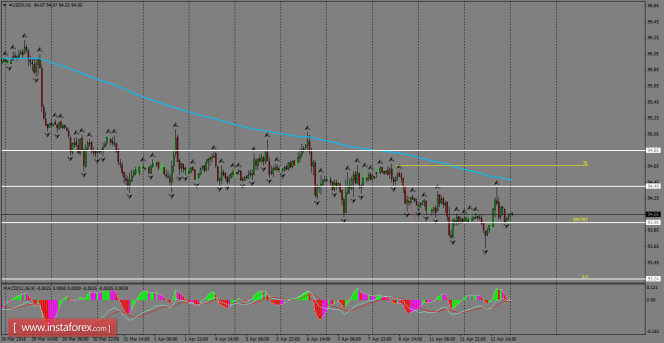

Daily Analysis of USDX for April 13, 2016

The Index is still trying to to consolidtate below the support zone of 93.95, but we can see that a strong demand territory is located around that price level. However, our bearish bias remains valid, as the USDX is still trading into a bearish tone below the 200 SMA and we could expect a decline soon toward the 93.24 level. MACD indicator is at neutral territory.

H1 chart's resistance levels: 94.40 / 94.85

H1 chart's support levels: 93.95 / 93.24

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 93.95, take profit is at 93.24, and stop loss is at 94.65.

The material has been provided by InstaForex Company - www.instaforex.com