NZD/USD: Janet Yellen did not mention the topic of raising rates

The head of the Fed, Janet Yellen, disappointed investors who were betting on the growth of the US dollar, after not speaking last Friday on the topic of monetary policy and not signaling a further increase in the rate.

The US dollar fell sharply on Friday, and 10-year US government bonds rose in price. Their yield on the basis of trading on Friday was 2.169% against 2.194% on Thursday. Gold futures on Friday in the US rose in price by 0.4%, to 1291 dollars per ounce.

Meanwhile, the New Zealand dollar became the leader of the decline last week after the New Zealand government lowered its forecast for economic growth for 2017-2018. Treasury Secretary Steven Joyce said that in the next four years, the average growth rate of New Zealand's GDP could reach 3%, whereas earlier it was forecasted an average annual growth rate of 3.1%.

The New Zealand dollar remains under pressure also on the eve of the forthcoming parliamentary elections in the country, scheduled for September 23. On September 27, the RBNZ regular meeting on monetary policy will be held.

In early August, RBNZ kept the current interest rate in New Zealand at the same level of 1.75%. The RBNZ stated that against the backdrop of "many uncertainties", monetary policy "will remain soft in the foreseeable future", but "can be adjusted accordingly". For a stable recovery of the New Zealand economy and rising inflation, "a lower New Zealand dollar rate is needed".

It is likely that the interest rate will remain at the current level of 1.75%, and in the RBNZ will once again confirm the bank's propensity to pursue a soft monetary policy, which will keep the pressure on the New Zealand currency.

For today, the economic calendar is empty. In the course of the American session, a correction is likely on the US dollar against its decline on Friday.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Technical analysis

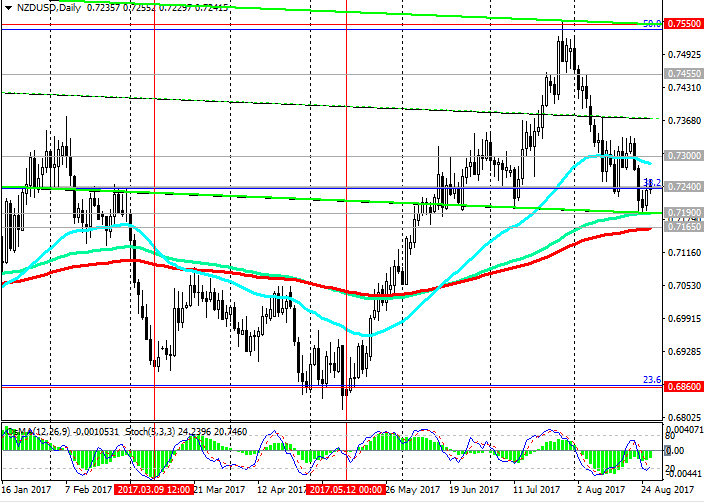

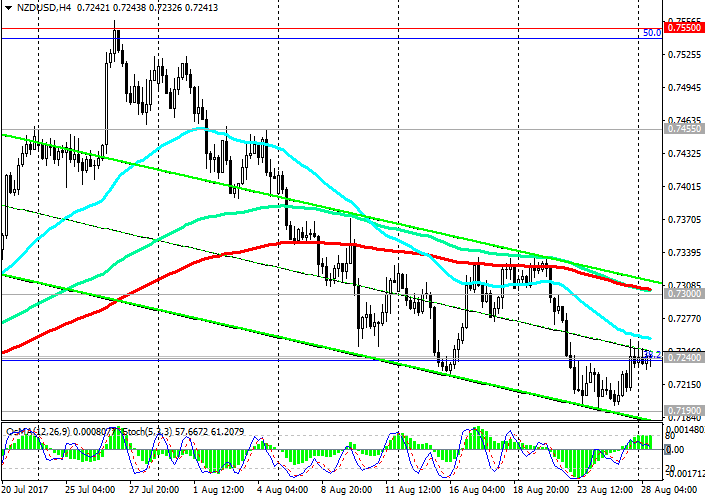

In July, the pair NZD / USD reached a new annual high near the mark of 0.7550 (Fibonacci level of 50% and the upper limit of the rising channel on the weekly chart). However, the further growth of the pair stalled. In the future, as a result of the active decline, NZD / USD broke through the important support levels of 0.7300 (EMA200 on the weekly chart), 0.7240 (the Fibonacci level of 38.2% of the upward correction to the global wave of decline of the pair from the level of 0.8800, which began in July 2014, the low of December 2016) and decreased to the level of support 0.7190 (EMA144 on the daily chart).

The pressure on the New Zealand dollar and the NZD / USD pair persists.

Indicators OsMA and Stochastics on the daily, weekly charts went to the side of sellers.

It is likely that the decline will continue to levels 0.7190, 0.7165 (EMA200 on the daily chart).

In the case of breakdown at the level of 0.7165, a further decline to support levels of 0.6860 (Fibonacci level of 23.6% and a lower range between 0.7550 and 0.6860 levels) is possible. At the level of 0.6860 are also the minimums of December 2016 and May 2017. A break at the level of 0.6860 will mean the end of the upward correction, which began in September 2015, and a return to the downward trend.

The alternative scenario involves a return to the zone above the level of 0.7300 and a resumption of growth towards the annual maximum and the resistance level of 0.7550 (50% Fibonacci level and the upper limit of the uplink on the weekly chart).

Support levels: 0.7190, 0.7165

Resistance levels: 0.7300, 0.7320, 0.7455, 0.7500, 0.7550

Trading Scenarios

Sell Stop 0.7220. Stop-Loss 0.7260. Take-Profit 0.7190, 0.7165

Buy Stop 0.7260. Stop-Loss 0.7220. Take-Profit 0.7300, 0.7320, 0.7455, 0.7500, 0.7550

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com