The main events of the week started are the meetings of the central banks of the USA and Japan. The two-day meeting of the Fed starts today, and will end on Wednesday with a publication (at 18:00 GMT) of interest rate decisions and a press conference, which will begin at 18:30 (GMT).

On Thursday, a more favorable than expected consumer price index in the US was published, which strengthened investors' expectations about the likelihood of another rate hike this year. According to the CME Group, investors estimate the likelihood of a rate hike by the end of the year at 58% against the 41% level noted last week.

On Wednesday, the Fed is expected to announce plans to reduce its portfolio of mortgage and government bonds by $ 4.5 trillion, but will leave interest rates unchanged.

If the leaders of the Fed express confidence in the restoration of economic growth in the US, it will support the dollar.

Concerning the New Zealand dollar, it is worth noting that volatility in trading on it could rise sharply on Monday, when the results of the general election in New Zealand, which will be held on Saturday, will be known. According to the latest opinion poll, the gap between the candidates remains very small. 42.4% of the respondents are ready to cast their votes for the National Party, and 40.4% for the opposition Labor Party. If the ruling National Party wins, the New Zealand dollar will strengthen on the foreign exchange market.

From the news for today it is worth paying attention to the publication after 13:00 (GMT) of the data from the auction of dairy products. The price index for dairy products, prepared by Global Dairy Trade, came out last time with the value of + 0.3%.

It is expected that the price of milk powder will not change or fall by 2%, which will have a negative impact on the New Zealand dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

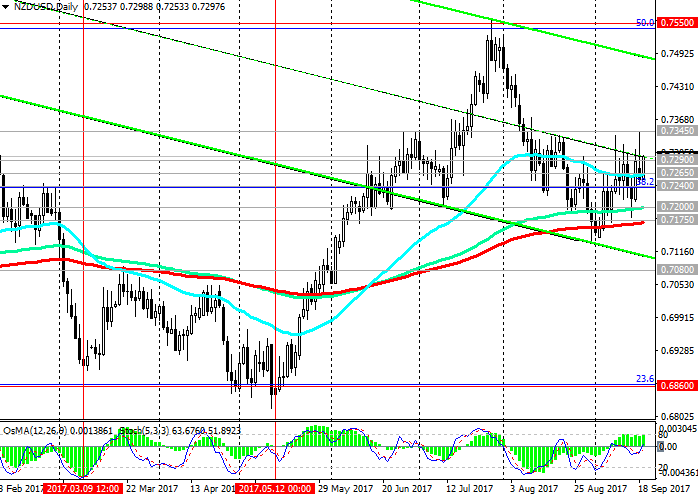

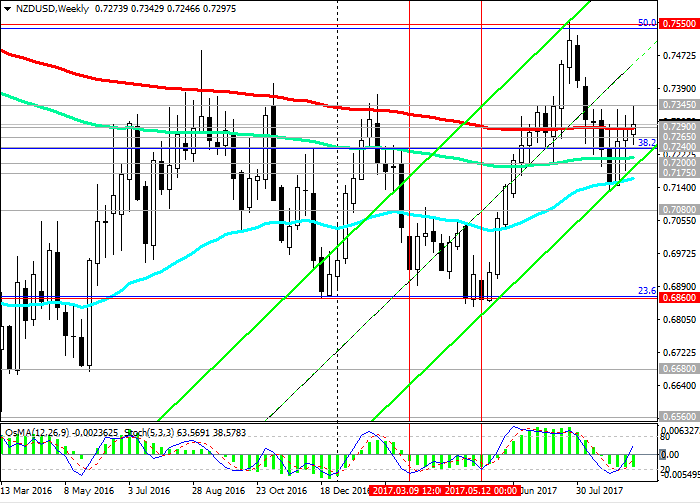

Today, NZD/USD is making another attempt to break through the resistance level of 0.7290 (EMA200 on the weekly chart).

At the same time, NZD / USD keeps positive dynamics, trading in the uplink on the weekly chart, the upper limit of which is above the resistance level of 0.7550 (the Fibonacci level of 38.2% of the upward correction to the global wave of decline from 0.8800, which began in July 2014, December 2016).

Indicators OsMA and Stochastics on the daily, weekly, monthly charts were turned to long positions.

In case of breaking through the local resistance level of 0.7345, the growth of NZD / USD pair will continue with the target at the level of 0.7550.

In the alternative scenario and in case of breakdown of the support level of 0.7240 (Fibonacci level of 38.2%), further decrease to the support levels 0.7200 (EMA144), 0.7175 (EMA200 on the daily chart) is possible.

The breakdown at 0.7175 raises the risks of a return to a downtrend. The immediate goal of further decline is the support level of 0.7080 (the lower boundary of the descending channel on the daily chart and EMA200 on the monthly chart).

The break of 0.6860 (the Fibonacci level of 23.6% and the lower limit of the range between 0.7550 and 0.6860) will mean the end of the upward correction, which began in September 2015, and return to the downtrend.

Support levels: 0.7265, 0.7240, 0.7200, 0.7175

Resistance levels: 0.7300, 0.7345, 0.7455, 0.7500, 0.7550

Trading Scenarios

Sell Stop 0.7260. Stop-Loss 0.7310. Take-Profit 0.7240, 0.7200, 0.7175, 0.7100, 0.7000, 0.6860

Buy Stop 0.7310. Stop-Loss 0.7260. Take-Profit 0.7400, 0.7455, 0.7500, 0.7550

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com