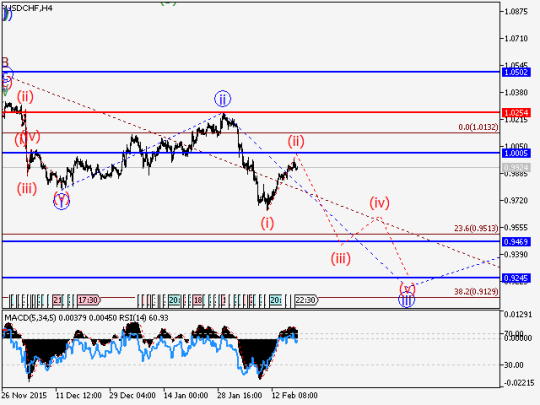

Estimated pivot point is at the level of 1.0970.

Our opinion: Buy the pair from correction above the level of 1.0970 with the target of 1.15 – 1.16.

Alternative scenario: Breakout and consolidation of the price below the level of 1.0970 will allow the pair to continue decline to 1.0806.

Analysis: Presumably, the development of the third wave of the senior level continues. Locally, it seems that the correction as the fourth wave (iv) of the junior level has completed. If this assumption is correct, the pair will continue to rise to 1.1500 – 1.1600 in the fifth wave (v) of iii. Critical level for this scenario is 1.0970. Breakdown of this level will trigger decline in the pair to 1.08 or further down.

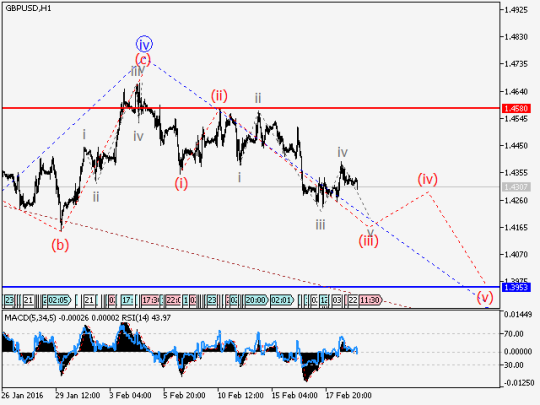

GBP/USD: Wave analysis and forecast for 19.02 – 26.02: Downtrend continues.

Estimated pivot point is at the level of 1.4580.

Our opinion: Sell the pair below the level of 1.4580 with the target of 1.3950.

Alternative scenario:

Breakout and consolidation of the price above the level of 1.4580

enable the pair to continue the rise to the levels of 1.50 - 1.55.

Analysis: Presumably, “bearish” impetus continues to develop in the third wave of the senior level. At the moment it seems that the formation of the fourth wave iv of 3 has completed and the fifth wave is being developed, within this wave the third wave (iii) of the junior level is evolving. If this assumption is correct, the pair will continue to decline to 1.3950. Critical level for this scenario is 1.4580.

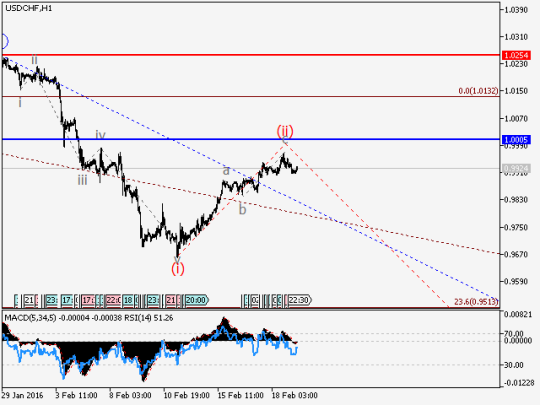

USD/CHF: Wave analysis and forecast for 19.02 – 26.02: Downtrend continues.

Estimated pivot point is at the level of 1.0254.

Our opinion: Sell the pair from correction below the level of 1.0254 with the target of 0.9470.

Alternative scenario:

Breakout and consolidation of the price above the level of1.0254 will

allow the pair to continue the rise up to the level of 1.05.

Analysis: Presumably, the formation of the downward momentum continues in the third wave iii of C. Locally, it is likely that the first wave of the junior level (i) of iii has completed and upward correction (which has a shape of a zigzag), as the wave (ii) is nearing completion. If this assumption is correct, after the completion of the correction, the pair can continue to rise up to 0.95. Critical level for this scenario is 1.0254.

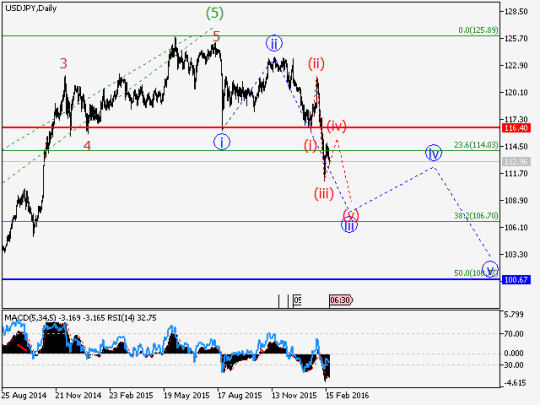

USD/JPY: Wave analysis and forecast for 19.02 – 26.02: Downtrend prevails.

Estimated pivot point is at the level of 116.40.

Our opinion: Sell the pair below the level of 116.40 with the target of 108.50 – 107.00.

Alternative scenario:

Breakout and consolidation of the price above the level of 116.40 allow

the pair to continue the rise to the level of 121.50 or higher up.

Analysis: Presumably, long-term “bullish” impetus has completed on the weekly timeframe. Currently, it seems that the “bearish” correction can reach the levels of 100.00 – 95.00. Locally it is likely that the first corrective wave is being formed, within which impetus in the third wave of the junior level is developing. If this assumption is correct, the pair will continue to decline to 108.50 – 107.00. Critical level for this scenario is 116.40.

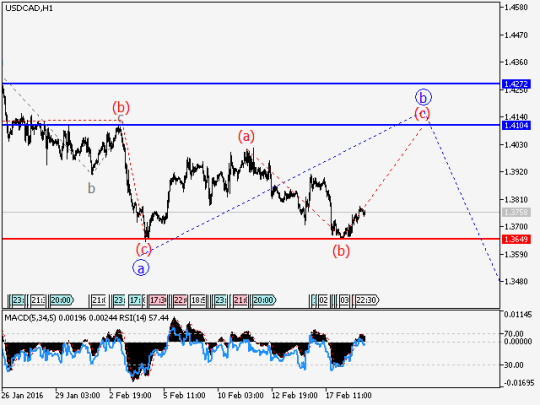

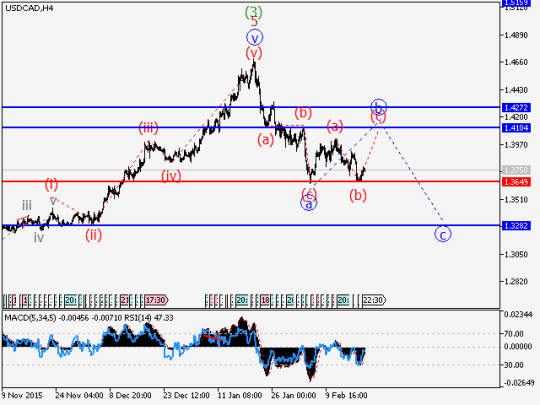

USD/СAD: Wave analysis and forecast for 19.02 – 26.02: The pair is undergoing correction.

Estimated pivot point is at the level of 1.3650.

Our opinion:

In the short-term: buy the pair above the level of 1.3650 with the

target of 1.41 – 1.4270. In the medium-term: wait for the completion of

the correction and sell with the target of 1.3280.

Alternative scenario: Breakdown and consolidation of the price below the level of 1.3650 will enable the pair to continue decline to 1.3280.

Analysis: Presumably, the formation of the downward zigzag has completed in the emerging large “bearish” correction. Locally, it seems that upward correction as the wave b is developing. If this assumption is correct, the pair can rise up to 1.41 – 1.43 in the wave (с) of b. Critical level for this scenario is 1.3650. Breakdown of this level will trigger the decline in the pair to 1.3280.

The analytical materials are provided by

Aleksander Geuta,

a trader and analyst of LiteForex