GBP/USD: The pound fell after the publication of inflation data

After the data on inflation in the UK were published at the beginning of today's European session, the pound fell sharply in the foreign exchange market. According to the National Bureau of Statistics, the UK consumer price index in June rose by 2.6% compared with the same period last year after rising by 2.9% in May.

Although annual inflation remains well above the target level of the Bank of England at 2%, and consumer prices are growing stronger than the level of wages. The price pressure on the company is already decreasing for the 5th consecutive month. Wage growth rates lag behind inflation, so the British have already reduced their spending, which led to a slowdown in the economy in the first quarter of this year.

The fall in household incomes, caused by a sharp drop in the pound, is a deterrent for the Bank of England in raising interest rates, despite high inflation.

Today at 13:30 (GMT) the speech of the head of the Bank of England Mark Carney is scheduled. It will be interesting to hear what he thinks about the future plans of the Bank of England against the background of inflation data presented today.

The pound fell sharply today and against the US dollar, despite the fact that the dollar fell significantly today in the foreign exchange market after it became known that the Obamacare health program will not be canceled in the near future. This means that other Trump legal initiatives (revision of the tax code or fiscal stimulus) may also run into obstacles. The ICE dollar index, reflecting the value of the dollar against a basket of six other currencies, fell by 0.3% on Tuesday, to a 10-month low. Since the beginning of this year, the dollar index fell by 7.2%.

As the Deputy Governor of the Bank of England Ben Broadbent said last week, "at the moment, it is not worth making a decision (regarding raising rates). There are many factors that can not be measured accurately, "given the uncertainty of the prospects for the UK economy.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

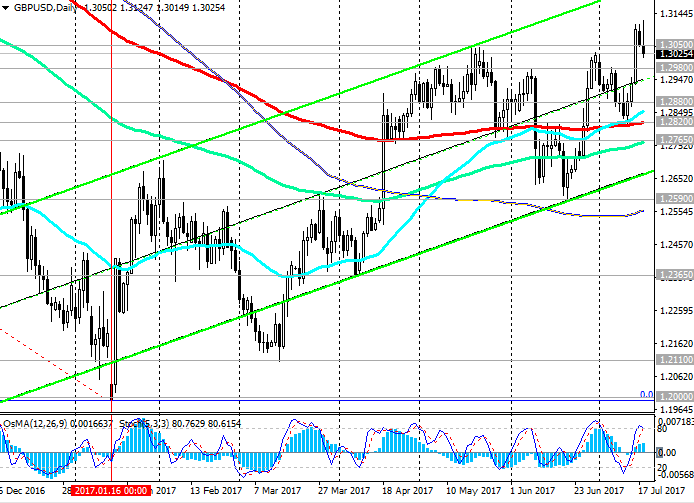

After today's data on inflation, the pair GBP / USD fell sharply. The fall of the pair was approximately 100 points. Previously, the GBP / USD pair rose, updating the annual high near the 1.3120 mark.

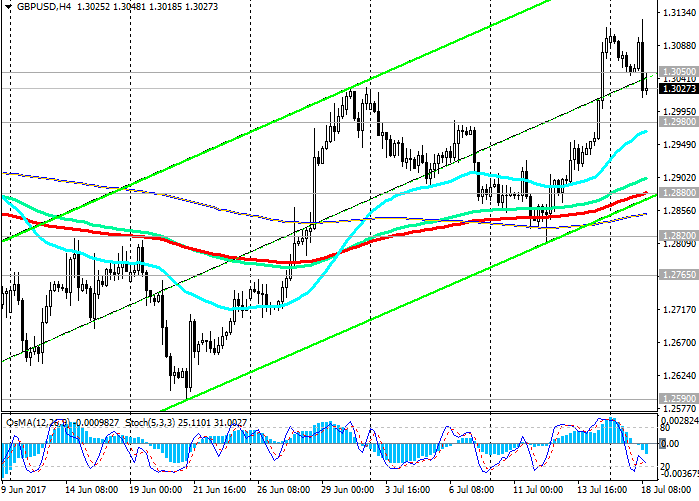

Indicators OsMA and Stochastics on the 1-hour, 4-hour charts turned to short positions, signaling the beginning of a downward correction.

If the decline continues, the GBP / USD pair will go to support levels 1.2980 (EMA200 on the 1-hour chart), 1.2880 (2880 (EMA200 and the bottom line of the uplink on the 4-hour chart).

In the case of breakdown of the support level 1.2820 (EMA200 on the daily chart), the GBP / USD decline will accelerate to targets near the levels of 1.2590 (June lows and the lower limit of the uplink on the weekly chart), 1.2365, 1.2110.

The positive dynamics of the GBP / USD pair persists while it is trading above the key support level of 1.2820 (EMA200 on the daily chart).

In case of breakdown of the local resistance level 1.3120, the GBP / USD pair will resume growth with the targets of 1.3210 (Fibonacci level 23.6% correction to the GBP / USD decline in the wave, which began in July 2014 near the level of 1.7200 and the upper limit of the rising channel on the weekly chart), 1.3300 (the upper line of the ascending channel on the weekly chart).

Support levels: 1.3000, 1.2980, 1.2940, 1.2880, 1.2820, 1.2765, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365, 1.2110

Resistance levels: 1.3050, 1.3100, 1.3120, 1.3210, 1.3300

Trading Scenarios

Sell Stop 1.3000. Stop-Loss 1.3055. Take-Profit 1.2980, 1.2940, 1.2880, 1.2820, 1.2765, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365, 1.2110

Buy Stop 1.3055. Stop-Loss 1.3000. Take-Profit 1.3100, 1.3120, 1.3210, 1.3300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com