AUD/USD to Curb Losses on Strong Australia Retail Sales Report

- Australia Retail Sales to Increase for Sixth-Time in 2016.

- Will Stronger Consumption Encourage the Reserve Bank of Australia (RBA) to Stay on Hold?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Australia Retail Sales

A 0.2% rebound in Australia Retail Sales may spark a bullish reaction in AUD/USD and encourage the Reserve Bank of Australia (RBA) to gradually move away from its easing-cycle as it instills an improved outlook for the region.

What’s Expected:

Why Is This Event Important:

After keeping the benchmark interest rate at the record-low of 1.50% in October, RBA GovernorPhilip Lowemay gradually move away from the easing cycle as the region continues to ‘grow at a moderate rate.’ In turn, a shift in the monetary policy outlook is likely to prop up the Australian dollar in light of the low-yielding environment. However, it seems as though central bank will keep the door to further support the economy as ‘inflation is expected to remain low for some time,’ and the RBA may preserve the verbal intervention on the aussie as the resilience in the local currency dampens the outlook for price growth.

Expectations: BullishArgument/Scenario

Release | Expected | Actual |

Westpac Consumer Confidence s.a. (MoM) (SEP) | -- | 0.3% |

Gross Domestic Product (YoY) (2Q) | 3.3% | 3.3% |

Wage Price Index (YoY) (2Q) | 2.0% | 2.1% |

Improved confidence paired with early signs of stronger household earnings may generate a strong retail sales report, and a marked rebound in household spending may push the RBA to keep the benchmark interest rate on hold throughout the remainder of 2016 as the rate-cuts from earlier this year work their way through the real economy.

Risk:BearishArgument/Scenario

Release | Expected | Actual |

Private-Sector Credit (MoM) (AUG) | 0.5% | 0.4% |

Employment Change (AUG) | 15.0K | -3.9K |

Home Loans (MoM) (JUL) | -1.5% | -4.2% |

However, waning job growth accompanied by the slowdown in private-sector credit may drag on consumption, and another disappointing print may trigger a bearish reaction in the Australia dollar as it fuels speculation for additional monetary support.

How To Trade This Event Risk(Video)

BullishAUDTrade:Australia Retail Sales Rebounds 0.2% or Greater

- Need green, five-minute candle following the print for a long AUD/USD trade.

- If market reaction favors a bullish aussie position, buy AUD/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUDTrade:Private-Sector Consumption Disappoints

- Need red, five-minute candle to consider a short AUD/USD position.

- Carry out the same setup as the bullish aussie trade, just in the opposite direction.

Potential Price Targets For The Release

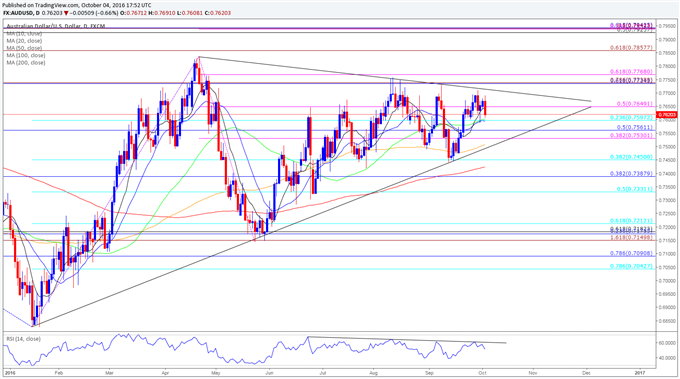

AUD/USD Daily

- AUD/USD may continue to consolidate within the wedge/triangle formation from earlier this year as the RBA endorses a wait-and-see approach for monetary policy, with the pair at risk for a move towards the lower end of its narrowing range as the Relative Strength Index (RSI) preserves the bearish trend carried over from the summer months, with the initial topside hurdle coming in around 0.7730 (61.8% retracement) to 0.7740 (78.6% expansion) amid the string of failed attempts to break/close above the Fibonacci overlap.

- Interim Resistance: 0.7835(2016 high) to 0.7860 (61.8% expansion)

- Interim Support: 0.7442 (September low) to 0.7450 (38.2% retracement)

Impact thatthe Australia Retail Sales reporthas had on AUD during the lastrelease

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JUL 2016 | 08/31/2016 01:30 GMT | 0.3% | 0.0% | 0 | +31 |

July 2016 Australia Retail Sales

AUD/USD5-MinuteChart

Australia Retail Sales unexpectedly held flat in July after expanding 0.1% the month prior, with the weakness led by a 6.2% decline in department store sales. A deeper look at the report showed demand for household goods also narrowed 0.7%, while discretionary spending on apparel advanced another 0.3% after climbing 3.3% in June. Despite the limited market reaction to the weaker-than-expected print, AUD/USD gained ground throughout the day to close at 0.7550.