USD/JPY took a deep dive to 104 and below on the lack of action from the Bank of Japan. This may well change next month, with fiscal and monetary stimulus in play. Here are two opinion from Barclays and from BNP Paribas:

Here is their view, courtesy of eFXnews:

We Still Expect Further BoJ Easing In July As A Baseline Forecast – Barclays

We retain our baseline forecast of further easing at the 28-29 July MPM, with a focus on “interest rates” and “quality.” Specifically, we expect a cut to the IOER rate applied to the policy-rate balance of current account deposits to -0.3% from the current -0.1%, along with an increase in the BoJ’s annual ETF and J-REIT purchases to about JPY5trn and JPY150bn, respectively, from the current JPY3trn and JPY90bn. We find it difficult to see more JGB buying.

Our outlook for further easing in July despite the decision to stand pat this time around is based primarily on our assumptions that: 1) the June BoJ Tankan reports to be released on July 1 and July 4 will show that monetary policy has not sufficiently stimulated business activity, sentiment or inflation expectations; and 2) the June CPI data to be released on 29 July will strengthen the downside risk to inflation expectations.

In our view, the June Tankan reports will be especially important. During his post-MPM press conference on 28 April, BoJ Governor Kuroda suggested that the effects of monetary policy, including negative interest rates, will “take less than 6-12 months” to appear. Most economists may think this sounds optimistic, but if NIRP effects can really be demonstrated over such a time frame, the June Tankan would provide the first opportunity to see that.

BoJ To Ease In July: Here Is The ‘Cleanest’ Trade To Play It? – BNPP

The BoJ opted to leave policy unchanged, as widely expected, despite the JPY’s appreciation in recent weeks. A strengthening currency is providing headwinds to inflation, but some of this strength can be attributed to uncertainty around the UK’s referendum and the slowdown of US activity.

The BoJ’s decision was therefore a reflection of a ‘wait-and-see’ strategy and our economists expect further easing to be delivered in July.

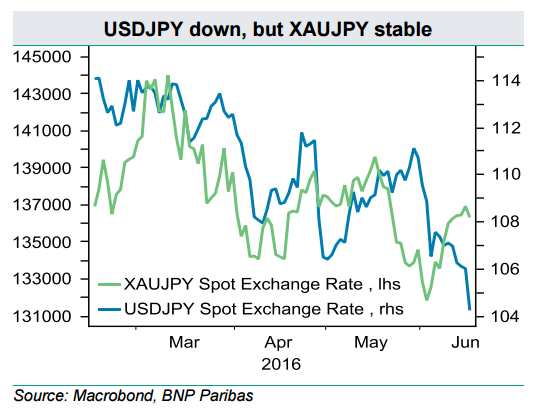

USDJPY and EURJPY have reached their lowest levels in 18 months and 42 months respectively, but XAUJPY has remained stable, supporting our view that long gold vs JPY is the cleanest way to position for policy easing in Japan over the months ahead and should perform if the Japanese government announces a new fiscal package.