THE US CENTRAL BANK IS NOT ANTICIPATED TO HIKE RATES OPTING INSTEAD TO MAKE USE OF RHETORIC AND FORECASTS

THE US CENTRAL BANK IS NOT ANTICIPATED TO HIKE RATES OPTING INSTEAD TO MAKE USE OF RHETORIC AND FORECASTS |

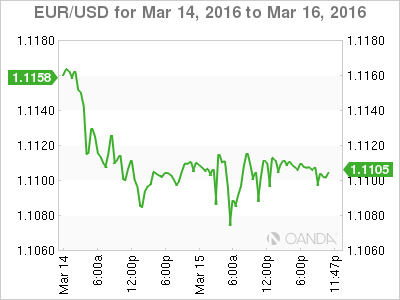

Central banks around the world are running out of options to boost growth. The European Central Bank (ECB) over delivered last week in a better than expected easing monetary policy action. Along with a rate cut deeper into negative territory the central bank announced a 20 billion euros expansion to its quantitative easing (QE) program that is now 80 billion euros a month. The EUR did not react as expected and appreciated after comments from ECB President Mario Draghi and is now awaiting the Fed to do their part. The market has seen the ECB do their part and is now looking to Washington to follow through on solidifying a monetary policy divergence. Chair Yellen and the Fed have endured their own communication disasters and will be cautious to try and give enough information to guide the market in the direction that is beneficial to the U.S. economy. Investors are growing weary of central bank actions and rhetoric so the task at hand for the Fed is not an easy one. The U.S. Federal Reserve will publish the Federal Open Market Committee (FOMC) statement on Wednesday, March 16 at 2:00 pm EDT. The U.S. central bank is expected to keep the Federal funds rate unchanged at < 0.50 percent as economic fundamentals are weaker than in December that prompted the first rate hike after starting an easing monetary policy 7 years ago. The market will focus on the economic projections and the language of the rate statement. Chair Janet Yellen's press conference starts at 2:30 pm EDT and will give more insight to investors about the confidence of the Central Bank on the state of the U.S. economy. |