EUR/USD, USD/JPY Game Plan for the Weeks Ahead

Talking Points:

- Two weeks from now brings the Bank of Japan (April 27th-28th), and the Fed (April 26th-27th), and there is a strong chance that this will be the next big instigator of volatility.

- Traders can look to trade such themes and events by watching for technical setups in anticipation of these meetings; this allows traders to trade on macro themes and price action with a careful eye on risk management.

- If you’re looking for more trading ideas, check out our Trading Guides; and if you’re looking for ideas more short-term in nature, check out our SSI indicator.

It’s a relatively quiet morning across markets, at least thus far. And while it’s always a dangerous thing to rest on one’s laurels when it comes to markets, this can also be a phenomenal time to investigate technical setups in anticipation of that next wave or leg of volatility.

So, for today’s Market Talk, we’re going to do what we often do in our Price Action webinars in looking at current technical setups across global markets to begin planning for the weeks ahead. With a rather critical Bank of Japan meeting along with FOMC over the next two weeks, there will likely be prime opportunities for volatility, and this type of setup planning is what can allow the trader to put themselves in a position to take advantage of that. As always, for each and every setup, risk management is of the upmost priority.

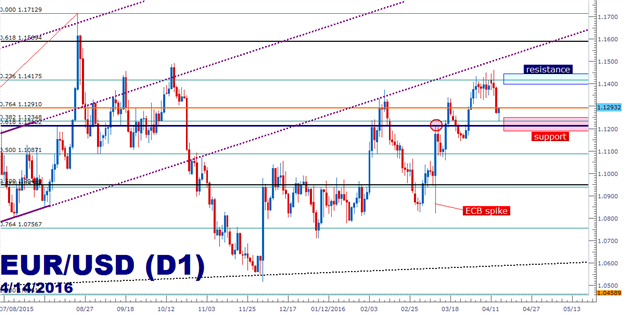

While much of the world was sure that an increase to QE would send the EUR/USD spiraling lower to that parity level, few anticipated that a dovish move from the Fed would actually offset all of that. This is precisely what’s happened, at least so far, in the wake of that March ECB meeting. Of specific interest to this setup, the spike created on the morning of that ECB announcement ran right up to a critical Fibonacci level at 1.1212 (shown in blue on the below chart), which is the 61.8% retracement of the ‘lifetime move’ in EUR/USD, taking the low from the year 2000 to the high set in 2008.

Should support develop at or above this level, traders can look at long positions back up to previous resistance values. The most recent swing-high came in at another Fib level, the 23.6% retracement of the most recent major move, and traders can look to take profits here, or perhaps scale-out a portion of the lot while moving the stop to breakeven on the remainder in the effort of looking for even higher-highs on the remainder of the lot.

CONTINUE...

https://www.dailyfx.com/forex/fundamental/daily_briefing/session_briefing/daily_fundamentals/2016/04/14/EURUSD-USDJPY-Game-Plan-srepstans.html