Published in the press on the weekend news, that German Chancellor Angela Merkel failed to create a ruling coalition, caused a surge in volatility at the opening of trading on Monday.

Euro, as well as European stock indexes, above all, DAX (the leading German index), fell at the opening of today. The fall of the euro against the pound in the pair EUR / GBP caused, on the contrary, the growth of the pound, including against the dollar. The pound gets support also against the backdrop of the fact that British Prime Minister Theresa May will most likely convince the government to support the increase in the payment to the European Union for Brexit.

As you know, the financial question is the cornerstone in the Brexit process. In September, British Prime Minister Theresa May promised that Britain would pay its share in the EU budget until 2020. But the EU authorities said that they still do not have a clear understanding of whether the UK will fully fulfill its obligations. The final amount of payments on Brexit may exceed 60 billion euros. It even mentions a figure of 100 billion euros, but representatives of the UK dispute this figure.

Last week, the representative of the EU in Brexit talks from the EU Michelle Barbier stated that it would be time for Britain to clarify the situation on the issues of "exit" from the bloc.

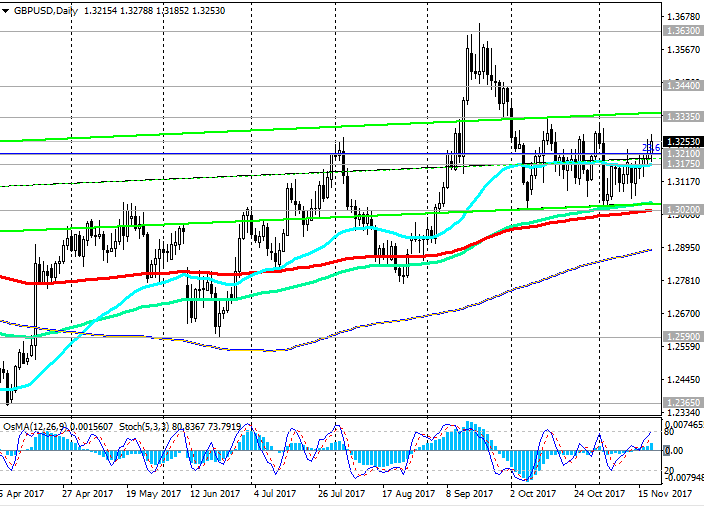

The draft budget will be presented on Wednesday. UK Finance Minister Philip Hammond will present his plan for taxes and expenses, which, apparently, will be met with approval. On this positive for the pound background, the GBP / USD pair can update the local highs of the previous month near the 1.3335 mark.

Nevertheless, the long-term outlook for the pound will remain negative until the details of the UK's exit procedure from the EU are finally understood.

Investors will also be interested in data on public sector borrowing, which will be presented on Tuesday (09:30 GMT), as well as the volume of capital investments of British companies in the third quarter, which will be known on Thursday (09:30 GMT). Also at this time on Thursday will be published the second estimate of GDP growth in the UK in the third quarter. Economists expect that in the third quarter GDP grew by 0.4% compared to the previous quarter, which coincides with a preliminary estimate.

Also volatility in the financial markets may rise on Wednesday, after at 18:00 (GMT) will be published "FOMC minutes". In the published minutes from the November meeting of the Federal Reserve, investors will seek signals on the future of US monetary policy. The publication of the protocol is extremely important for determining the course of the current policy of the Fed and the prospects for raising the interest rate in the United States. According to interest rate futures, the probability of a rate hike in December in the US is above 90%.

Economists expect that the US labor market situation will continue to improve, and inflation will rise to a target level of 2%, which will force the Fed to raise the key interest rate four times next year.

And this is the strongest factor for the growth of the dollar, including in the pair GBP / USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support

levels: 1.3210, 1.3175, 1.3145, 1.3100, 1.3065, 1.3020, 1.2975, 1.2590, 1.2365,

1.2110, 1.2000

Resistance levels: 1.3300, 1.3335, 1.3440, 1.3500, 1.3630, 1.3760, 1.3970, 1.4100

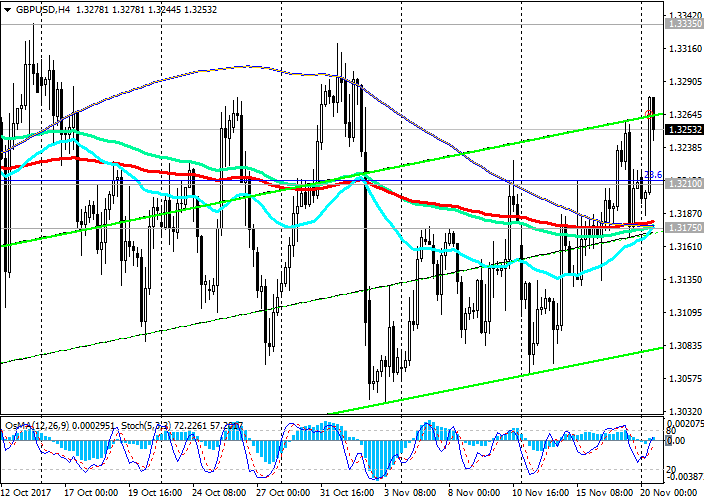

Trading Scenarios

Sell Stop 1.3230. Stop-Loss 1.3280. Take-Profit 1.3200, 1.3175, 1.3100, 1.3065, 1.3020, 1.2975, 1.2590, 1.2365, 1.2110, 1.2000

Buy Stop 1.3280. Stop-Loss 1.3230. Take-Profit 1.3300, 1.3335, 1.3400, 1.3440, 1.3500, 1.3630, 1.3760, 1.3970, 1.4100

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com