Statements made by ECB President Mario Draghi on Tuesday at a conference in Portugal provoked a sharp rise in the euro and a fall in European stock indices.

Mario Draghi said that "all the signs now point to the strengthening and expansion of the basis for the recovery of the Eurozone economy." Draghi spoke very cautiously about the ECB's monetary policy, saying that "it is necessary to reasonably approach the adjustment of the parameters of our policy in response to the improvement of the economic situation in order to ensure the combination of our incentives with the restoration of the economy against the background of continuing uncertainties."

At the same time, Draghi repeated that "it is necessary to persevere in carrying out our monetary and credit policy. Any changes in its direction should occur gradually and only if the justification for improving the dynamics seems to be quite reliable, "and" interest rates should be low so that the growth rate can recover ". Recall that the ECB's key rate (on deposits for commercial banks) has remained negative since June 2014.

And, nevertheless, Draghi's speech was perceived by market participants as a hint at the likelihood of curtailing the incentive program in the Eurozone in the near future. Now, many market participants expect that the ECB will begin to close the quantitative easing program in January 2018, and after the completion of the curtailment of the QE program, the ECB will gradually raise deposit rates and refinancing rates.

The euro showed the strongest growth for the year yesterday, while the prices of Eurozone bonds and most European stocks fell. At the same time, the yield of government bonds of countries such as Germany, France and Italy has risen sharply.

EuroSTOXX50 continues to decline today, losing about 1.4% during two incomplete days and trading at the beginning of the European trading session near the 3510.0 mark. If the ECB really starts to curtail the QE program in the Eurozone, the euro will continue to strengthen, and the European stock indexes decline.

Today, the attention of market participants will be focused on the speeches of the heads of central banks of Great Britain, Japan, Canada and the Eurozone, which will begin at 13:30 (GMT). In this period of time, a surge in volatility is expected in the foreign exchange market, including world stock markets.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

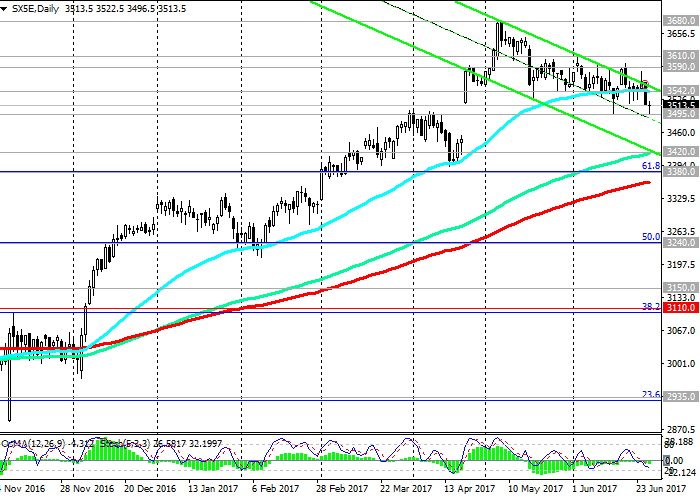

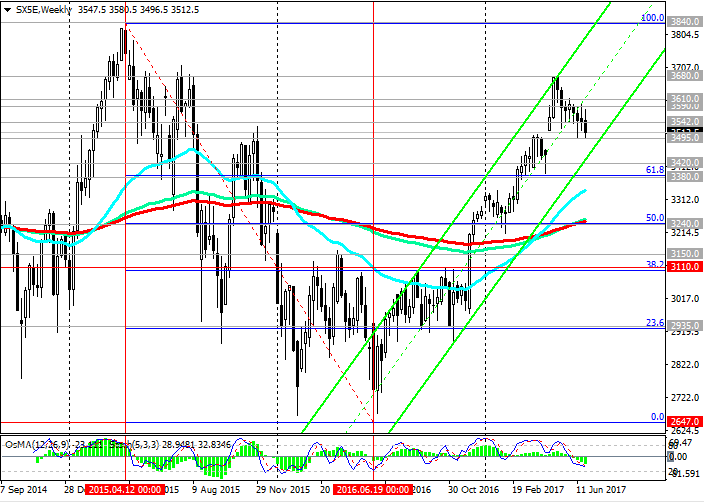

The EuroStoxx50 index broke yesterday the support level of 3542.0 (EMA50 on the daily chart, EMA200 on the 4-hour chart) and remains under pressure, decreasing in the descending channel on the daily chart. In case of breakdown of the support level of 3495.0 (June lows and April highs observed on the eve of the presidential elections in France), the EuroStoxx50 index will continue to decline. The reduction targets will be the support levels 3420.0 (EMA144 and the lower border of the descending channel on the daily chart), 3380.0 (EMA200 on the daily chart and the Fibonacci level of 61.8% correction to the decline wave since April 2015 and from the level of 3840.0).

Only in case of return to the zone above the level of 3542.0 can we speak about restoring the positive dynamics of the EuroStoxx50 index. In case of breakdown of the resistance level of 3610.0 (June highs), the growth of the EuroStoxx50 index may resume within the uplink on a weekly chart, the upper limit of which is just near the Fibonacci level of 100% (the beginning of the decline wave since April 2015 and the level of 3840.0).

Support levels: 3495.0, 3420.0, 3380.0

Resistance levels: 3542.0, 3590.0, 3610.0, 3680.0, 3700.0

Trading Scenarios

Sell Stop 3490.0. Stop-Loss 3525.0. Take-Profit 3420.0, 3400.0, 3380.0

Buy Stop 3525.0. Stop-Loss 3490.0. Take-Profit 3542.0, 3590.0, 3610.0, 3680.0, 3700.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com