3 reasons for the extended GBP/USD and 3 reasons why it can fall from here

30 June 2016, 14:36

0

89

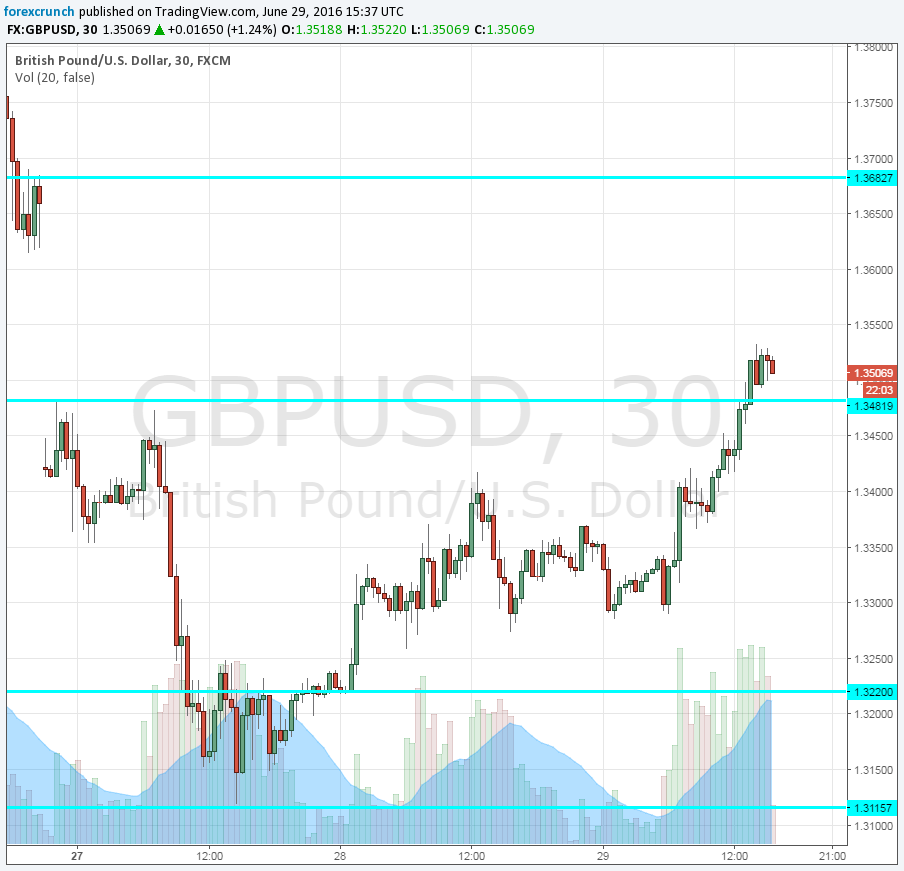

GBP/USD is trading back at the 1.35 handle, around 400 pips off the lows seen on Monday. The reaction to Brexit was brutal but the correction is quite spectacular as well. What’s next for the pound? Will it continue higher or is the recovery over?

Here are three reasons for the rise and three for the fall:

3 Reasons for Recovery

- EU-turn: UK politicians are afraid to trigger the official exit, aka Article 50. With every day that passes, there are more doubts it will really happen, or at least not in a meaningful way. There are good arguments for a Bregret especially if the decision reaches parliament. The Norwegian model which means every obligation and every right within the EU but without a say in decision making is also an option.

- Necessary correction: A crash of 10% at the extreme on Friday and a fall of over 1800 pips between Thursday and Monday is not something you see every day. But forex trading is never a one way street.

- End of month / quarter re-balancing: towards the end of every cycle, portfolio managers need to make sure their books are balanced according to their commitments. A fall in the pound and pound denominated assets during June and Q2 means a correction. This time the magnitude is huge and the correction began early.

3 Reasons why ti could fall

- Out is still out: The UK has a strong democratic tradition. While Remain voters are devastated, the vast majority does not seek a new referendum. The process is seen as fair and the result was not really that close. This is according to a YouGov poll. We have also heard comments from pro-Remain Tories, saying “we are all Brexiteers”. This did not sink in yet. And while things can change in the future, as the economic situation deteriorates, in the next few sessions markets can come to grips that Brexit is here to stay.

- The weekend gap was not close: Contrary to EUR/USD, where the fall on Monday was minimal and the gap was closed quickly, we are not seeing the same for the pound. The close on Friday was at 1.3663 and the current high is 1.3533. Even in these volatile times, a gap of over 100 pips after three days of trading is a lot. The longer the gap stays open, the more bearish the signal is.

- End of end-of-month/quarter: These re-balancing moves mentioned beforehand have a time limit: the end of the month. This could mean Thursday afternoon in London, or it could begin beforehand. This re-re-balancing, aka a return to the general trend, could begin sooner than later.

What do you think?