The main US stock indices remain upward, gaining support from positive companies and soft rhetoric of the Fed representatives regarding plans for further tightening of monetary policy in the US.

By the end of trading on Tuesday, the DJIA index increased by 0.5%, to 21614 points, Nasdaq Composite grew by about 0.1%, S & P500 gained 0.3%. Earlier, the indices were supported by the growth of shares of American banks, which in the last month gained about 6% in the hope that a gradual increase in interest rates will lead to an increase in their loan proceeds.

The growth of the indices was also helped yesterday by the rising oil prices after Saudi Arabia, which is the world's largest oil exporter, said it would cut supplies in August.

The cautious rhetoric of Fed Chairman Janet Yellen and a restrained assessment of the likelihood of another rate hike this year by a number of representatives of the Fed have contributed to weakening investors' expectations of further tightening of monetary policy in the US. Given the Fed's concerns about low inflation, rates are also unlikely to be raised at the two next Fed meetings in September and October. Preserving the soft monetary policy of the Fed is beneficially reflected in the US stock market. On the other hand, the negative political situation in the US and the problems in implementing the electoral program to stimulate the US economy by the administration of the US president put pressure on the stock indices.

Today, investors will be focused on the publication (at 18:00 GMT) of the Fed's decision on the interest rate. According to the CME Group, the probability of a rate hike at the July meeting is only 3%, in December - 54%. Investors will carefully study the statement of the Fed and look for signals about further plans to raise interest rates and reduce the balance of the Fed.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

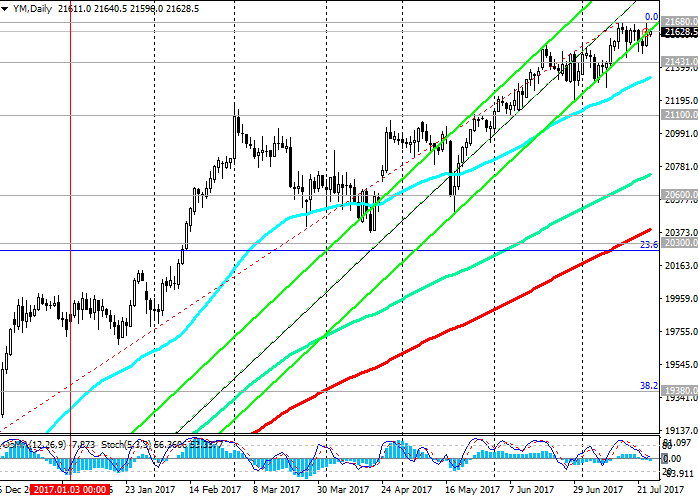

In July, the DJIA index reached a new absolute maximum near the mark of 21680.0. At the same time, the DJIA index keeps positive dynamics and continues to grow in the ascending channels on the daily and weekly charts.

The positive dynamics of the DJIA is maintained as long as the index trades above the key support level 20400.0 (EMA200 on the daily chart, as well as the Fibonacci level of 23.6% correction to the wave growth from the level of 15660.0 after rebounding in February this year to the collapse of the markets since the beginning of the year. Of this wave and the Fibonacci level of 0% is near the mark of 21536.0). The long positions in the DJIA index trade are still relevant.

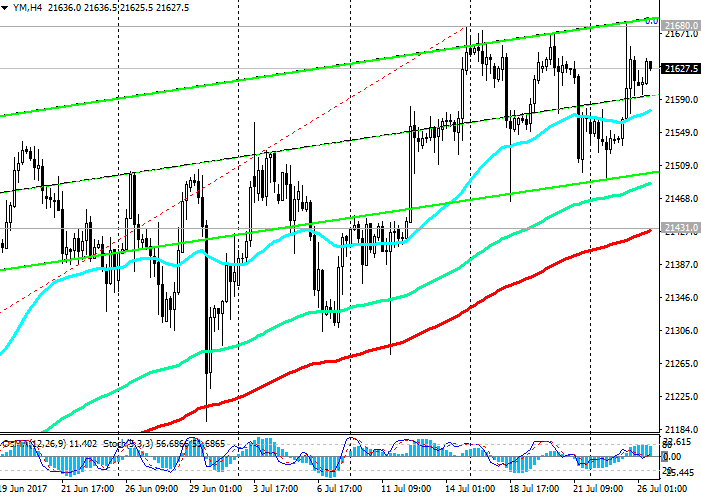

Only in case of breakdown of the support level 21431.0 (EMA200 on the 4-hour chart) can we again return to consideration of short positions on the DJIA index with the aim near the levels 20400.0, 20300.0 (Fibonacci level 23.6%). And only in case of breakdown of the support level of 19380.0 (Fibonacci level of 38.2%) can we speak about the breakdown of the bullish trend.

Support levels: 21510.0, 21431.0, 21360.0, 21100.0, 20600.0, 20400.0, 20300.0

Resistance levels: 21680.0, 22000.0

Trading scenarios

Buy Stop 21690.0. Stop-Loss 21500.0. Take-Profit 21700.0, 21800.0, 22000.0

Sell Stop 21500.0. Stop-Loss 21690.0. Take-Profit 21360.0, 21100.0, 21000.0, 20600.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com