Trading recommendations

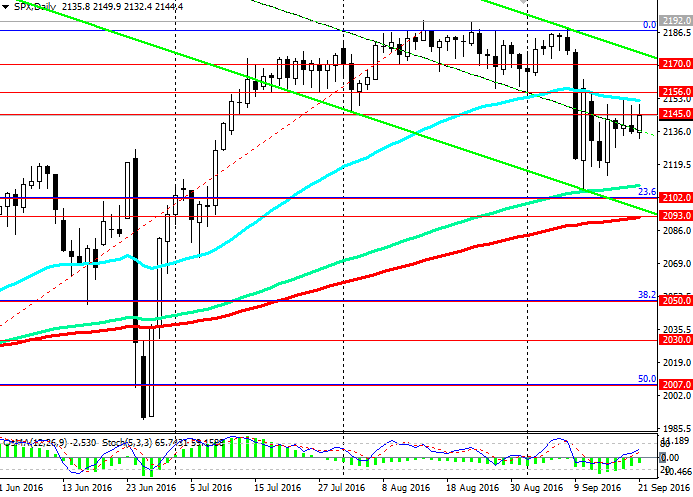

Sell Stop 2132.0. Stop-Loss 2146.0. Objectives 2102.0, 2093.0, 2050.0, 2030.0, 2007.0

Buy Stop 2153.0. Stop-Loss 2143.0. Objectives 2156.0, 2170.0, 2192.0, 2200.0

Technical analysis

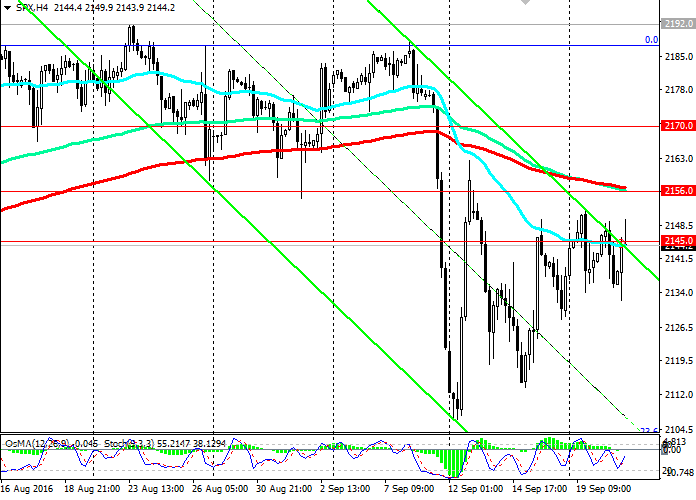

Today, the world's stock indexes rose after the Bank of Japan's decision not to change the monetary policy. However, many investors skeptical about further stable growth of the global stock markets maintained. The fourth day of the S & P500 is trading near the short-line balance and EMA200 the 1-hour chart, passing through the level of 2145.0. Through this level also takes the upper line of the descending channel and EMA50 on 4-hour chart. On the daily chart S & P500 index has formed a new downstream channel with a lower limit, passing near the support level of 2093.0 (EMA200 daily chart).

Despite the fact that on the weekly chart Stochastic and OsMA indicators sided with the sellers, on the 4-hour and daily charts the indicators are developed on long positions, signaling the possibility of continuing growth. In case of breaking the resistance level of 2156.0 (EMA200, EMA144 on 4-hour chart) may continue to grow to the resistance level of 2170.0 (the upper limit of the downward channel on the daily chart).

While the S & P500 is above 2093.0, 2102.0 (23.6% Fibonacci level of the correction to the growth since February 2016 and the level of 1828.0) its positive momentum is maintained.

The reverse scenario is associated with a reduction in the levels of support 2102.0, 2093.0.

Critical for the bullish trend may be the reduction of the index to the level of support 2050.0 (38.2% Fibonacci level), 2030.0 (EMA200 on the weekly chart). Break of the support level of 2007.0 (50.0% Fibonacci level) can already talk about the end of the bullish trend.

The script for continued growth assumes the resumption of the bullish trend in the rising channel on the weekly chart, the upper limit, passing near the level of 2270.0. Nearest – are resistance levels 2156.0, 2170.0, 2192.0 (August highs).

We are waiting for the Fed's decision on interest rate, which will be published in the 18:00 (GMT). Sharp increase in volatility is expected in the financial markets.

Support levels: 2102.0, 2093.0, 2050.0, 2030.0, 2007.0

Resistance levels: 2145.0, 2156.0, 2170.0, 2192.0

Overview and Dynamics

World stocks rose after the central bank of Japan has confirmed that he intends to continue the program of active policy easing by taking a new approach. Bank of Japan kept interest rates unchanged at 0.1%. The Bank of Japan introduced a target level for the 10-year interest rates in order to strengthen the fight against deflation, saying it will continue to pursue a program of quantitative easing until inflation is not "exceed" 2%. Among other measures, he called a possible increase in the monetary base in the future. It is unlikely that the preservation of the target volume of bond purchases at 80 trillion yen in the year and the introduction of the target level of 10-year interest rates will accelerate inflation, or "soften the financial conditions." It is possible that the Bank of Japan in the long term deepen into negative territory on interest rates.

European StoxxEurope600 index in early trading in Europe rose by 1%, while the banking sector would add 2.5%. Japanese Nikkei Stock Average on the basis of trading in Asia increased by 1.9% to 16,807.62 points. Chinese Shenzhen Composite Index trading results increased on 0,3%, ChiNext Price - on 0,2%, Shanghai Composite - on 0.1%. US stocks are also growing. S & P500 to the beginning of the European session rose by 0.5% and is trading at the moment close to the level of 2145.0.

Yet many investors are skeptical about the dynamics of rising stock markets. Bank of Japan monetary measures have not changed, and investors are now focused on the September meeting of the US Federal Reserve, which will be completed later today. At 18:00 (GMT) will be published on the Fed's decision on interest rates in the United States. While almost no one expects a rate hike, hinting at the possibility of an increase in December may jeopardize the continued stable growth of risky assets, including stocks, which has been observed since the beginning of February and the summer.

Earlier in September, the Fed's Boston President Eric Rosengren said that "there are substantial grounds" for the tightening of monetary policy, which will allow to avoid overheating of the economy.

At the moment, investors assess the probability of a rate hike at 18% and expect the Fed raising interest rates at its meeting in December, with a probability of 60% already. Also, investors will closely monitor the performance of the Fed's leadership at a press conference, which will begin at 18:30 (GMT) to understand the intentions of the Fed to raise rates later this year.

If the Fed will signal further tightening in US monetary policy before the end of the year, the dollar will strengthen its position in the financial markets, and high-risk instruments, and stock market indexes fell.

Author signals - https://www.mql5.com/en/signals/author/edayprofit