US Treasury Secretary Stephen Mnuchin said that the administration of US President Donald Trump intends to "put the trade war on a pause" and postpone the introduction of duties on the import of goods from China, until the two sides discuss the details of the agreement to reduce the trade deficit.

The successful season of reporting US companies for the first quarter also contributed to the growth of US stock indices in recent days.

At the same time, long-term estimates of inflation in the US are still restrained, despite improvements in indicators. In this regard, investors are interested in how actively the Fed will react to one-time price increases.

As you know, at the December meeting, the leaders of the Federal Reserve planned 3 rate increases in 2018. In 2017, the rates were also raised 3 times. This temp of tightening of monetary policy is already taken into account in quotes.

According to the futures quotations for interest rates of the Fed, investors estimate the probability of four rate increases at 50% (against 32% a month earlier). In this case, the probability of an increase in the rate in June is estimated at 100%. Strong recent economic data from the US has strengthened investors' expectations about 4 Fed interest rate rises in 2018, despite the fact that the Fed is still signaling about 2 more rate hikes.

Now investors will carefully monitor the release of the minutes of the Fed's May meeting (on Wednesday 18:00 GMT), which may shed light on how quickly rates will be raised in response to increased inflation.

On Friday (13:20 GMT) the head of the Federal Reserve Jerome Powell will act. If he signals a high probability of 4 rate increases this year, then US stock indices may fall again. As a rule, raising rates leads to the strengthening of the national currency and to a decrease in the attractiveness of the assets of the stock market.

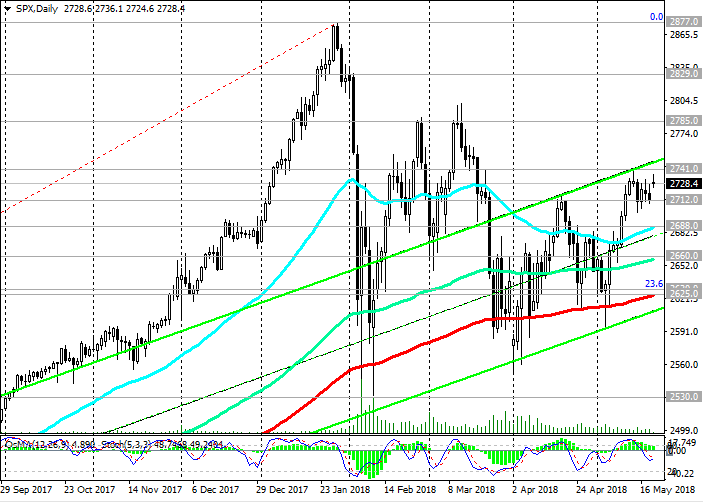

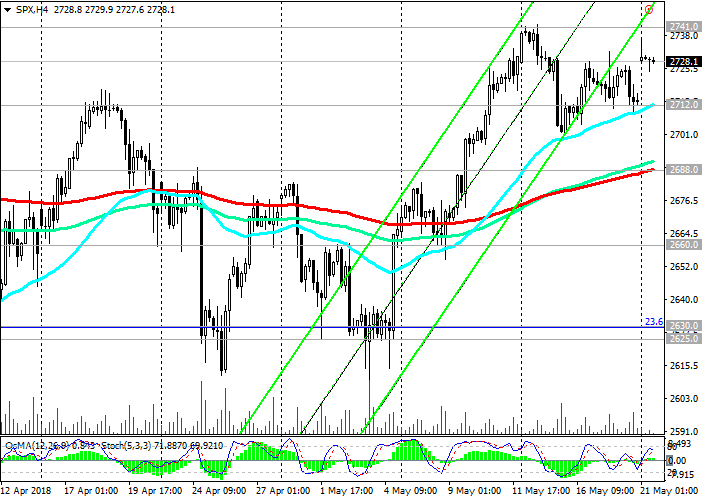

Meanwhile, the bullish trend of the US stock market remains.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 2712.0, 2688.0, 2660.0, 2630.0, 2625.0, 2530.0

Resistance levels: 2741.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2700.0. Stop-Loss 2742.0. Objectives 2688.0, 2660.0, 2630.0, 2625.0

Buy Stop 2742.0. Stop-Loss 2700.0. Objectives 2760.0, 2785.0, 2800.0, 2829.0, 2877.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com