In this article, we will learn the answers to the most common questions about the AOTI indicator.

Which timeframe is better, for which currency pairs are the indicator suitable, how to install the indicator? Let’s find out the answers to these and other questions right now.

![]()

For which currency pairs is the indicator suitable?

The All-in-One Trade Indicator (AOTI) is determining the daily levels (targets) for EURUSD, EURJPY, GBPUSD, USDCHF, EURGBP, EURCAD, EURAUD, AUDJPY, GBPAUD, GBPCAD, GBPCHF, and GBPJPY. All other modules work for any instruments.

![]()

Which timeframe is better for the AOTI indicator?

Initially, the AOTI indicator was created for the M5 timeframe. On this timeframe, even insignificant price movements are visible, which is important for me. And I recommend using this timeframe for trading.

But for your strategy, you can use any timeframe. The only condition is that the timeframe must be less than H4, since on this timeframe the levels are not pretty visible.

All other features (reversal arrow signals, support/resistance micro-levels, dual-channel trend direction, price channel, MA bands, etc) work at any timeframes.

![]()

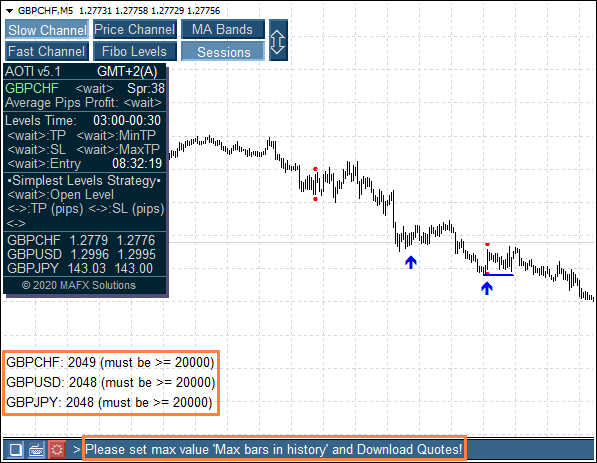

How to download the history quotes for the indicator?

Launch the Indicator and Load Historical Data for Additional Currency Pairs

If your terminal is new or installed recently, and you run the indicator on a currency pair for which the indicator can calculate daily levels, you may see the following message:

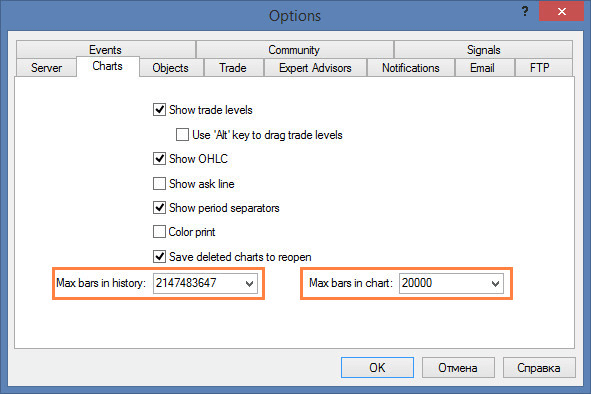

'Max bars in history' can be the maximum possible value so that you get the maximum potential value when loading historical data.

'Max bars in chart' for the AOTI indicator, you need to set the value 20000-50000 (depending on the power of your computer). The recommended value is 25000.

What we need to do

Read more about this here: www.mql5.com/en/blogs/post/733703

![]()

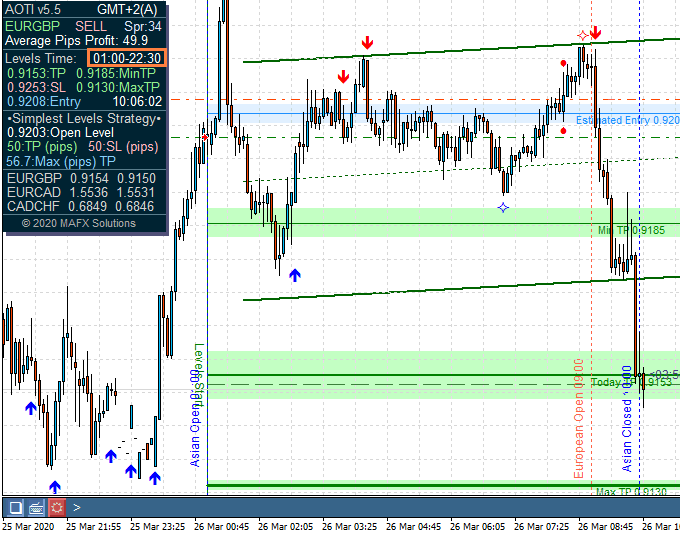

At what time the indicator determines the daily levels?

At the 'Levels Time' field, the AOTI indicator shows what time the Daily Levels will be determined, and until what time they are valid.

If the GMT Offset of your broker is +2, then the levels will be built at 01:00 terminal time.

How to set correct GMT Offset see here.

![]()

What is GMT Offset?

The difference in time between our local time and GMT (UTC) is called GMT offset. All brokerage companies are located in different countries with their own GMT offsets. Therefore it is so important to set the correct GMT offset in the expert advisors or indicators settings.

To determine the GMT Offset, look at this formula:

GMT Time hours – it’s a time of your broker (not yours local)!

Read more about determining the GMT Offset here.

![]()

What other features are in the indicator and how can they help us?

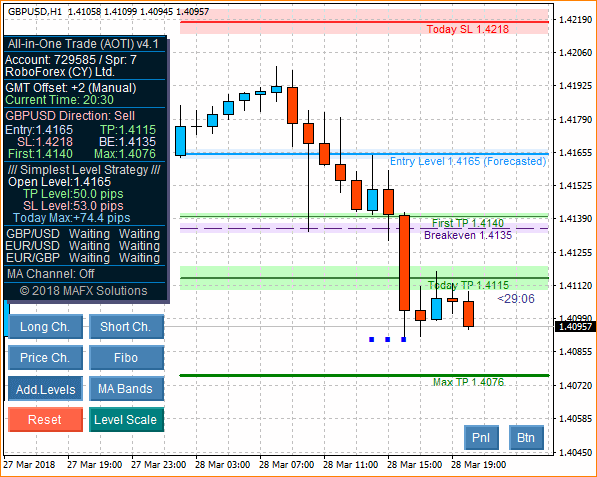

Previously, we have talked many times about the Simplest Strategy of the Levels (SSL).

This method is the simplest, but it has its own negative sides. We do not use additional analysis, we do not use additional indicator signals, we do not use all the features of the indicator. What else is interesting in the indicator and how it can help us?

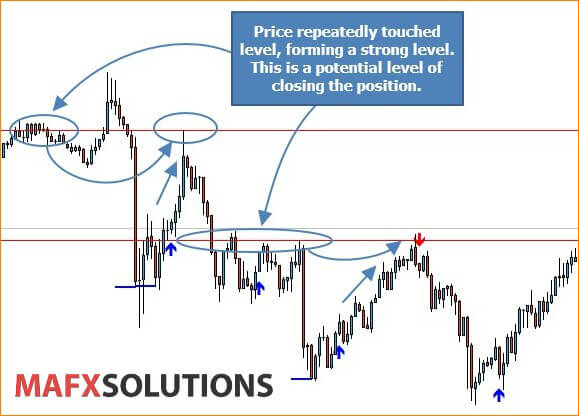

One picture instead of 1000 words:

But the indicator does not trade on its own. It shows important levels and important signals. But we accept the decision. It requires experience and practice but gives joy from the result as a result – profit and successful deals.

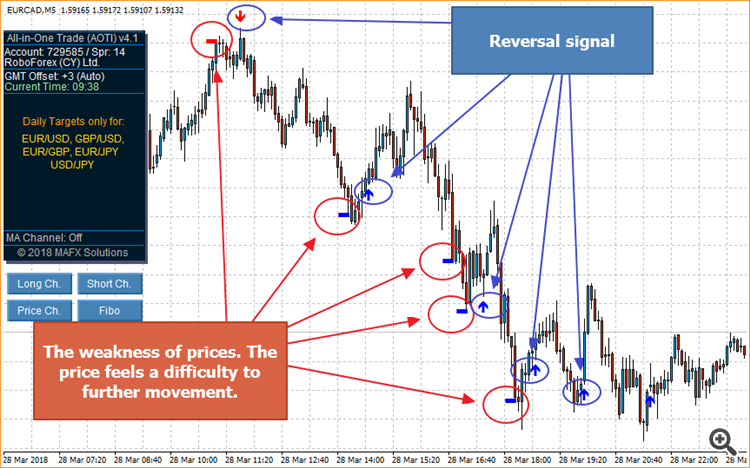

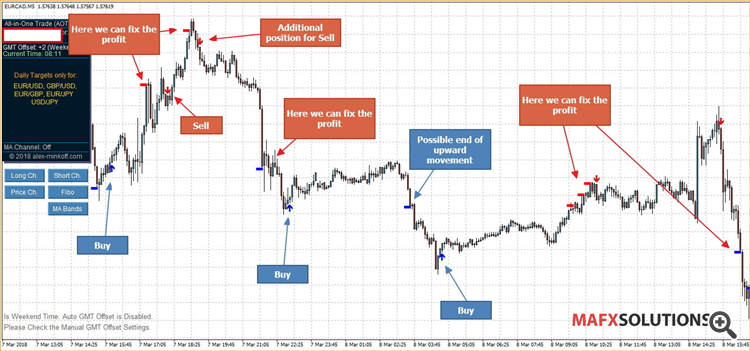

We can use Arrows and Support/Resistance micro-levels for scalping. Price a few times touches for certain levels. These levels are strong and they give the opportunity to fix the profit.

Another example – EURCAD. Example simplified, without any analysis of news and other things.

The Support/Resistance micro-levels – shows a slowdown in the current price movement. This is a possible level of profit taking.

The Arrows is a reversal signal.

MA Bands:

Fibo feature. Shows potential rollback levels and the ability to open additional positions.

![]()

The article will be supplemented with new questions and answers.

Well, thank you for your attention. That’s it for today.

Good Luck & Big Profits!