Quotations of oil futures fell on Tuesday, however, they remained on the mid-2015 highs. January futures for Brent crude oil fell in price by 0.53%, to 63.35 dollars per barrel. The spot price for Brent crude at the beginning of today's European session is near the mark of 63.55 dollars per barrel after the day before the price reached the high of 2017 near the mark of 64.45 dollars per barrel.

Oil prices at the beginning of the week rose to their highest levels since 2015 due to the fact that the Saudi Crown Prince Mohammed bin Salman ordered the arrest of more than 50 people on suspicion of corruption, including members of the royal family, ministers and big businessmen.

Oil prices also received support after Yemeni hussites rebels launched a ballistic missile in the vicinity of Riyadh, which was shot down in the vicinity of the capital. The tensions between Saudi Arabia and Iran, which supports the hussites, intensified. Both countries are members of OPEC.

Investors are concerned that the power struggle in Saudi Arabia, which is the world's largest oil exporter, brings uncertainty to the market, and numerous conflicts in the Middle East can lead to disruptions in oil supplies.

Also, the rise in prices is fueled by the expectation that at the November meeting, OPEC will extend the deal. As you know, last year, OPEC and other oil exporters, including Russia, entered into an agreement to reduce total production by 1.8 million barrels a day. In Vienna on November 30, OPEC will hold a meeting, within which the extension of the agreement on the reduction of production, which expires in March 2018, will be discussed.

Today, traders are waiting for data from the Energy Information Administration (EIA) of the US Department of Energy on oil reserves in the country. The weekly EIA report will be published at 15.30 (GMT).

According to the American Petroleum Institute (API), which was published on Tuesday evening, US oil inventories fell 1.6 million barrels last week. Gasoline stocks increased by 520,000 barrels, and distillate stocks decreased by 3.1 million barrels, according to the API report.

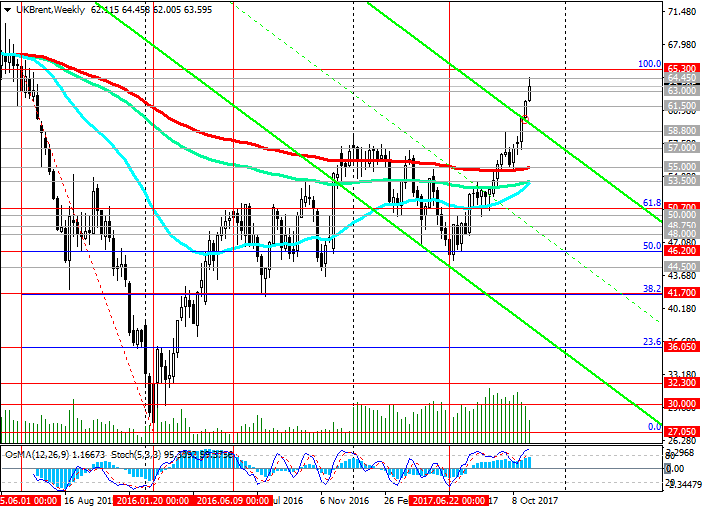

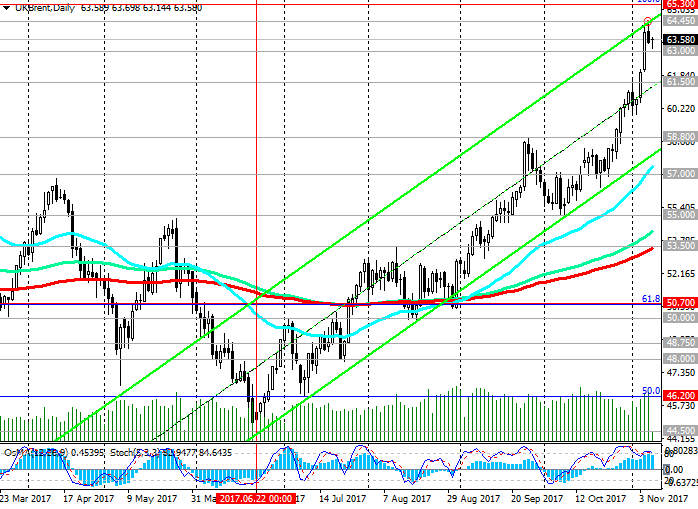

There is a strong positive impulse of a fundamental nature. The next target is resistance level 65.30 (Fibonacci level 100% correction to the decline from the level of 65.30 from June 2015 to the absolute minimums of 2016 near the mark of 27.00).

Technical indicators (OsMA and Stochastic) on the daily, weekly, monthly charts are on the buyers’ side. Long positions are preferred.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Trading Scenarios

Sell Stop 62.90. Stop-Loss 63.90. Take-Profit 62.00, 61.50, 60.00, 58.80, 58.00, 57.00, 56.20, 55.55, 55.00, 54.70, 53.50, 52.20, 50.70, 50.00

Buy Stop 63.90. Stop-Loss 62.90. Take-Profit 64.45, 65.00, 65.30, 66.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com