EUR/USD Risks More Losses on Sticky U.S. Consumer Price Index (CPI)

EUR/USD Risks More Losses on Sticky U.S. Consumer Price Index (CPI)

Trading the News: U.S. Consumer Price Index (CPI)

A marked pickup in the U.S. Consumer Price Index (CPI) may heighten the appeal of the dollar and spark a further decline in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to implement higher borrowing-costs in 2016.

What’s Expected:

Why Is This Event Important:

Signs of stronger price growth may encourage the Fed to further normalize monetary policy over the coming months especially as the U.S. economy approaches ‘full-employment,’ while Chair Janet remains confident in achieving the 2% inflation target over the policy horizon.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Producer Price Index ex Food & Energy (YoY) (JAN) | 0.4% | 0.6% |

Advance Retail Sales (MoM) (JAN) | 0.1% | 0.2% |

Average Hourly Earnings (YoY) (JAN) | 2.2% | 2.5% |

U.S. firms may boost consumer prices amid rising input costs accompanied the rebound in household spending, and a sharp pickup in the CPI may spark a bullish reaction in the dollar as it fuels interest-rate expectations.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

U. of Michigan Confidence (FEB P) | 92.3 | 90.7 |

NFIB Small Business Optimism (JAN) | 94.5 | 93.9 |

Gross Domestic Product (Annualized) (QoQ) (4Q A) | 0.8% | 0.7% |

Nevertheless, waning confidence paired with the slowdown in private-sector activity may drag on price growth, and a dismal development may produce near-term headwinds for the greenback as market participants push out bets for the next Fed rate-hike.

How To Trade This Event Risk

Bullish USD Trade: CPI Climbs to 1.3% or Higher, Core Inflation Remains Sticky

- Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Inflation Report Fails to Meet Market Expectations

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Join DailyFX on Demandfor Real-Time Updates on the DailyFX Speculative Sentiment Index!

Potential Price Targets For The Release

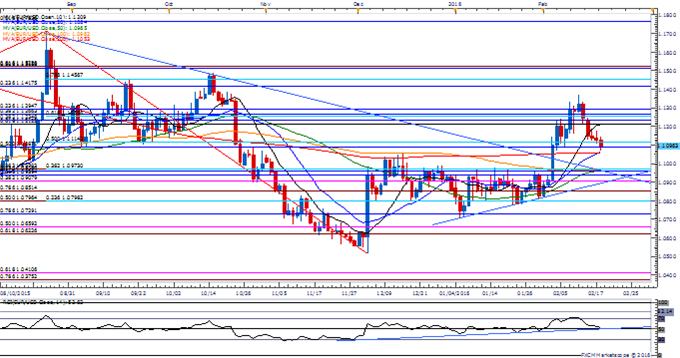

EURUSD Daily

- Even though the diverging paths for monetary policy casts a long-term bearish outlook for EUR/USD, the pair may continue to retrace the decline from the previous year as it breaks out of the downward trend from late-2014, while the Relative Strength Index (RSI) preserves the bullish formation carried over from November.

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

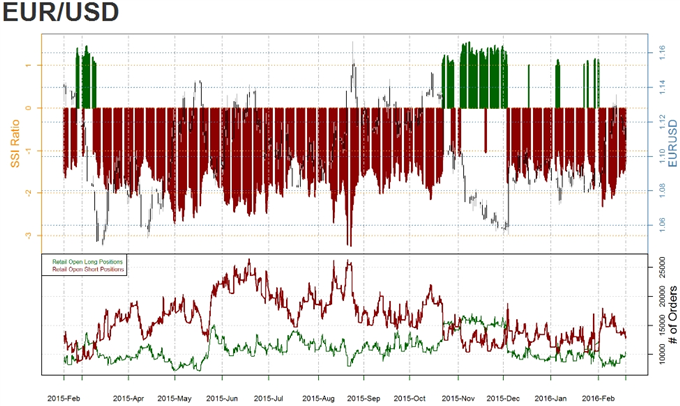

- the chart above shows the retail crowd remains net-short EUR/USD since February 1, with the ratio hitting an extreme earlier in the month as it slipped below -2.00.

- The ratio continues to come off of recent extremes as it narrows to -1.34, with 43% of traders now long.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Impact that US CPI has had on EUR/USD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

DEC 2015 | 01/20/2015 13:30 GMT | 0.8% | 0.7% | +14 | -16 |

December 2015 U.S. Consumer Price Index

The U.S. Consumer Price Index (CPI) fell short of market expectations as the headline reading for inflation increased an annualized 0.7% in December, while the core figure advanced to 2.1% from 2.0% in November to mark the fastest rate of growth since July 2012. A deeper look at the report showed lower energy costs continued to drag on price growth, but the Fed may stay on course to further normalize monetary policy in 2016 as Chair Janet Yellen remains upbeat on the economy. The greenback struggled to hold its ground following the mixed batch of data, with EUR/USD climbing above the 1.0930 region, but the market reaction was short-lived as the pair pulled back during the North American trade to end the day at 1.0882.