EUR/USD Forecast: aiming to correct lower, but bullish anyway

The EUR/USD pair eases from its recent highs, but remains within a limited intraday range amid a holiday in Japan and ahead of the release of EU inflation data. The greenback anyway, retains the weak tone after poor inflation and retail sales figures released last Friday cooled down the case for a tighter monetary policy in the US, trading near multi-month lows against most of its major rivals. In June, the EU CPI is expected to have remained flat, while up by 1.3% compared to a year earlier. The macroeconomic calendar has little else to offer today, with market's attention centered on the ECB's monetary policy meeting that will take place next Thursday.

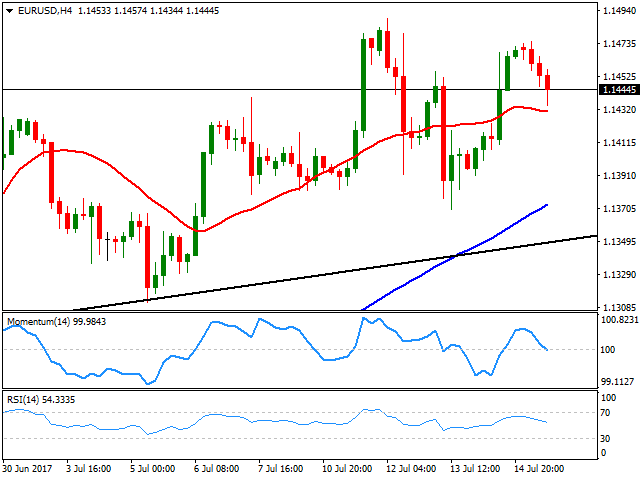

In the meantime, the pair trades around 1.1440, and aiming to extend its downward corrective movement according to technical readings in the 4 hours chart, as the 20 SMA turns lower currently around 1.1430, providing an immediate support, whilst technical indicators turned south with the Momentum indicator already below its mid-line and the RSI around 55, not enough at this point to confirm a bearish extension, but clearly reflecting limited buying interest.

Below 1.1420, the pair could extend its downward move towards the 1.1370/80 region, while below this last, 1.1340 comes next. To the upside, the pair has a strong resistance area between 1.1460 and 1.1490, with a break below this last required to confirm a bullish continuation, towards 1.1525 first and 1.1560 later on the day.