Major US stock indices on Monday remain positive dynamics, stably bargaining on eve of the Fed meeting scheduled for December 12-13. On Friday, US indices rose and recorded growth in the past week against the background of the restoration of shares of technology companies and more favorable than expected, the report on the US labor market. As you know, the report of the US Department of Labor pointed to an increase of 228,000 new jobs (with a forecast of +200,000). Unemployment remained at the same level of 4.1%. The picture was somewhat spoiled by the index of the average hourly earnings, which in November was less than the forecast and amounted to 0.2% (the forecast was 0.3%).

This week, important decisions of three other leading central banks in the world and fresh data on inflation are expected. On December 14, sessions of the NBS, the Bank of England and the ECB are scheduled. As unforeseen decisions of central banks are not expected, the most interesting are the forecasts of inflation and economic development.

It is widely expected that the Fed at its meeting will decide to raise the interest rate by 0.25% to 1.50% (publication of the decision on the rates is scheduled for 19:00 (GMT) on Wednesday). Investors, basically, have already considered this increase in prices, and their attention will be riveted to the report of the Fed with forecasts on inflation and economic growth, as well as the views of FOMC members regarding further plans for monetary policy.

Probably, the Fed will adhere to current plans, according to which it intends to gradually raise rates three more times in 2018.

Against the backdrop of positive, as investors expect, Fed reports, US stock indexes will continue to grow, despite overbought. If, however, the Fed report or the views of FOMC members contain fears about the future of economic development in the US or accelerate the growth of inflation, the stock indexes may short-term, but sharply decline.

Investors will carefully study the text of the report in order to understand the prospects of the course of the current policy of the Federal Reserve System. Volatility during the publication of the report can significantly increase.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

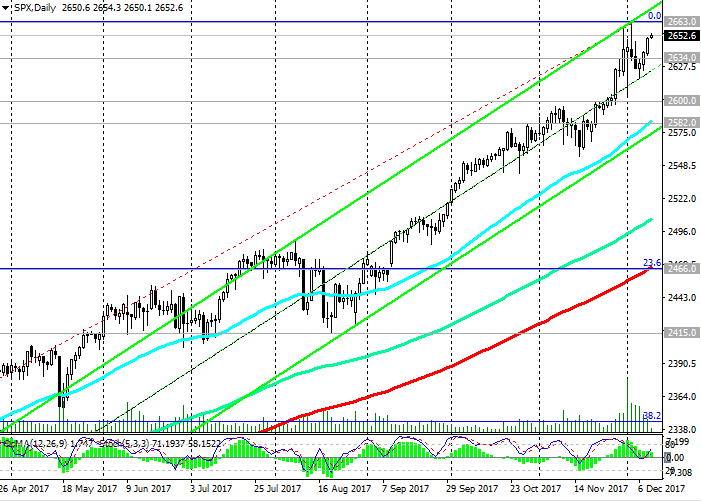

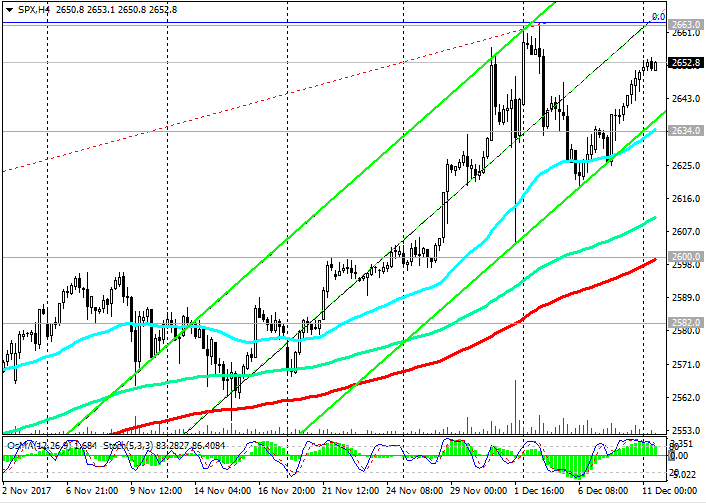

Support levels: 2634.0, 2600.0, 2582.0, 2565.0, 2500.0, 2466.0, 2444.0, 2415.0

Resistance levels: 2663.0, 2700.0

Trading Scenarios]

Sell Stop 2637.0. Stop-Loss 2660.0. Objectives 2634.0, 2600.0, 2582.0, 2565.0, 2500.0, 2466.0

Buy Stop 2660.0 Stop-Loss 2637.0. Objectives 2663.0, 2685.0, 2700.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com