GBP/NZD: Turn of the Tide? 2.1437 Line in the Sand

Talking Points

- GBP/NZD at pivotal support ahead of EU Summit / UK Retail Sales

- Updated targets & invalidation levels

- Event Risk on Tap This Week

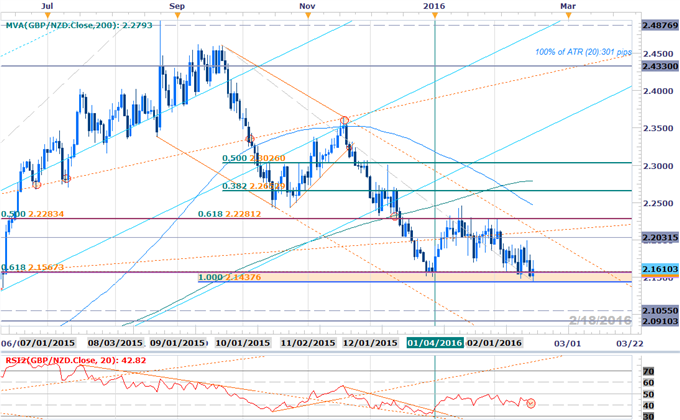

GBPNZD Daily

Technical Outlook: GBPNZD is testing a critical support confluence at 2.1438-2.1567 – a region defined by the 100% extension of the December decline, the 61.8% retracement of the 2015 trading range and the 2016 yearly open. Note that daily RSI has continued to hold above the 40-threshold, suggesting that the downside momentum may be waning here.

Near-term resistance stands at the convergence of yearly high-day close & channel resistance at 2.2032backed by a Fibonacci confluence at 2.2281/83(broader bearish invalidation). A break lower keeps the broader downtrend in focus targeting the 2014 high at 2.1055 and the 2014 high-day close at 2.0910.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders” series.

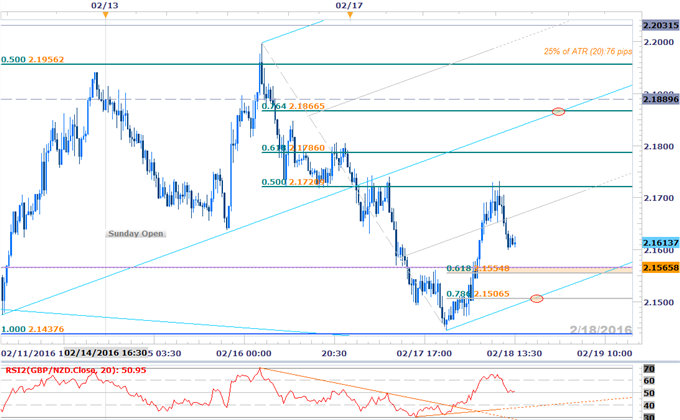

GBPNZD 30min

Notes: The short-bias is at risk near-term & we’ll be looking for long-triggers while above 2.1555/65 with our bullish invalidation level set at 2.1506. Topside resistance targets eyed at 2.1721, 2.1786 & the weekly open / 76.4% retracement at 2.1867/893. Keep in mind this is wider range setup with a quarter of the daily average true range (ATR) yielding profit targets of 74-78 pips per scalp.

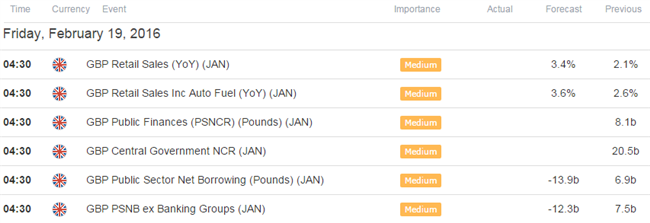

UK Retial Sales figures are on tap for tomorrow with current forecasts calling for a rebound in household spedning. However headlines coming out of the EU Summit may take center stage as the UK tries to broker a deal to retain its membership- expect some volatility.

Relevant Data Releases