For several days in a row, the main US stock indexes are traded in a narrow range, while maintaining, in general, a positive dynamic.

As it became known, on Saturday Trump stopped on the candidacy of Powell. He is a Republican and since 2010 has been one of the central bank governors, well aware of the Fed's activities "from within". Powell is considered to be a supporter of the actions of the current head of the Fed, Janet Yellen, and is less inclined to aggressively tighten monetary and credit policy than other candidates. In his opinion, the Fed's actions to raise interest rates "should be carried out gradually, while the development of the economic situation in the country roughly corresponds to expectations". The appointment of Powell is likely to mean continuity in the conduct of monetary policy and, perhaps, a slight easing of measures to regulate financial markets.

In addition, the Fed on Wednesday, as expected, kept interest rates unchanged, but signaled that it could raise them one more time this year. Until the end of the year, another meeting of the Fed is scheduled, which should be held December 12-13.

"Economic activity is growing at a strong pace, despite the obstacles, made by hurricanes," the Fed said in a statement following the meeting that ended on Wednesday.

Markets with a high degree of confidence expect a rate hike in December.

At the beginning of the European session, the dollar partially recovered from the initial losses, but remained on the negative territory to most other major currencies. Yield of 10-year US government bonds, according to Tradeweb, fell to 2.371% from 2.378% recorded on Wednesday, and investors, just in case, buy gold in case of unforeseen events.

Today investors are waiting for a busy day. The Bank of England is expected to raise the key interest rate for the first time in more than a decade, while Republicans in the United States are preparing to publish a plan for changing the taxation system.

At 12:00 (GMT), the Bank of England's interest rate decision will be published, and at 12:30 the Bank of England head, Mark Carney, will make an explanation of the bank's further plans.

Thus, today, volatility in the financial markets is expected to grow rapidly. Nevertheless, the US stock market is expected to retain a positive momentum. In addition, analysts closely monitor corporate reporting, which many regard as the main driver of the rally in the stock markets this year

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

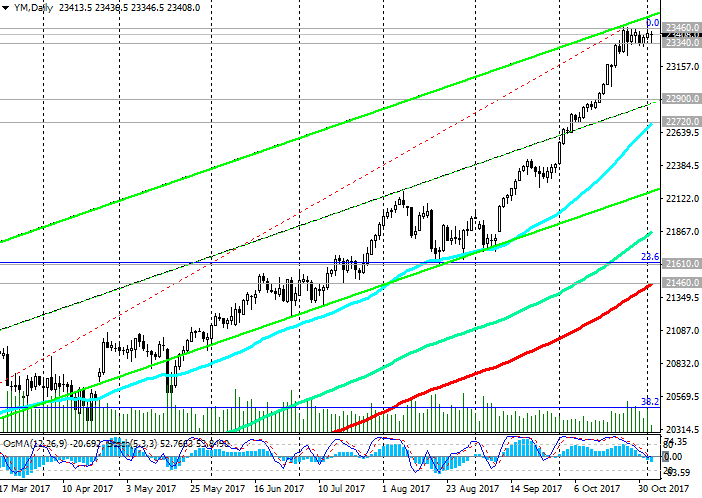

Last month DJIA updated the absolute maximum near the mark 23460.0. Since January 2016 DJIA has been growing steadily. Especially remarkable are the last 8 almost recoilless weeks of growth.

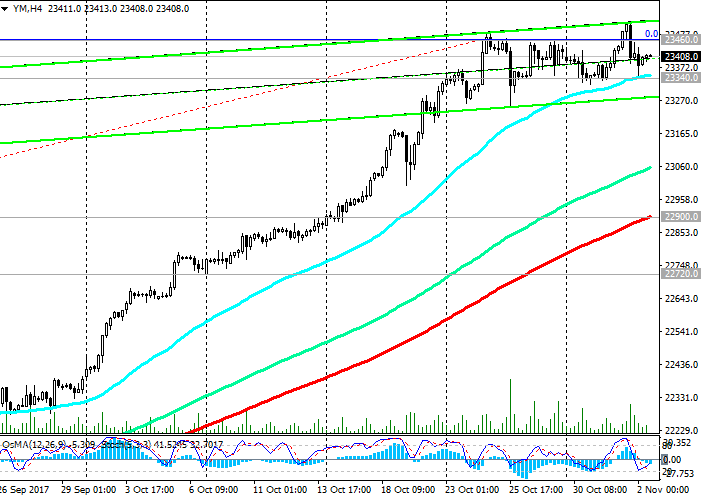

Positive dynamics is maintained, and at the beginning of today's European session, the index is trading near the mark of 23400.0. In case of breakthrough of resistance level 23460.0, DJIA growth will continue until the price "gropes" for new resistance levels.

Consideration of short positions is possible only in the short term with targets at support levels 22900.0 (EMA200 on the 4-hour chart), 22720.0 (EMA50 on the daily chart).

The signal to open short positions will be a breakdown of short-term support level of 23340.0 (EMA200 on the 1-hour chart).

So far, the DJIA index is trading above the key support levels of 21610.0 (the Fibonacci level is 23.6% correction to the wave growth from the level of 15660.0 after the recovery in February of this year to the collapse of the markets since the beginning of the year. The maximum of this wave and Fibonacci 0% is near the mark 23460.0), 21460.0 (EMA200 on the daily chart), its long-term positive dynamics persists.

Support levels: 23340.0, 22900.0, 22720.0, 22410.0, 22140.0, 22000.0, 21610.0, 21460.0

Resistance levels: 23460.0

Trading scenarios

Buy Stop 23490.0. Stop-Loss 23300.0. Take-Profit 23600.0, 23700.0, 24000.0

Sell Stop 23300.0. Stop-Loss 23490.0. Take-Profit 23285.0, 22820.0, 22670.0, 22410.0, 22140.0, 22000.0, 21610.0, 21460.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com