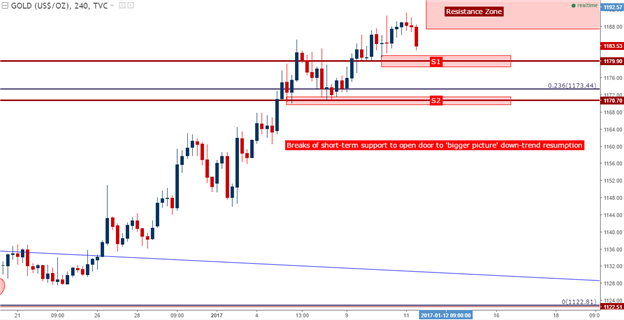

Gold Prices Run to Resistance Zone; Is the Rally Over?

Previously, we looked at the recent top-side move in Gold prices with the question of whether this was a retracement as part of the ‘bigger picture’ trend lower or if we were, in fact, seeing a trend-change. Given how incredibly oversold Gold prices had become during the ‘Trump Trade,’ it made sense for a retracement to develop after an extreme move-lower with a lack of additional trend-side drivers; but a week later, prices have yet to resume that down-ward trend and traders will likely want to take a step back in order to discern near-term directional possibilities.

In our last article we had looked at levels at $1,188 and $1,200 and today, we’re going to add in a 3rd level for traders to watch at $1,204.76, which is the 38.2% retracement of the ‘post-Election’ move in Gold prices. These three prices can each act as resistance to collectively produce a ‘resistance zone’ in which traders can look for a near-term top to form in the effort of trading the bigger picture trend-lower. If price action in Gold breaks above $1,205, traders will likely want to re-evaluate the bearish trend and move-forward with a more-bullish bias.

For traders looking to time bearish entries on shorter-term charts, price action swings around $1,180 and again at $1,172 could open the door to bearish-continuation strategies; looking to use near term resistance coupled with support breaks to indicate the possibility of the ‘bigger picture’ down-trend resumption.