Too Early to Call the Bottom: DXY Needs This Level First

Too Early to Call the Bottom: DXY Needs This Level First

Talking Points:

- EUR/USD remains the key driver behind the DXY Index's attempt at establishing a bottom against the 2015-2016 range high.

- JPY-crosses vulnerable heading into Friday's Trump-Abe meeting.

Yesterday we see how theUS Dollar(via DXY Index) wasattempting to put in a bottom, a veritable turning point after a disappointing start to 2017. And while the key driver remains in place - theEuroand its emerging political concerns, if they're from France or Greece - we still haven't seen enough price development in order to say: "this is the bottom."

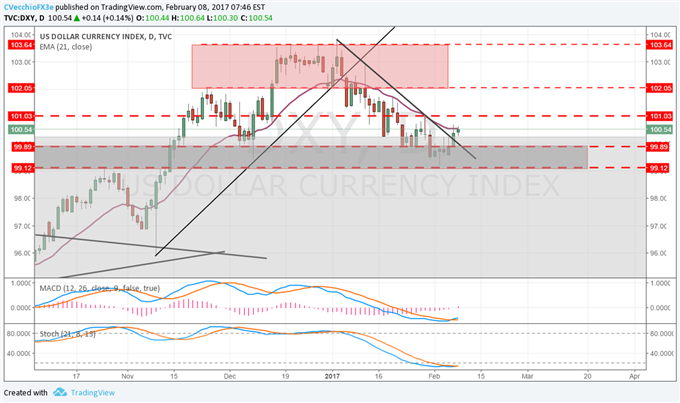

Chart 1: DXY Index Daily Timeframe (October 2016 to February 2017)

There are three technical facets of the DXY Index downtrend that suggest that the bottom has not been established yet (chart 1, above). First, DXY has not closed above its daily 21-EMA since January 4. While there have been several attempts for price to climb through this moving average, we've yet to see price put in a close above it; this is a hint from the market that the short-term nature of the market has been, and tentatively remains, bearish.

Second, on the daily timeframe, the Slow Stochastics and MACD have yet to emerge from their bearish territory. While MACD has turned, Slow Stochastics remain in oversold territory; as momentum indicators, we'd prefer to see these on the other side of their neutral/median lines: above 0 for MACD; above 50 for Slow Stochastics. However, on a 4-hour timeframe, we've seen both of these indicators cross into bullish territory, suggesting that a turn may be starting to build.

Chart 2: DXY Index 4-hour Timeframe (January 18 to February 8, 2017)

Finally, on a pure price basis, we haven't seen DXY clear out its most recent swing high at 101.03. When we scale down to a 4-hour timeframe (chart 2, above), the level that marked the high on the January 30 daily candle is actually constituted by a bearish key reversal; this topping candlestick pattern reinforces the notion that the downtrend still has life.

As I prefer to be a bit more conservative with my entries - patience is a virtue, I've been told - waiting for price to move above 101.03 should yield a more confident assessment of which way price will move going forward. Should we see DXY Index clear out 101.03 on a daily closing basis, the odds of a bottom having been established would increase significantly. Until then, there's no reason to be a 'hero' and try to call the low.