Trading recommendations

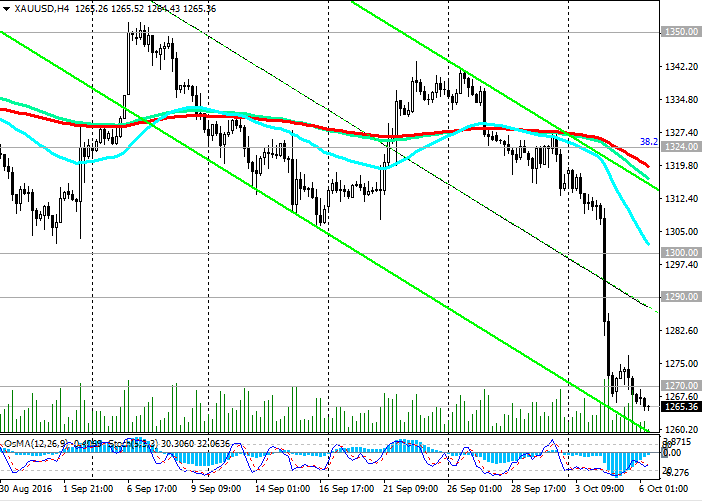

Buy Stop 1278.00. Stop-Loss 1265.00. Objectives 1290.00, 1300.00, 1324.00, 1350.00, 1370.00, 1385.00

Sell in the market. Stop-Loss 1278.00. Objectives 1252.00, 1218.00

Technical analysis

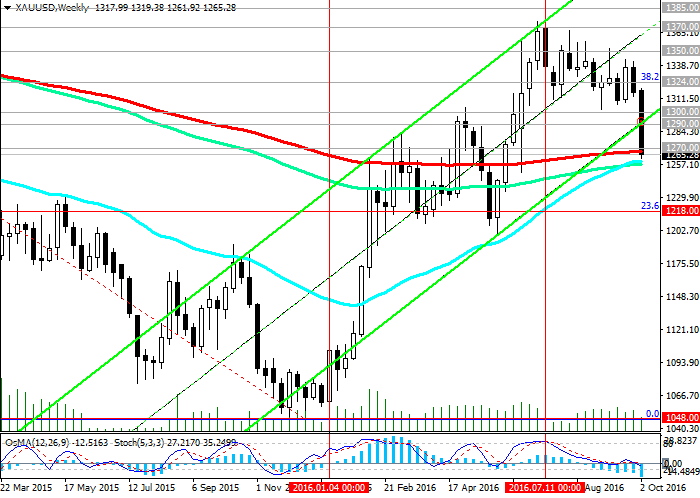

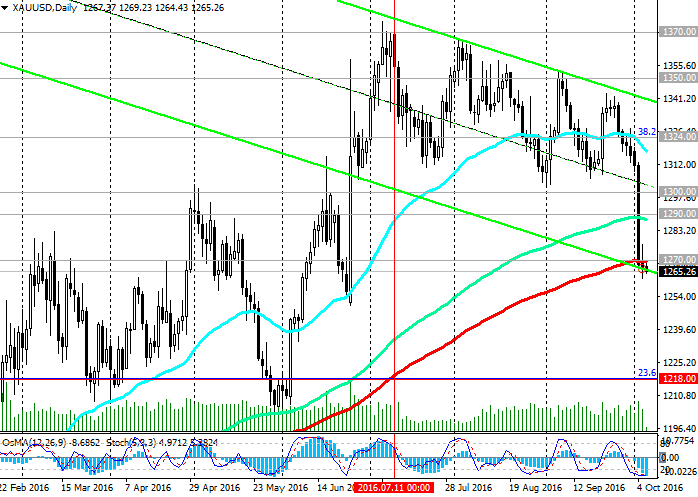

In late September, the pair XAU / USD has broken the important support level of 1324.00 (38.2% Fibonacci level of the correction to the wave decline from October 2012 and EMA50 daily chart). As a result of the sharp fall (more than 3%) on Tuesday, the pair XAU / USD has broken through the three important support level - 1300.00, 1290.00 (EMA144), 1270.00 (EMA200 on the daily chart). Today XAU / USD pair is trading near the mark of 1265.00, through which the lower line of the descending channel on the daily chart (the upper limit of the channel runs at the moment near the level of 1340.00), as well as EMA200 on the weekly chart, EMA50 on the monthly chart. Thus, the pair XAU / USD is at an important level of support, a break of which will trigger deeper decline to the level of 1218.00 (23.6% Fibonacci level of the correction to the wave decline from October 2012). Fixing prices below 1218.00 will create preconditions for the further decrease in pair XAU / USD and return to the downward global trend, which began in October 2012.

Indicators OsMA and Stochastic on the 4-hour, daily, weekly charts sided with the sellers on the monthly chart - are also deployed on short positions.

An alternative scenario suggests the pair returned above the level of 1300.00 to 1324.00 level (Fibonacci level of 38.2%). Fixing the price above the local resistance level of 1350.00 will increase the likelihood of further growth, and a break above the level range 1370.00, 1385.00 create risks of further growth of gold prices to the level of $ 1400.00 per ounce. Gold yet still receives support on a background of the continuing uncertainty in the global financial markets, the tendency of a number of the world's central banks to the soft monetary policy. Also, you may receive the gold buyers at the current relatively low levels of support.

Support levels: 1265.00, 1252.00, 1218.00

Resistance levels: 1270.00, 1290.00, 1300.00, 1324.00, 1350.00, 1370.00, 1385.00, 1400.00, 1410.00, 1435.00

Overview and Dynamics

After the fall on Tuesday, more than a 3% decrease in the price of gold continues. , Bloomberg News reported that the ECB intends to gradually reduce (with the rate of approximately 10 billion euros per month) volume of bond purchases as part of its quantitative easing program, which provides monthly buying European assets at 80 billion euros. The yield on 10-year US Treasuries rose on Tuesday to near 2-week high of 1.6920%, and on Wednesday it was about 1.68%.

Market participants nervously react to any signs of folding the central banks of the current expansionary policies. The probability that the Fed will raise rates in December is about 60%, according to CME Group's.

Yesterday's strong macro data from the US strengthened the dollar. Even though the weak report on employment from ADP, the dollar continued to strengthen in the forex market. PMI from ISM services sector rose to 57.1 in September, compared with a forecast of 53.0 and the previous value of 51.4. Production orders (indicator is an important indicator of the state of the US economy) in August rose 0.2% against the forecast of -0.1% and 1.4% in July.

According to the report of the Institute for Supply Management (ISM), published on Monday, PMI (PMI) for the manufacturing sector rose to 51.5 in September from 49.4 in August. This is a very positive indicator, and values above 50 indicate expanding activity in this important sector of the US economy.

Now attention switches to market participants on Friday, when the 12:30 (GMT) will be published data on the labor market in the US in September. growth is expected by 21 000 (up to 172,000) of new jobs created is with / agricultural sector of the US economy, as well as maintaining a low level of unemployment (4.9%).

US macroeconomic data continue to come out with a positive performance. In this way, the probability of a rate hike in the US will grow significantly, and it is a negative signal for the price of gold. In the context of increasing interest rates in the United States gold losing investment attractiveness, yielding dollar and safer assets such as government bonds. A stronger dollar also makes gold, whose prices are denominated in US currency less attractive for holders of other currencies as the cost of borrowing for its acquisition and storage grow.

From the news today forward data from the US. At 12:30 it will be published the number of new (primary) applications for the grant on unemployment in the US last week. Previous value 254 000, forecast 256 000. The result is higher than expected indicates a weakness of the labor market that negatively affects the US dollar, and vice versa.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.