The European stock and stock markets of Australia, New Zealand and Hong Kong are still closed today on the occasion of the holiday (Catholic Easter).

Asian indices fell on Monday amid tensions in world trade and concerns about the technology sector.

The key index of the Shanghai Stock Exchange fell by 0.2% after the introduction of import tariffs; South Korean Kospi dropped 0.1%, Taiwan's Taiex declined 0.3%, Japanese Nikkei traded 0.3% lower.

The Chinese authorities introduced reciprocal import duties on US agricultural products, including a 25% tariff on American pork and a 15% duty on fruit. In total 128 items of goods imported from the United States are in the restrictive list.

As you know, President of the United States Donald Trump signed on March 9 an order to impose tariffs on imports of steel and aluminum. Fees for import of steel amounted to 25%, for imports of aluminum - 10%, because according to Washington, the import of steel and aluminum "threatens the national security" of the country.

Then on March 22, the White House adopted a memorandum on imposing trade restrictions on Beijing in order to reduce the deficit in US trade with China, which "according to various estimates, was between $ 375 billion and $ 504 billion". In total, the amount of restrictions on Chinese imports will be $ 60 billion. In China, after this, the United States were warned against the "trade war".

Investors are worried about the aggravation of trade relations between the US and China and have not yet decided what exactly this situation will turn out.

It is likely that against the background of the decline in leading Asian stock indices today, the main US trading indices will also open on negative territory.

News background today is meager. Negative mood of investors will be reflected in the decline of US indices at the opening of the American market. In full, the volatility and trading volumes on world financial markets will recover only on Tuesday.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

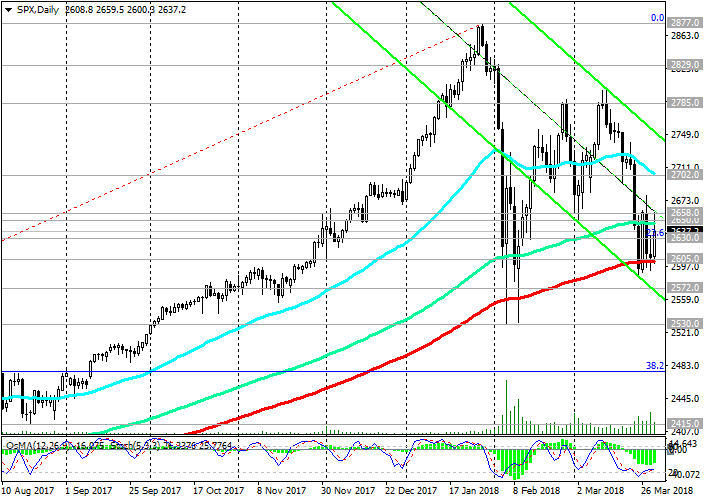

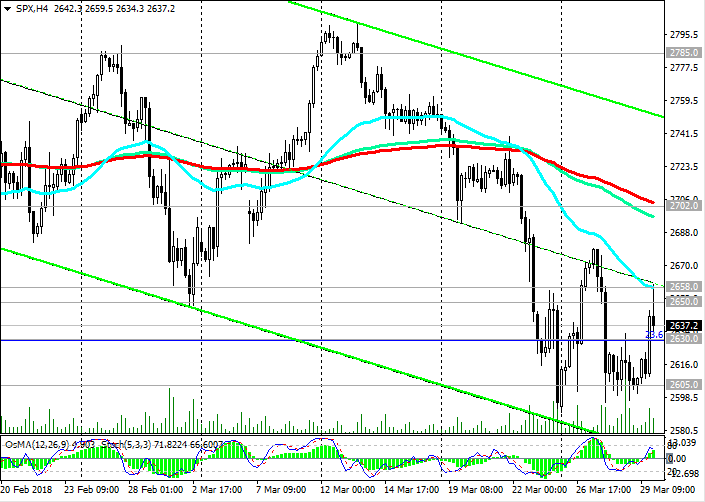

Support levels: 2630.0, 2605.0, 2572.0, 2530.0, 2480.0

Resistance levels: 2650.0, 2658.0, 2702.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2615.0. Stop-Loss 2660.0. Objectives 2605.0, 2572.0, 2530.0

Buy Stop 2660.0. Stop-Loss 2615.0. Objectives 2702.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com