FOMC Preview: USD Strength Susceptible to Lower Path for Fed Funds

FOMC Preview: USD Strength Susceptible to Lower Path for Fed Funds

Fed Funds Futures Highlight 95% Probability for 25bp Rate-Hike.

- Will Fed Officials Further Reduce the Longer-Run Interest Rate Forecast?

Trading the News: Federal Open Market Committee (FOMC) Rate Decision

Even though the Federal Open Market Committee (FOMC) is widely expected to vote in favor for a December rate-hike, Chair Janet Yellen and Co. may largely endorse a wait-and-see approach for 2017 as‘the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.’

What’s Expected:

Why Is This Event Important:

The fresh projections coming out of the central bank is likely to take center stage asthe rotation within theFOMC (Chicago Fed President Charles Evans, Philadelphia Fed President Patrick Harker, Dallas Fed President Robert Kaplan and Minneapolis Fed President Neel Kashkari) clouds the monetary policy outlook going into 2017, and a further reduction in the longer-run interest rate forecast may undermine the bullish sentiment surrounding the greenback should central bank officials increase their efforts to tame market speculation. With Fed Funds Futures highlighting a 60% probability for another move in June 2017, a shift in interest rate expectations may heavily influence U.S. dollar price action over the remainder of the year especially as Chair Yellen remains in no rush to remove the accommodative policy stance.

Expectations: BullishArgument/Scenario

Release | Expected | Actual |

U. of Michigan Confidence (DEC P) | 94.5 | 98.0 |

ISM Non-Manufacturing (NOV) | 55.5 | 57.2 |

Personal Consumption (3Q P) | 2.3% | 2.8% |

Improved confidence paired with the pickup in private-sector activity may encourage the FOMC to further normalize monetary policy in 2017, and the post-electionUSDrally may gather pace over the remainder of the year should central bank officials continue to forecast a terminal interest rate close to 3.00%.

Risk:BearishArgument/Scenario

Release | Expected | Actual |

Non-Farm Payrolls (NOV) | 180K | 178K |

Average Hourly Earnings (YoY) (NOV) | 2.8% | 2.5% |

Consumer Price Index ex. Food & Energy (YoY) (OCT) | 2.2% | 2.1% |

However, the Fed may continue to warn ‘market-based measures of inflation compensation have moved up but remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months’ amid the mixed data coming out of the U.S. economy, and the dollar may face a near-term correction should the central bank scale back the interest rate forecast and soften its hawkish outlook for monetary policy.

For More Updates, JoinDailyFX Currency Analyst David Song for LIVE Analysis!

How To Trade This Event Risk(Video)

Bullish USDTrade:FOMC Implements Higher Borrowing-Costs, Warns of Looming Rate Hikes

- Need red, five-minute candle following the rate decision to consider a shortEUR/USDtrade.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USDTrade:Fed Cuts Inflation Forecast & Looks to Buy More Time

- Need green, five-minute candle to favor a long EUR/USD position.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For TheRelease

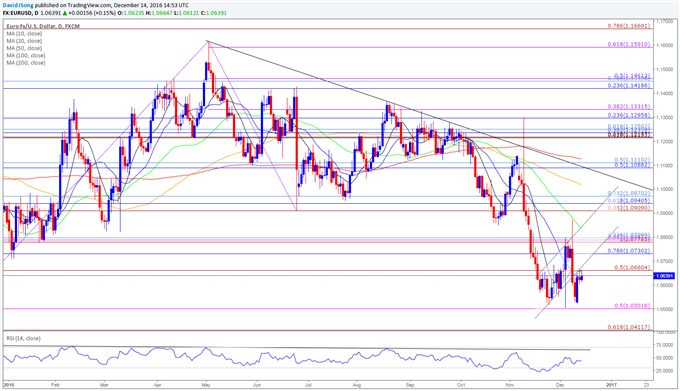

EURUSD Daily

- Broader outlook remains tilted to the downside for EUR/USD as a bear-flag unfolds, while the Relative Strength Index (RSI) preserves the bearish formation from earlier this year; lack of momentum to push/close above 1.0660 (50% expansion) raises the risk for a move back towards the 1.0500 (50% expansion) handle.

- Interim Resistance: 1.0780 (100% expansion) to 1.0800 (23.6% retracement)

- Interim Support: 1.0500 (50% expansion) to 1.0517 (December 2015-low)

ImpacttheFOMC Interest Rate Decisionhas had on EUR/USD during the lastmeeting

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

NOV 2016 | 11/02/2016 14:00 GMT | 0.50% | 0.50% | -5 | -2 |

November 2016 FOMC Interest Rate Decision

EUR/USD 5-Minute

The Federal Open Market Committee (FOMC) stuck to the sidelines in November, with Kansas City Fed President Esther George and Cleveland Fed President Loretta Mester going against the majority as the two dissenters voted for a 25bp rate-hike. Despite the wait-and-see approach, it seems as though Chair Janet Yellen and Co. are following a similar path to 2015 and appear on their way to deliver a December rate-hike as ‘the Committee judges that the case for an increase in the federal funds rate has continued to strengthen.’ Despite increased efforts to prepare U.S. households and businesses for higher borrowing-costs, market participants showed a limited reaction to the fresh batch of central bank rhetoric, with EUR/USD struggling to hold above the 1.1100 handle as the pair ended the day at 1.1097.