http://www.sharekhan.com

Types

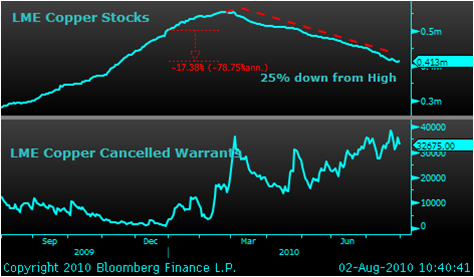

The term commodity is specifically used for an economic good or service when the demand for it has no qualitative differentiation across a market.[1] In other words, a commodity good or service has full or partial but substantial fungibility; that is, the market treats its instances as equivalent or nearly so with no regard to who produced them. As the saying goes, "From the taste of wheat, it is not possible to tell who produced it, a Russian serf, a French peasant or an English capitalist."[2] Petroleum and copper are other examples of such commodities,[3] their supply and demand being a part of one universal market. Items such as stereo systems, on the other hand, have many aspects of product differentiation, such as the brand, the user interface and the perceived quality. The demand for one type of stereo may be much larger than demand for another.

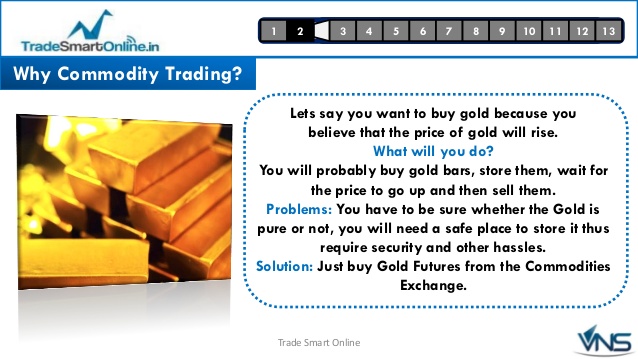

In contrast, one of the characteristics of a commodity good is that its price is determined as a function of its market as a whole. Well-established physical commodities have actively traded spot and derivative markets. Generally, these are basic resources and agricultural products such as iron ore, sugar, rice. Soft commodities are goods that are grown, while hard commodities are ones that are extracted through mining.

There is another important class of energy commodities which includes electricity, gas, coal and oil. Electricity has the particular characteristic that it is usually uneconomical to store; hence, electricity must be consumed as soon as it is processed.

Commoditization

Commoditization occurs as a goods or services market loses differentiation across its supply base, often by the diffusion of the intellectual capital necessary to acquire or produce it efficiently. As such, goods that formerly carried premium margins for market participants have become commodities, such as generic pharmaceuticals and DRAM chips. An article in The New York Times cites multivitamin supplements as an example of commoditization; a 50 mg tablet of calcium is of equal value to a consumer no matter what company produces and markets it, and as such, multivitamins are now sold in bulk and are available at any supermarket with little brand differentiation.[4] Following this trend, nanomaterials are emerging from carrying premium profit margins for market participants to a status of commodification.[5]

There is a spectrum of commoditization, rather than a binary distinction of "commodity versus differentiable product". Few products have complete undifferentiability and hence fungibility; even electricity can be differentiated in the market based on its method of generation (e.g., fossil fuel, wind, solar), in markets where energy choice lets a buyer opt (and pay more) for renewable methods if desired. Many products' degree of commoditization depends on the buyer's mentality and means. For example, milk, eggs, and notebook paper are not differentiated by many customers; for them, the product is fungible and lowest price is the main decisive factor in the purchasing choice. Other customers take into consideration other factors besides price, such as environmental sustainability and animal welfare. To these customers, distinctions such as "organic versus not" or "cage free versus not" count toward differentiating brands of milk or eggs, and percentage of recycled content or Forest Stewardship Council certification count toward differentiating brands of notebook paper.

http://www.commodity-guru.com

कमोडिटी एक्सचेंज (commodities exchange) यानि वस्तुओं के विनिमय का कारोबार, वह विनिमय है, जहाँ विभिन्न जिंसों (कमोडिटीज) एवं उनके व्युत्पन्न वस्तुओं का व्यापार होता है। विश्व के अधिकांश जींस बाजार कृषि उत्पादों एवं अन्य कच्चे उपादों (जैसे गेहूँ, चीनी, दाल, तेल, कपास, धातुएँ आदि) का व्यापार करते हैं। इनके व्यापार में तरह-तरह के सौदे (कांट्रैक्ट) होते हैं जैसे स्पॉट मूल्य (spot prices), फारवर्ड (forwards), वायदा (futures) आदि।

| This article does not cite any sources. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. (April 2008) (Learn how and when to remove this template message) |

Commodity trading in India has a long history. In fact, commodity trading in India started much before it started in many other countries. However, years of foreign rule, droughts and periods of scarcity and Government policies caused the commodity trading in India to diminish. Commodity trading was, however, restarted in India recently. Today, apart from numerous regional exchanges, India has six national commodity exchanges namely, Multi Commodity Exchange (MCX), National Commodity and Derivatives Exchange (NCDEX), National Multi-Commodity Exchange (NMCE) and Indian Commodity Exchange (ICEX), the ACE Derivatives exchange ( ACE )and the Universal commodity exchange (UCX). The regulatory body is Forward Markets Commission (FMC) which was set up in 1953. As of September 2015 FMC is merged with the Securities and Exchange Board of India, SEBI.