EUR/USD Forecast: U-Turn in Sentiment Points to 1.1460 and Beyond

EUR/USD Forecast: U-Turn in Sentiment Points to 1.1460 and Beyond

Well, well, who would have thought it? The EUR/USD pair is back above 1.1300 and with scope to keep rallying next week, up to the major 1.1460 region and beyond, as all of a sudden, a US rate hike is out of the table for June, and probably, for July, and for September… and, well, out of the table.

Following a 4-week decline, the EUR/USD recovered almost half of those losses this Friday, after the US Nonfarm Payroll report showed that the economy added measly 38,000 new jobs in May, against consensus at 160K new jobs, while the last two months were revised down by a hefty 59K. Average hourly earnings rose 0.2%, in line with market's expectations, whilst the annual rate held steady at 2.5%. The unemployment rate fell to 4.7%, the lowest in almost a decade, but that only highlights the sharp drop in the participation rate from 62.8% to 62.6% owing to the 458K drop in the labor force.

The ECB economic policy meeting, which at the time, scared investors

with Draghi's lack of conviction, seems now a bed of roses compared to

the shock produced by US employment data. Still, the EU is in trouble,

with inflation seen now up to 0.2% this year by the Central Bank,

indeed, too poor to even think on an end of stimulus programs, or an

uptick in the economy.

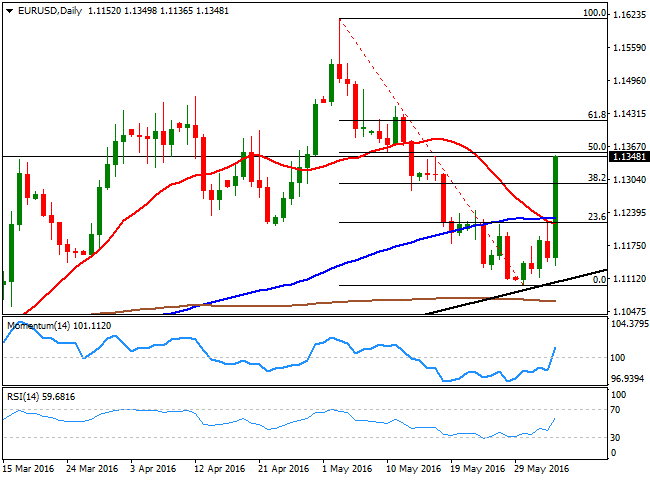

Anyway, the pair can keep recovering ground, at least for a couple of weeks or until a new rocking catalyst. From a technical point of view, the daily chart shows that the price is now flirting with the 50% retracement of the last monthly decline, at 1.1356 to be exact, coming back from a huge daily ascendant trend line coming from November 2015 monthly low. Furthermore, the price has broken above its 20 and 100 SMAs, both in the 1.1230/50 region, as they were not there, whilst the technical indicators have turned sharply higher above their mid-lines.

Should the price extend beyond the mentioned Fibonacci resistance,

there's room for a test of 1.1460, a major static resistance level for

the next week, en route then to May's high of 1.1615.

Pullbacks down to 1.1280/90, a strong static support region that now

converges with the 38.2% retracement of the mentioned monthly decline,

should now attract buying interest, although a break below it can see

the pair sliding down to 1.1200 during the upcoming days. Still, there's

little now supporting such a decline, although with currencies, well,

who knows?