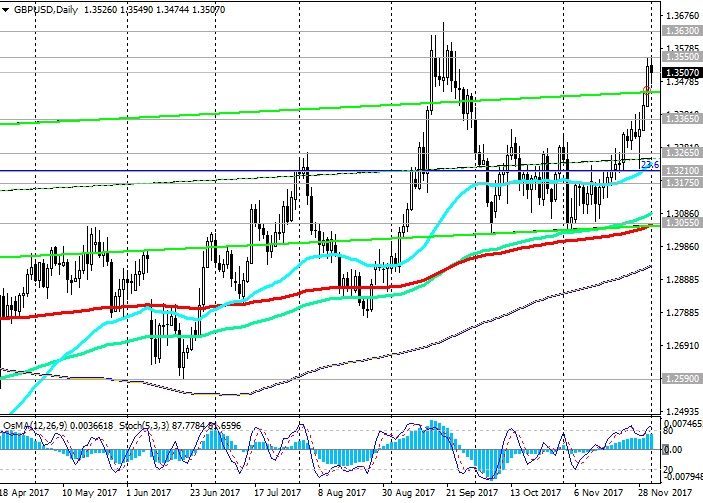

After an active 4-week growth, the GBP / USD is declining during today Asian and European sessions.

Nevertheless, the current decline is of a short-term nature. The positive dynamics of the pound and GBP/USD remains.

At the beginning of today's European session, the pair GBP / USD is trading near the 1.3500 mark, well above the important short-term support level of 1.3365 (EMA200 and the bottom line of the rising channel on the 1-hour chart).

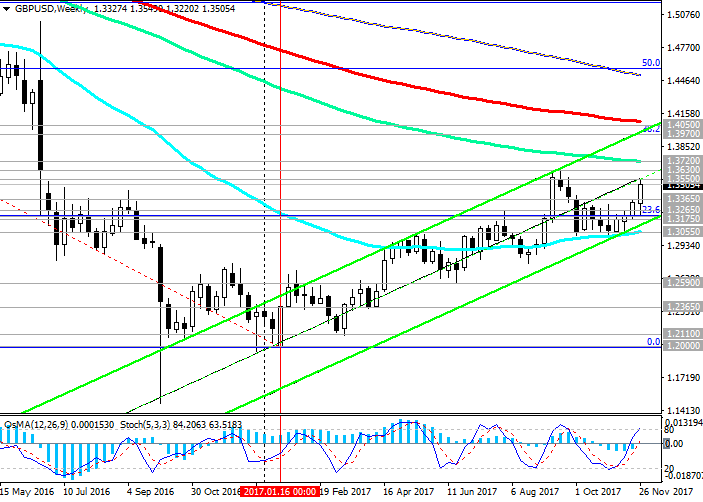

But only in case of breakdown of the key support level 1.3055 (EMA200 on daily chart, EMA50 on the weekly chart) can we speak about the end of growth.

In the case of the breakdown of the support level 1.3365, the targets for the corrective decline of the GBP / USD will be the support levels of 1.3265 (EMA200 on the 4-hour chart), 1.3210 (the Fibonacci level of 23.6% correction to the GBP / USD decline in the wave, which began in July 2014 near level 1.7200).

Breakdown of the key support level 1.3055 will cancel the scenario for growth and confirm the reverse scenario - the end of the upward correction to the global downtrend of the GBP / USD, which began in July 2014.

While GBP / USD is trading above the key support level of 1.3055, its positive dynamics persists.

If the local resistance level of 1.3550 be broken (November highs), the GBP/USD growth may continue to 1.3720 (EMA144 on the weekly chart), 1.3970 (38.2% Fibonacci level), 1.4050 (EMA200 and the upper line of the rising channel on the weekly chart).

Support levels: 1.3500, 1.3400, 1.3365, 1.3265, 1.3210, 1.3175, 1.3100, 1.3055

Resistance levels: 1.3550, 1.3630, 1.3720, 1.3970, 1.4050

Trading recommendations

Sell Stop 1.3460. Stop-Loss 1.3520. Take-Profit 1.3400, 1.3365, 1.3265, 1.3210, 1.3175, 1.3100, 1.3055

Buy Stop 1.3520. Stop-Loss 1.3460. Take-Profit 1.3550, 1.3630, 1.3720, 1.3970, 1.4050

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.