0

80

GBP/USD Retail Longs Narrow 23% Ahead of Bank of England Testimony

Talking Points:

- GBP/USD Retail Longs Narrow 23% Ahead of Bank of England (BoE) Testimony.

- USDOLLAR Continues to Carve Bearish Pattern Ahead of Fed Speeches.

GBP/USD

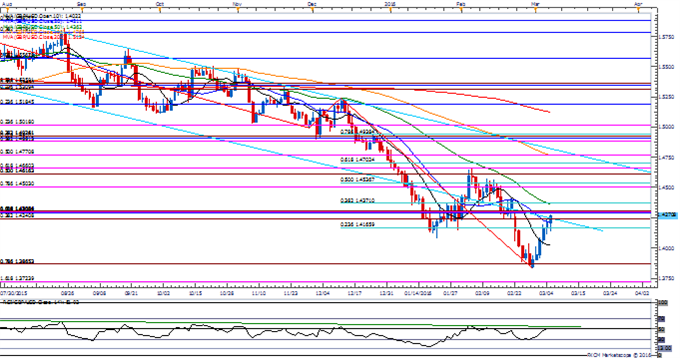

- After carving a lower-lower at the end of February, the long-term downward trend in GBP/USD may reassert itself over the coming days/weeks as the pair struggles to push back above former support around 1.4240 (38.2% expansion) to 1.4300 (78.6% retracement).

- With the Bank of England (BoE) scheduled to speak on the U.K.’s EU-membership on March 8, the fresh comments coming out of the Parliament hearing may produce additional headwinds for theBritish Pound should Governor Mark Carney & Co. largely endorse a wait-and-see approach and adopt a more dovish outlook for monetary policy.

- Still keeping a close eye on the gap from February 22 as GBP/USD has yet to fill the move on a close-basis, with the next key topside region of interest coming in around 1.4660 (61.8% expansion) to 1.4700 (61.8% retracement).

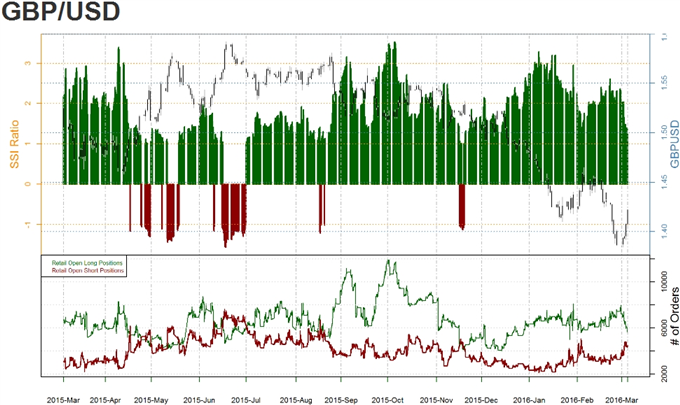

- Despite the decline in GBP/USD, the DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long GBP/USD since November 19, with the ratio hitting an extreme in January as it climbed above the +3.00 mark.

- Retail sentiment remains off of extremes as the ratio currently sits at +1.54, with long positions narrowing 23.3% from the previous week.

USDOLLAR(Ticker:

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12035.87 | 12091.15 | 12032.78 | -0.17 | 108.10% |

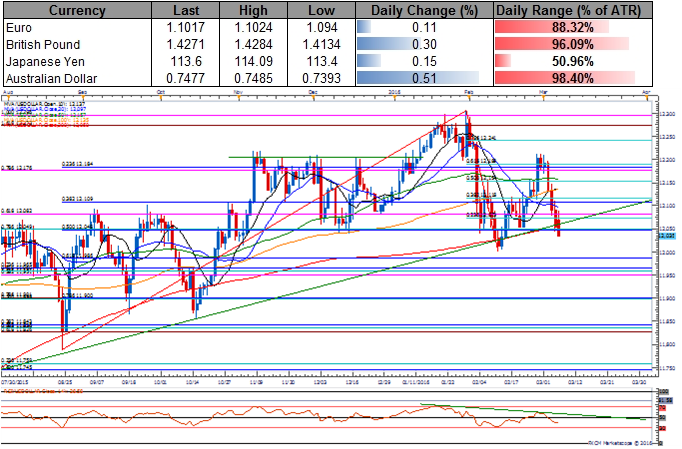

- The USDOLLAR remains at risk of extending the decline from earlier this month as it continues to carve a series of lower highs & lows, while the Relative Strength Index (RSI) appears to be carving a bearish formation in 2016.

- Will keep a close eye on the fresh rhetoric from Fed Vice-Chair Stanley Fischer and Governor Lael Brainard as the Federal Open Market Committee (FOMC) is widely anticipated to retain its current policy at the March 16 interest rate decision.

- Failure to hold above the 2016 low (12,001) may open up the next downside targets around 11,986 (61.8% retracement) following by 11,965 (23.6% retracement).