The GDP growth in the UK this year has significantly slowed. Economic growth in the 1st and 2nd quarters was half that of the last three months of 2016.

High inflation, exceeding the target level of the Bank of England, continues to reduce the disposable income of the British, which reduces domestic demand. The British economy, largely dependent on domestic consumption, grew by only 0.3% in the second quarter (+ 0.2% in the first quarter). In a situation of shrinking domestic demand, British companies will have to increase capital investment.

The decline in consumer spending and the slowdown in the UK economy, which are taking place against the background of Brexit, will help the Bank of England continue to adhere to extra soft monetary policy. As you know, last summer the Bank of England lowered the interest rate to a record level of 0.25%, the lowest for the last 300 years.

The slowdown in the UK economy, the protracted Brexit talks and the unclear prospects for the monetary policy of the UK central bank continue to have a negative impact on the pound quotes. It is likely that the pound will remain under pressure at the beginning of this week before the debate in parliament on Thursday.

On Friday (11:30 GMT + 3), the National Statistical Office of Great Britain will publish July data on industrial production and manufacturing in the manufacturing industry, which will allow us to assess the state of the British economy at the beginning of the third quarter. It is expected that the data will come with almost zero growth, which will also negatively affect the quotes of the pound.

Today, most of the US financial markets are closed due to the celebration of Labor Day. The low activity of traders and low trading volumes in the foreign exchange market are expected. The growth of volatility in the foreign exchange market will begin tomorrow, when during the Asian session (02:01 GMT + 3) the British Retail Consortium (BRC) will publish a report on retail sales for August, and at 07:30 (GMT + 3) the RBA will publish a decision on interest rate in Australia.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

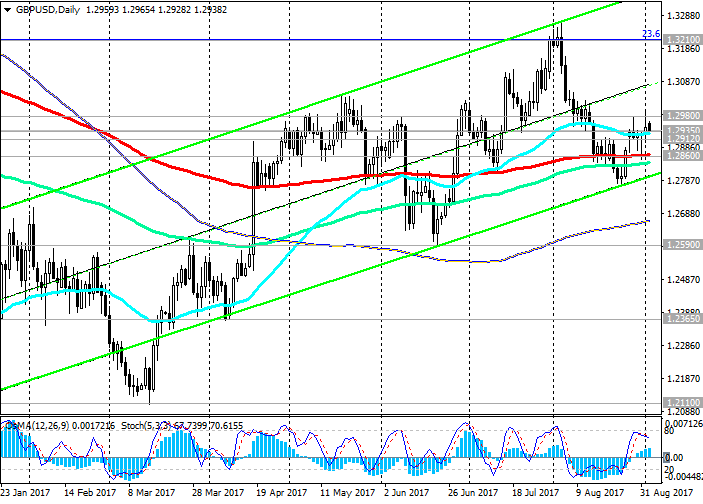

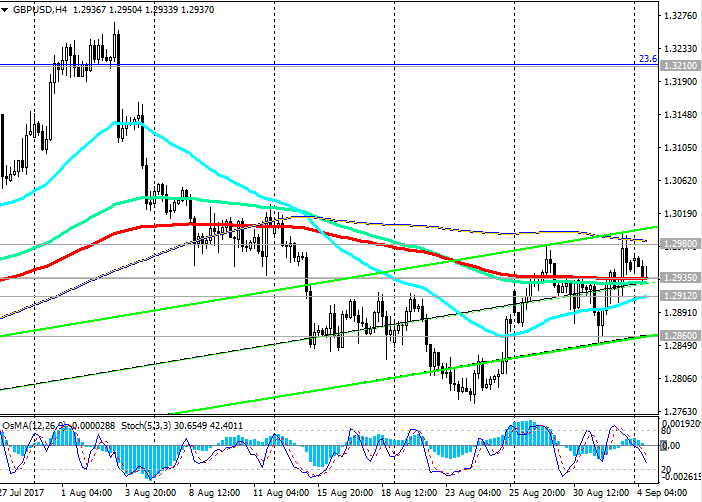

Despite continued pressure on the pound, the pair GBP / USD remains positive, trading above support levels 1.2935 (EMA200 on the 4-hour chart, EMA50 on the daily chart), 1.2860 (EMA200 on the daily chart) in the uplink on the daily chart.

Breakdown of the local resistance level 1.2980 will create the prerequisites for the recovery of the mid-term upward correction trend. The closest target in this case will be the resistance level 1.3210 (Fibonacci level 23.6% correction to the decline in the GBP / USD pair in the wave, which began in July 2014 near the level of 1.7200). Levels of 1.3300 (the upper limit of the channel on the weekly chart), 1.3460 (July and September highs) will be the next growth target.

A fall below support level 1.2860 will strengthen the risk of GBP / USD returning to a downtrend.

Indicators OsMA and Stochastics on the 4-hour, daily, weekly, monthly charts were deployed to short positions.

Support levels: 1.2935, 1.2912, 1.2860, 1.2800

Resistance levels: 1.2980, 1.3000, 1.3100, 1.3210, 1.3300, 1.3400, 1.3460

Trading Scenarios

Sell Stop 1.2910. Stop-Loss 1.2990. Take-Profit 1.2860, 1.2765, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365

Buy Stop 1.2990. Stop-Loss 1.2910. Take-Profit 1.3050, 1.3100, 1.3210, 1.3300, 1.3400, 1.3460

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com